Crypto analyst Filip L says that likely AVAX price consolidation will result in a 10% drop. According to the analyst, Cosmos price is on the verge of a 15% meltdown as ATOM completes its dead cat bounce. The analyst states that the Litecoin price risks a 15% drop once the LTC halving hype ends. Analyst Lockridge Okoth says that among altcoins, ETC bulls should expect at least one more drop.

Among altcoins, AVAX will drop below $16.50

Avalanche (AVAX) price has had a whip week so far as volatility has increased in recent trading. The idea that AVAX volatility is linked to the earnings of a few big tech firms is debatable. That said, it’s sure to get investors moving. With recent lawsuits and developments in the crypto and altcoin market environment, risk premiums still need to be deducted from the current price. It should also silence further upside potential for now.

AVAX thus consolidated at $17.40. Additionally, it is preparing to break towards $16.75 on the monthly pivot. This monthly pivot has already been broken several times this month. Therefore, it no longer holds solid support. A rapid decline towards $16 is possible, as has been the case in recent weeks. We also expect to test the 200-day Simple Moving Average for support.

This AVAX will refresh the price action if some tail risks can be removed from the equation. This will push the altcoin higher. This would be in line with the 55-day SMA and a bounce from this level. Once this week’s high of $18.25 is broken, a stretch towards $19.50 with gains of over 10% is possible.

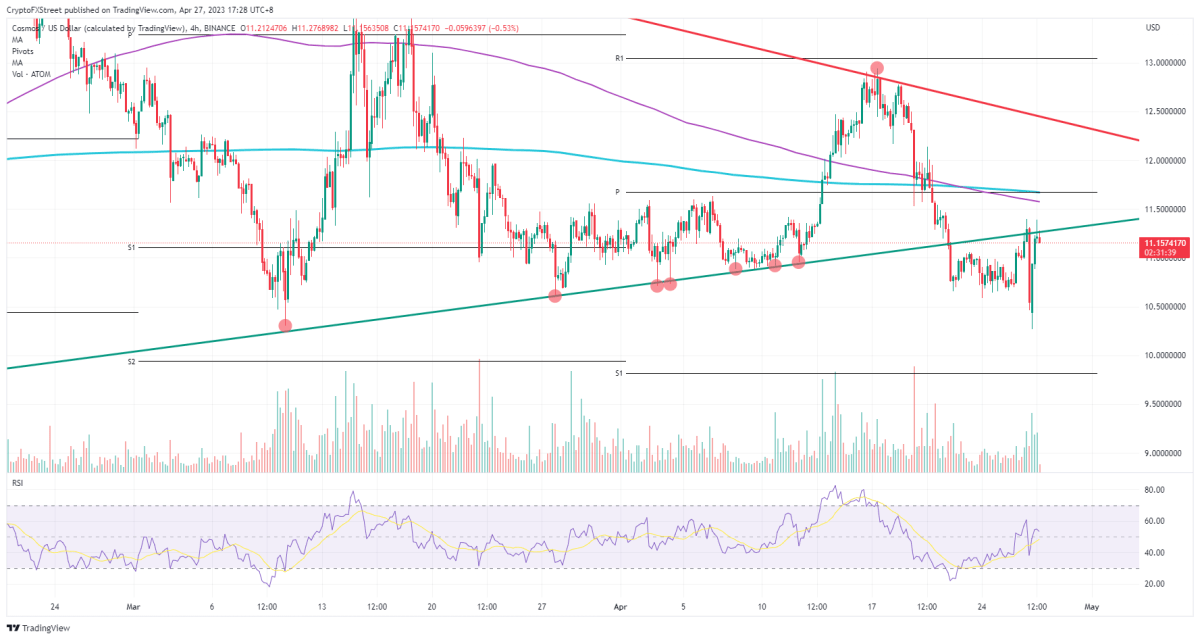

Cosmos bulls dropped the ball here

The bulls are reluctant to push ATOM above the already existing green ascending trendline in the long run. He even sees bulls playing with fire because they look stubborn. This becomes a clear goal for the bears to score. Because now a fade or a rejection against this trendline will lead to a solid leg lower. Worst case scenario would be a dead cat spatter that will take up too much space in the very short term.

Therefore, ATOM is at risk of at least falling towards $10.50. Therefore, it could start flirting with a break below Thursday’s low. In this case, it will not be possible to stop this movement and the $10 level will be abandoned. The monthly S1 at around $9.80 will likely stop further declines. However, a slight overshoot is still possible.

Bulls can wait for the final catalyst or headline that could drag them beyond the line. For example, as Bitcoin is trading above $30,000. It is possible that this is enough for the bulls to want to be part of a general rally in cryptocurrencies and push the price action back above the green ascending trendline. Although there are quite a few elements to act as a cap on price action nearby, it would still mean close to 10% gains nearby.

