In the coming days, the bullish outlook for some altcoins is noteworthy. Here are the altcoins that are possible to rise due to their technical data, according to analysts.

Litecoin is among the altcoins expected to rise

According to analyst Valdrin Tahiri, analysis of LTC’s daily time frame suggests a positive forecast for its price, supported by several factors. First, the price broke out of the descending resistance line, which has been present since April 18, marking the completion of the previous correction. Before this breakout, there was a strong bounce back that retraced the 0.618 Fibonacci retracement support level on May 8. The principle behind Fibonacci retracement levels suggests that after a significant price move in one direction, the price will either retrace or partially revert to a previous price level before continuing in its original direction.

The 0.618 Fib level mostly acts as a bottom during corrections. So, the recovery of this level is also a strong sign that the previous correction is over. Second, LTC has completed a corrective pattern known as the ABC structure. This reinforces the belief that the correction is over and a new upward move has begun. Similar to the daily time frame, the short-term six-hour time frame shows that the increase will continue. The main reason for this is the number of waves we encounter when considering the Elliott Wave theory.

Technical analysts use Elliott Wave theory as a tool to identify recurring long-term price patterns and investor psychology that help them determine the direction of a trend. LTC price has started a five-wave increase since the aforementioned bounce on May 8. If so, it is currently in the fifth and final wave of this upward move. According to the analyst, the most likely target for the top of this move is $102.

60 percent rise expectation for RPL

On the other hand, according to analyst Lockridge Okoth, Rocket Pool (RPL) price is showing the possibility of rising. Rocket Pool (RPL) price is preparing for a breakout after months of consolidation within a triangle. This technical formation predicts a continuation with the pennant representing a period of indecision right at the midpoint of the movement. The price is held by a small symmetrical triangle that starts wide and converges to a point as the pattern develops. However, in the bullish case, a 60 percent gain is possible and could be extended to the target of $78.8 in RPL.

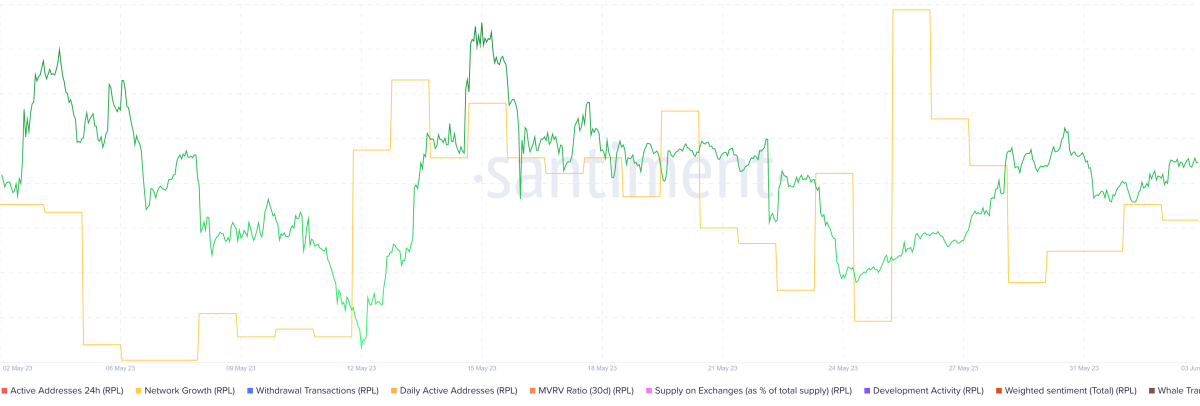

Also, Santiment data shows commendable growth in the Rocket Pool network. Notably, the network saw a staggering 70 percent increase in less than a month. Network growth in this context defines the number of new addresses created daily on the network. Shows user adoption over time. It can be used to identify when the project is gaining or losing momentum.

15% probability of rally for HBAR among popular altcoins

Again, according to analyst Okoth, Hedera displays a 15 percent probability of rallying. According to the analyst, Hedera Hashgraph (HBAR) price is preparing for a rally with indications of a rising momentum. Hedera Hashgraph (HBAR) price jumped after news of meeting at Google headquarters. Hedera’s council members; Discussed staking, property tokenization, and transaction fees directed towards staking rewards. As the conversation and excitement around the development continued, the Hedera price took advantage of the social dominance. This caused HBAR to consolidate support at $0.049.

An increase in buying pressure above the current $0.050 price could indicate that Hedera price tags the 50-day EMA at $0.055. Turning this roadblock into support could pave the way for HBAR to complete a 15 percent climb and face the tricky $0.057 hurdle. Hedera price could visit resistances at $0.058 and $0.063 due to the 100- and 200-days EMA, before $0.078 was last tested in early April.

INJ may show massive rise in the coming days

Finally, in a recent analysis, Kaleo pointed out that a potentially successful retest of a diagonal resistance for the INJ/BTC pair. Thus, he pointed to the altcoin’s growing strength against Bitcoin. According to his description, this altcoin is in a long position. He then updated his perspective, predicting that slight consolidation could occur after a rally to the top of 0.0003031 BTC ($8.23). “It wouldn’t be a surprise to see some buildup here before continuing the uptrend,” he added.

Kaleo also expressed his optimism regarding Injective’s performance against the US Dollar. She noted that the INJ/USD pair looked poised to grow after it broke the diagonal resistance and then retested it as a support. “The INJ/USD chart looks great too,” she underlined her confidence.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.