On May 22, 2024 CoinEx Launched by (CoinEx Global), “ETH ETF VS. The huge debate titled “High FDV Dilemma: Where is the Market Heading” caught the attention of crypto investors and spread rapidly among some communities. Thanks to the recent high level of interest and discussion among investors in the cryptocurrency industry on topics such as “Ethereum ETF”, “high FDV dilemma”, “high market value and low circulation” and “VC projects”, the interest in this event is at the moment of writing. it still continues.

In the discussion spearheaded by CoinEx, the guests all agreed that the market has high expectations for the approval of the Ethereum ETF.

WoShy @bc1qWorkShy confirmed expectations, citing Ethereum’s recent price increase and adding that every SEC decision regarding crypto assets in history has had a significant impact on the long-term price of cryptocurrencies.

VIP3 @web3vip stated that former US President Donald Trump’s endorsement of cryptocurrencies has given a boost to the crypto market and will have multiple impacts on the price of Ethereum and even other cryptocurrencies in the future.

The High FDV Dilemma: Questions and Research

FDV, or Fully Diluted Value, refers to the fully diluted value of a token and is the market value obtained by multiplying the current token price by the circulation. During the boom cycles of the sector, most investors consider FDV as an important criterion for investment. Among the various debates, an important point of contention is that some believe that the valuation after full dilution of the tokens is already inflated, as the current circulation of many VC projects is only a tenth of the total circulation or even lower. In the short term, looking at FDV has no practical reference value.

Relying on FDV as a key factor in investment decisions will only lead to losses, which is undoubtedly a major investment trap for new investors.

On the other hand, opponents argue that it is completely determined by market supply and demand and cannot be intervened. The main reason for this is the lack of liquidity in the sector, especially in light of the recent downturn in the market, which has caused a number of venture capital projects to be halted.

Additionally, the industry is moving towards specialization and the logic and standards of “dual discovery” (price and value discovery), which are very important for investment discovery, are also changing. The problem cannot simply be attributed to the high FDV of projects with rigid thoughts and perspectives.

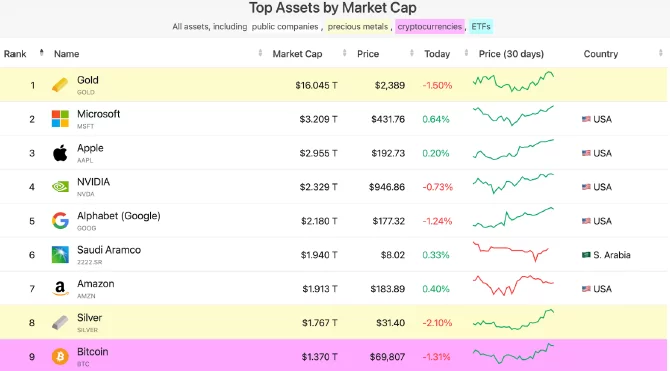

Indeed, increase is a necessary issue for the cryptocurrency industry to develop positively. The successful approval of the BTC ETF, through the tireless efforts of numerous advocates and pioneers from within and outside the industry, has brought ever-increasing growth to the industry, increasing the total global cryptocurrency market capitalization to $2.6 trillion and Bitcoin’s market cap at $1.37 trillion. ranked ninth globally (according to companiesmarketcap.com data).

Approval of the Ethereum ETF will inevitably lead to further increases not only in funds but also in investors and users. Therefore, how to avoid the High FDV Dilemma has become a strong demand for many new investors and even some industry veterans.

Choosing the Right Stock Exchange: The Key to Avoiding the High FDV Dilemma

Undoubtedly, the “High FDV Dilemma” will eventually lead to a reduction in available stock as ETFs inevitably attract increasing users and funds. One rise, one decline – this is not conducive to the normalization, scaling and sustainable development trend of the cryptocurrency industry in the long term. To address the High FDV Dilemma, we need to understand why VC projects tend to set “low circulation, high value”: because under established market demand, due to the scarcity of short-term market liquidity, a lower circulation of project tokens is more conducive to setting token prices.

We need to mention three roles here: exchanges, new users and VCs. We know that professional traders and investors have their own comprehensive investment philosophies and naturally stay out of the loop. The “low circulation, high FDV” setting for project tokens by VCs is mainly to have higher pricing power in the issuance of tokens to better achieve the goal of increasing FDV. Therefore, only exchanges can play a key role in truly addressing the “High FDV Dilemma” faced by new users.

As a leading worldwide cryptocurrency asset trading platform dedicated to making cryptocurrency transactions simpler, CoinEx constantly strives to improve products and services, improve user experience, and continually improve our services to meet the diverse investment needs of our users to ensure the quality of services we provide to our customers. believes that we should focus on delivering quality assets. In this process, project selection is an important key and stock exchanges need to play their role fully to save more investors from the “High FDV Dilemma”.

CoinEx is constantly improving its project selection criteria, gradually establishing a listing mechanism based on “good, fast and comprehensive”, and focusing on discovering and paying attention to innovative high-quality projects with low valuations and high growth, winning the appreciation of a wide range of investors (especially new investors) .

As TMJ said at the CoinEx-led X Space event, “These projects will have their own price discovery; All they need is time.” We are all looking forward to the future of the cryptocurrency industry.

About CoinEx

Founded in 2017, CoinEx is a global cryptocurrency trading platform with a “user first” brand approach. It offers a range of products and services including Spot, Futures, Margin Trading, Crypto Debt and Strategic Trading. With a user-centric market orientation, a variety of product features, and a commitment to continuous improvement in product services, CoinEx supports more than 1,000 cryptocurrencies, offers more than 1,500 trading pairs, and serves more than 5 million users in more than 200 countries and regions worldwide. It became a stock market.

We provide our users with a smooth journey in their cryptocurrency ventures by providing them with a simple, easy-to-use, professional and stable platform for cryptocurrency transactions.