Many students benefited from the project that organized tax-free sales of phones and computers to university students. However, an event that took place the other day surprised those who heard about it. According to the news, a university student could not benefit from the application because of the 21 kuruş bag he bought for a tax-free phone.

He couldn’t benefit from the tax-free phone application because of the 21 kuruş bag!

Tax-free telephone and computer applications started in the past months. Within the scope of this application, university students can buy mobile phones and computers tax-free. An incident that happened the other day surprised those who heard about it.

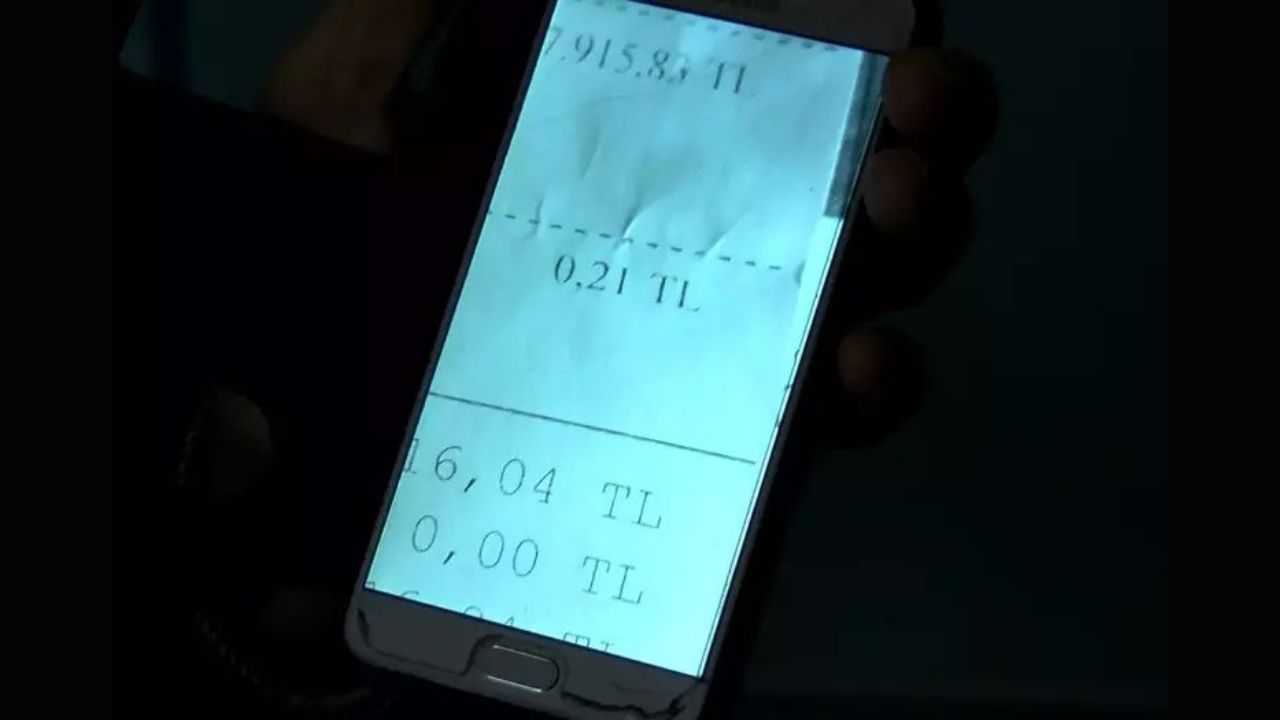

A university student tried to benefit from a tax-free mobile phone application. 9 thousand 500 lira received a phone call. However, in addition to the phone, the user 21 cents He added a bag. Because of this bag 4 thousand 500 lira There was no tax refund.

