Cryptocurrency and bitcoin While the downward trend in the market continues, the gold price has gained 3.85% in the last 7 days.

The price of an ounce of gold climbed from $ 1,826 on February 10 to $ 1,897 at the time of this writing. However, there has been an explosion in the demand for gold-indexed cryptocurrencies.

Economic Uncertainty in the World Helped the Price of Gold

The world economy has seemed to be shaky for a while, and many think it’s due to the possibility of war between Russia and Ukraine.

Stock markets plunged last week amid uncertainty. In addition, as a result of the losses in the crypto money market, the total market value of the crypto world has decreased below 2 trillion dollars.

Unlike cryptocurrencies, gold has performed well this week, gaining 3.85% in the last 7 days.

The Cryptocurrency Market Indexed To The Gold Price Is On The Rise

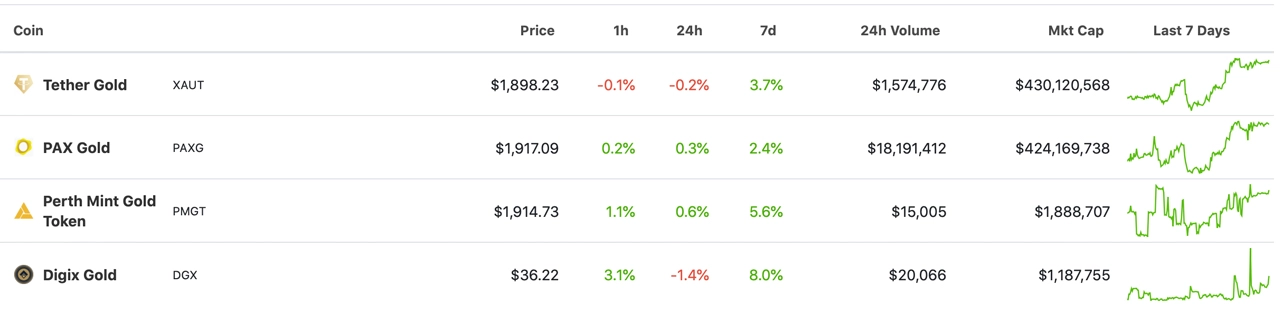

As the precious metals market moved upwards, the demand for gold-linked cryptos also increased. The combined market cap of Tether Gold (XAUT), Pax Gold (PAXG), Perth Mint Gold Token (PMGT), and Digix Gold (DGX) altcoins has risen between 2.4% and 8% over the past week.

In terms of market value, XAUT and PAXG stand out as the largest gold-indexed cryptocurrencies. XAUT’s total market cap is around $430 million, while PAXG has a market cap of around $424 million.

In January, XAUT’s market cap was hovering around $410 million. However, while the market value of PAXG was at the level of $332.7 million, an increase of $92 million was observed in 25 days.

In the last two years, XAUT has grown by 20,000% in market capitalization, while PAXG has grown by 16,000% in the same time period.

*Not investment advice.