There is a question that crosses our minds when we are children, and that haunts us from time to time even when we are adults; Why don’t we print more money and become a more prosperous country when we have the power to print money?

In our country The power to print money belongs to the Central Bank. central bank of the Turkish Republic (CBRT) holds the authority to print Turkish Lira; It is an INDEPENDENT institution that can issue money on behalf of the state, directs monetary policy, including interest, and according to the law.

If we take a brief look at the history of the CBRT; The monetary policy of the Ottoman Empire was entrusted to the Ottoman Bank, which was established with British capital. With the establishment of the Republic, the nationalization of the Ottoman Bank came to the agenda, but when this was not possible due to the material conditions of the period; first, the idea of transferring the powers of the Ottoman Bank to Türkiye İş Bankası was put forward. However, the idea of transferring authority to Türkiye İş Bankası, which is not an independent institution, was abandoned and completely independently CBRT was established. Although some of its powers have been transferred to the Banking Regulation and Supervision Agency (BDDK) with the various developments experienced until today, the CBRT is still not concerned with the money in our country. most authoritative is an institution.

Why doesn’t the central bank print more money?

The dollar is based on 10 lira and our purchasing power is melting day by day Nowadays, it has always been in our minds that we sometimes say, “If the Central Bank printed 2 units of money instead of 1 unit of money a day, and with this, two coins were in our pockets instead of one, we could buy the products we wanted more easily”.

This event, which has been tickling our minds since childhood, is unfortunately not possible. First of all, the Central Bank to show something in return for every coin (emission) printed needs. Worldwide, this provision is represented by gold. For example, if the Central Bank is printing 20 lira today, it should show a gold reserve for 20 liras. well how much you work, you ll gain the amount for your work. Unfortunately, there is no such thing that I can print 200 liras for 20 liras of gold so that my people can live in prosperity.

What happens if the Central Bank prints more money than necessary?

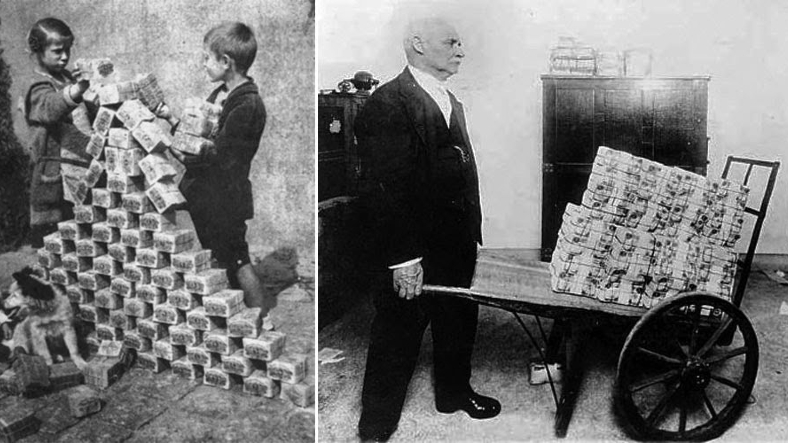

If we print 200 lira today when we have a gold reserve worth 20 lira, the only thing we would do hyperinflation is to create. In other words, the price of 1 lira bread is 10 liras. There have been states in history that have made this mistake. The most famous example is the one who was defeated in the First World War. By printing money off Germany’s war debts trying to pay.

As a result of this event in Germany in 1923, only daily inflation reached 23%. In other words, the money in the pocket of a person living in Germany at that time. was losing 23% every day, in other words, to all products 23% raise every day was coming. Inflation in Germany during this period 29500% has seen. A loaf of bread sold for 250 Mark in January was sold for 200 million Mark at the end of the year. If one day the Central Bank prints more money than necessary in our country, the same thing will happen in our country.

So how does the Turkish Lira turn into a more valuable currency?

Although some economy writers tell on television programs that the CBRT will boost our economy by buying and selling dollars, these tried and daily moves are more damaging to our economy. As you now understand, we need to produce more in order to print more money. In addition, printing more money does not offer a permanent solution. what matters It’s not about buying a lot of products with a lot of money, but a lot of products with a little money. is to receive. This is possible with a strong and regular economy. So in short Increasing our export rate and minimizing our import rate required. In short, this type of permanent solutions in the economy structural reform name is given. A trustworthy judiciary, good relations with other states, a fully implemented democracy, and a country that receives, not gives, brain drain are the sine qua non of structural reformers.