According to market data from Santiment, crypto whales have been accumulating massive amounts of XRP coins over the past seven days, totaling hundreds of millions of dollars, and are currently holding more than 10 million each. XRP There are more than 350 whale addresses holding tokens. The drastic movement in the trading volume of the crypto asset points to significant price implications for XRP in the coming weeks.

The escalating spree of savings shows that most XRP investors are confident that Ripple will secure a groundbreaking victory in the ongoing legal battle launched by the SEC over claims that it made $1.3 billion through an unregistered security offering.

In a recent interview, attorney Joseph Hall, a former SEC official who commented on the course of the case, stated that the SEC should not have brought the case in the first place. Citing the commission’s lack of justification for filing the case, Hall did not directly announce the outcome, but strongly implied that Ripple would win. He even said the commission’s regulatory efforts could be “stopped”.

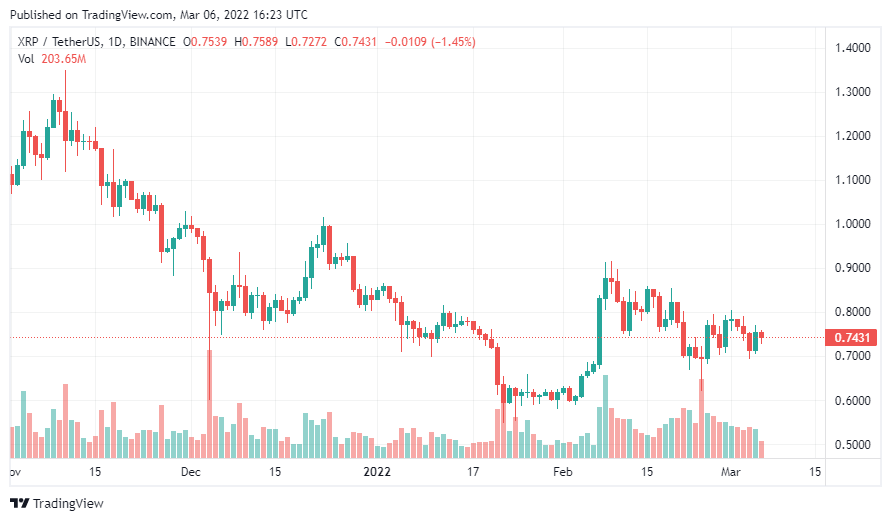

If we look at the past price movements, the scenario observed in November-December 2020 and present today shows the most likely direction of future price changes. After rapid accumulation of around 1.3 billion XRP at that time, the price of XRP rose significantly relative to BTC over the next three months as the crypto asset proved to be a more stable cryptocurrency during the overall crypto market crash. Santiment analysts suggest that a similar logic can be applied to the expected price dynamics in the coming weeks.

If we look at the scenarios that can happen, in XRP first It can be said that the reasonable price orientation is the expected rapid increase in XRP price if the SEC case is won by Ripple. Experts believe that Ripple does not have significant commitment to the current institutional and regulatory uncertainty, and they think that XRP could enjoy a more stable environment for long-term expansion, as most government policies focus on BTC and ETH.

In addition, most XRP long-term investors seem future-oriented and are not willing to short positions even in the face of small price increases. Since the number of short-term XRP investors is also much lower than BTC, XRP prices tend to be more sluggish under these conditions.

According to expertsvengeful The possible price direction is that the crypto market is about to enter a new bearish phase. This means that as whales shift their preferences to Ripple’s XRP instead of Bitcoin, Ethereum or Solana, they expect an overall shift in demand for major crypto-assets to drop.

The main practical benefit of this analysis is the existence of a time lag between changing whale behavior and future price movements. Thus, private investors were able to take protective measures such as increasing their XRP and stablecoin holdings. It is also worth noting that close monitoring of XRP accumulation can also be used as an indicator to predict the general stability of the crypto market and the probability of a future negative trend reversal.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.