Analysts, who foretold the Bitcoin crashes of past years, say that the leading crypto could see further corrections. BTC’s failure to break the $26,400 resistance, coupled with tonight’s FOMC meeting, is forcing technical analysts to find new lows…

Bluntz says Bitcoin correction is not over yet

You can take a look at the analyst’s past accurate predictions from this article. Bluntz said in his current analysis that he expects Bitcoin to make a rapid bounce before returning to the downtrend. According to the analyst, Bitcoin’s bearish chart means more bad news for the crypto space. Bluntz had previously predicted that Bitcoin would fall as low as $24,000 in June.

The crypto analyst remains optimistic for the long-term, despite the short-term bearish trend in Bitcoin. Looking at the technical chart below, “As price action continues, it is likely to drop below $24,000. “A kind of sideways triangle is definitely forming on the four-hour chart, with the underlying trend now.”

Michaël van de Poppe drew attention to the levels that the Fed rate decision could lead to

Van de Poppe, popular on Twitter, drew attention to Bitcoin’s critical $26,400 resistance in his latest analysis. BTC could approach this level as high as $26,133.36. Poppe says that with the Fed’s interest rate decision, which will be announced at 21:00 tonight, we can see a decrease in the region of 24.5-25,000 dollars. Still, he mentioned that these levels would be a buying opportunity.

Bitcoin is currently trading at $25,969.36. It moved around -0.5% on the day. cryptocoin.com We have included the expectations for today’s FOMC meeting in this article.

Dave the Wave interprets MACD indicator as bullish

Foretelling Bitcoin’s May 2021 crash, Dave the Wave says that BTC is in a long-term bullish trend as the MACD indicator has risen above a level that previously marked the start of a new bull market.

According to their analysis, “There is currently a distance between the BTC monthly MACD and the signal line. In macro terms, reduced volatility is an increasingly stable price. Technically, on the longer time frame, the MACD is ready to go higher just below the zero line. Therefore, the outlook is bullish and the logarithmic growth curve is still in the buy zone.

How much do Bitcoin whales support the long-term view?

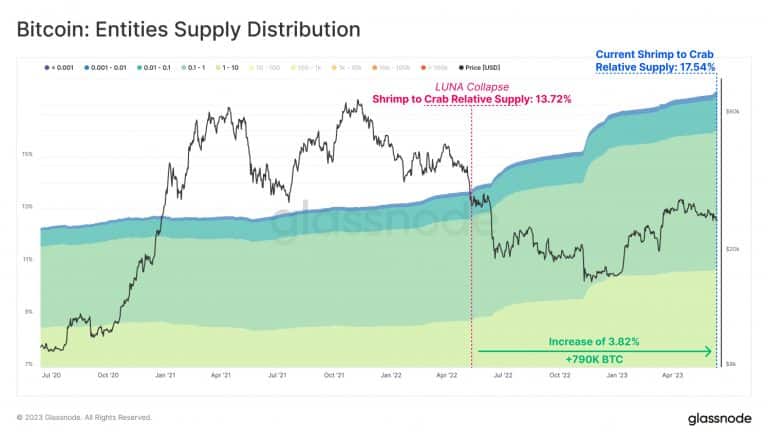

Both Dave the Wave and Bluntz outlined an optimistic scenario for the long-term outlook. In this direction, it will be important how much the whales will support the price with purchases. Glassnode’s new report shows that wallets holding less than 10 BTC continued to accumulate after the LUNA crash. According to the report, these individual investors increased their share of the BTC supply from 13.7% to 17.54% after this period.

Also, more interestingly, new investors of this caliber have been saving since the FTX bankruptcy. Among other factors, these data are an indication that individual demand is increasing. Bitcoin has also gained new use cases in 2023 with the BRC-20 in recent months. An NFT-driven token standard aids leading crypto adoption.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.