Inflationary pressure may force the ECB to act. The ECB held a flat rate statement and press conference on Thursday. The BoE and Fed have already taken action by raising rates or lowering the QE, but the main central bank behind the curve has also been the ECB. The effect of all this on gold and other details cryptocoin.com‘in.

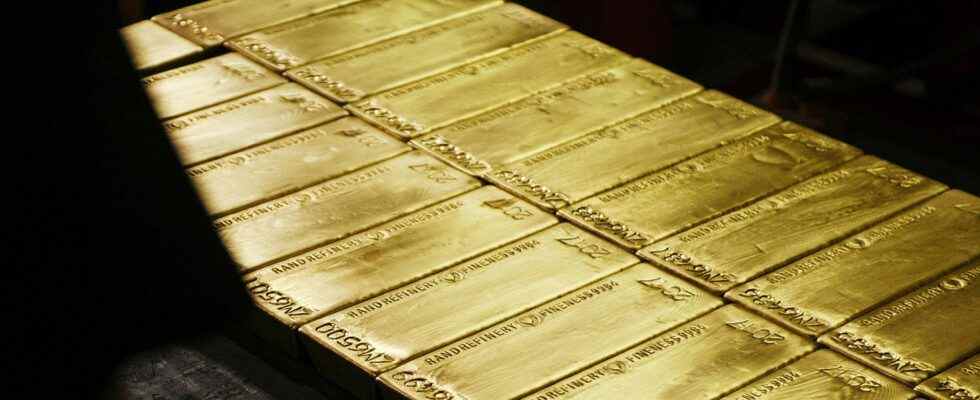

The future of gold prices

“We are probably near the peak of inflation in the euro area,” said Villeroy of the ECB today. That’s hard to pinpoint, but the latest Markit PMI reports confirm that cost pressure has eased over the past month. Key in the studies here may be the omicron COVID-19 variant as it hit mainland Europe. But producing countries around the world did not report the same rapid increases seen in the UK, for example. ECB officials have now said they are seeing a new era of inflation with a target in sight. ECB’s Rehn seems to see a clearer picture, as he says inflation forecasts are subject to very high uncertainty. This was confirmed by comments from ECB’s Simkus, who said that inflation will be higher than expected in 2022.

This could mean a few things for gold. If central banks around the business start raising rates to combat inflation, this will offer another safe haven to shift some allowances. The problem with gold is that it is a non-yielding asset and bonds, for example, can see both capital gains and returns. Another scenario is that inflation is still very high in real terms and gold becomes a better investment than bonds as an inflation hedge. ECB’s Muller said the ECB may be ready to tighten faster if inflation stays above 2%. For clues, energy and soft commodity prices should be considered in the next few months. Leading rates against inflation in the coming year will give us important clues about the performance of precious metals markets. Because inflation is so high, real inflation rates will be more important than the rates set by central banks.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.