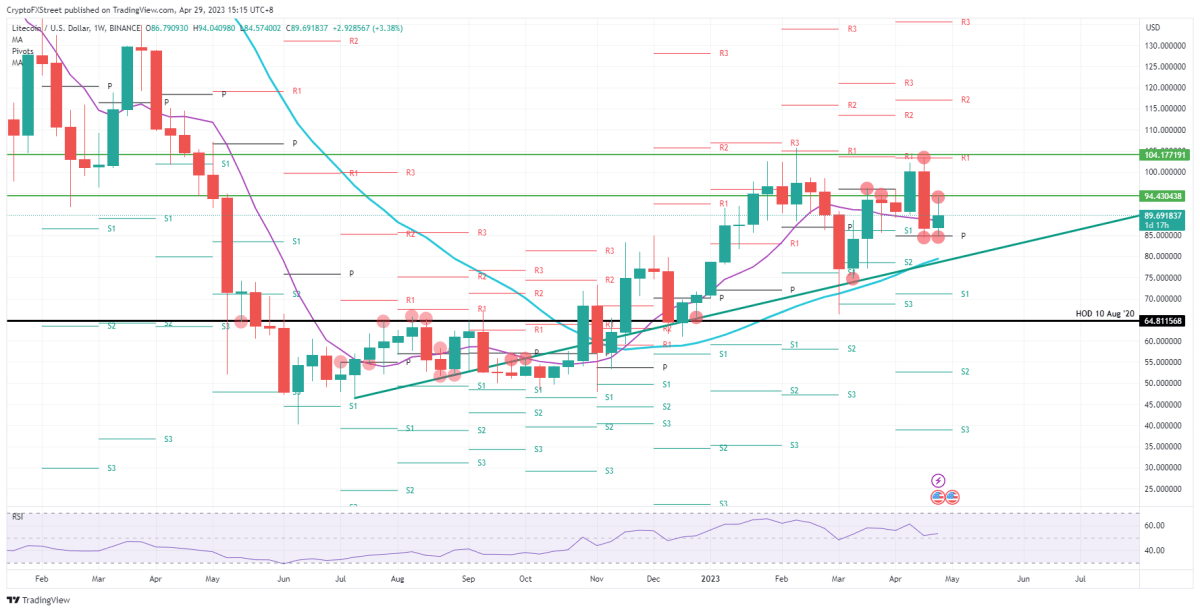

Among altcoins, LTC is under bearish pressure

Litecoin (LTC) was nicely supported by the floor on the monthly pivot near $85. The bulls played their hand here, defending so strongly. That’s why the good news goes so far. What was better was that the altcoin price climbed above $95.43 and confirmed the recovery bounce.

LTC bulls are exposing themselves for another rejection as $94.43 remains unopposed and could be seen as a second rejection after $104 last week. With low highs and a flat bottom at $85, the bears have a clear target where they want to push LTC price. Expect the pressure to continue to build up next week. Also, once $85 gives way, it could quickly sell towards $80. This move is likely to test the 200-day Simple Moving Average for support.

Recovery can be put on hold and smaller recovery spikes can be seen in the coming weeks. This means a very slow rise towards $94.43 for testing. So, it means a higher breakout. Next up, of course, is $104 for a third test. Also, there will be a higher probability of a successful breakout this time.

ETC price will probably drop by at least 10%, at most 15%

Ethereum Classic (ETC) price is consolidating under the bearish rule of the Exponential Moving Averages (EMA). The 200-day EMA at $21.8 at the time of writing has kept ETC stumped since September 2022. The 50- and 100-day EMA also stepped in, suppressing possible upward movements for the altcoin at $20.5 and $20.7, respectively. Overall, the altcoin is in a bearish trend. Moreover, cryptocoin.comAs you’ve followed, there are strong indications that the downtrend is continuing, while investors are waiting for a significant catalyst from within the Ethereum network.

Depending on the general trend, it is possible for the altcoin price to see another notable drop in the next few days or weeks before a significant recovery. In such a case, the altcoin is likely to find support around $18.2, which marks a 15% drop from the current price. Or, worse, it is likely to find support below the $16.7 support level. Below the average line of the EMA and the Relative Strength Index (RSI). Also, the overall pressure from its southward push supported the bearish outlook, pointing to further declines.

On the other hand, it is possible that a bullish takeover could change the narrative for the altcoin. If pushed aside investors buy ETC, the altcoin’s market cap could increase in the short term. With this move, the altcoin is likely to rally above the three EMAs and make a potential bounce. The bearish discourse will be invalidated if the candlestick closes above the 200-day EMA at $21.8. In a highly bullish situation, ETC is likely to move north to reach the $24.7 resistance level. This represents an increase of 25%.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.