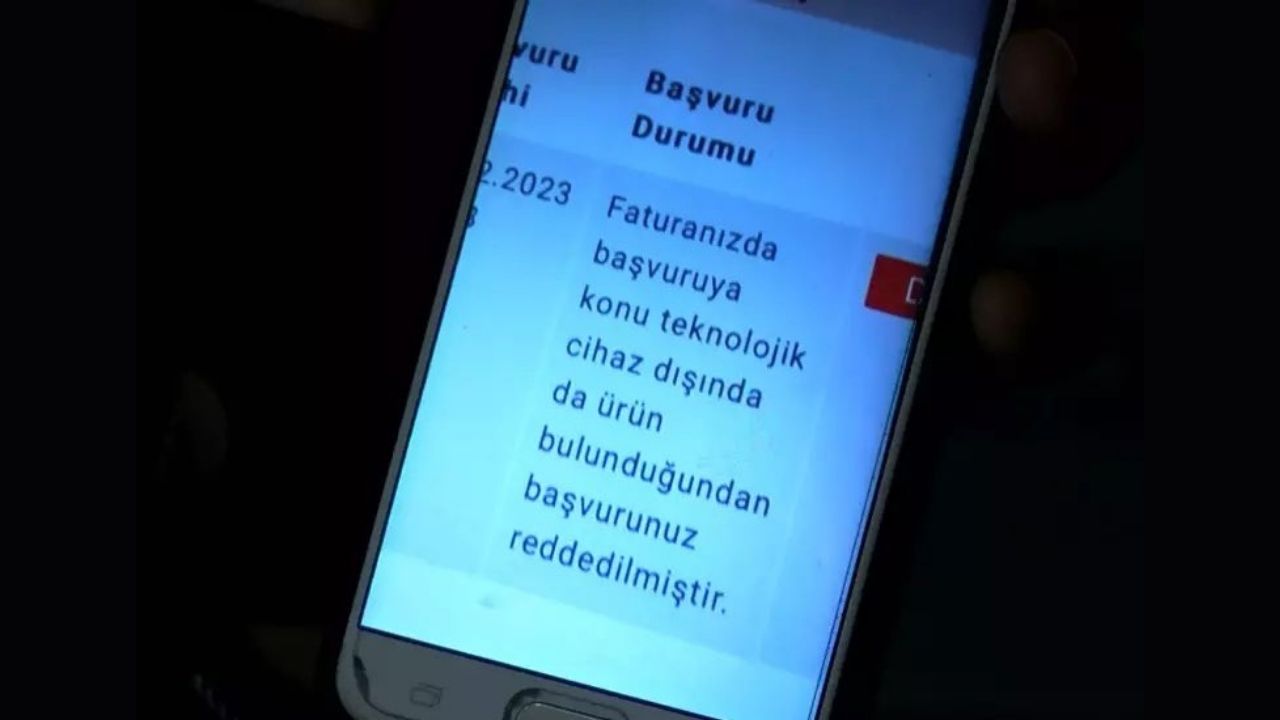

He received a message regarding his application because the 21 kuruş bag fee was also reflected in his invoice. In the message, “Your application has been rejected because your invoice contains products other than the technological device subject to the application.” His statement was included.

Additionally, the Federation of Consumer Associations reported that they received many complaints regarding this issue. In order to benefit from the Presidential Decree supporting tax-free phone and computer sales, it is necessary to comply with some conditions. The terms are as follows:

- The applicant must be a citizen of the Republic of Türkiye.

- The applicant must be a student enrolled in a higher education institution, excluding open education programs.

- The applicant must not be less than 26 years old as of the date of Device Purchase.

- The final sales price of the computer devices and mobile phone devices for which technological device support is applied must be less than 9,500 Turkish Liras, including taxes.

- The technological device purchased is not second-hand.

- An electronic invoice is issued for the technological device purchased.

- The IBAN number reported for the technological device purchased belongs to the applicant.

- The telephone line to be used for the purchased mobile phone device must belong to the applicant.

So, what do you think about the tax-free phone and 21 kuruş bag incident? Don’t forget to share your opinions with us in the comments section!