Michaël van de Poppe, a popular crypto analyst and trader, shared his predictions for a handful of leading crypto assets as the markets rallied.

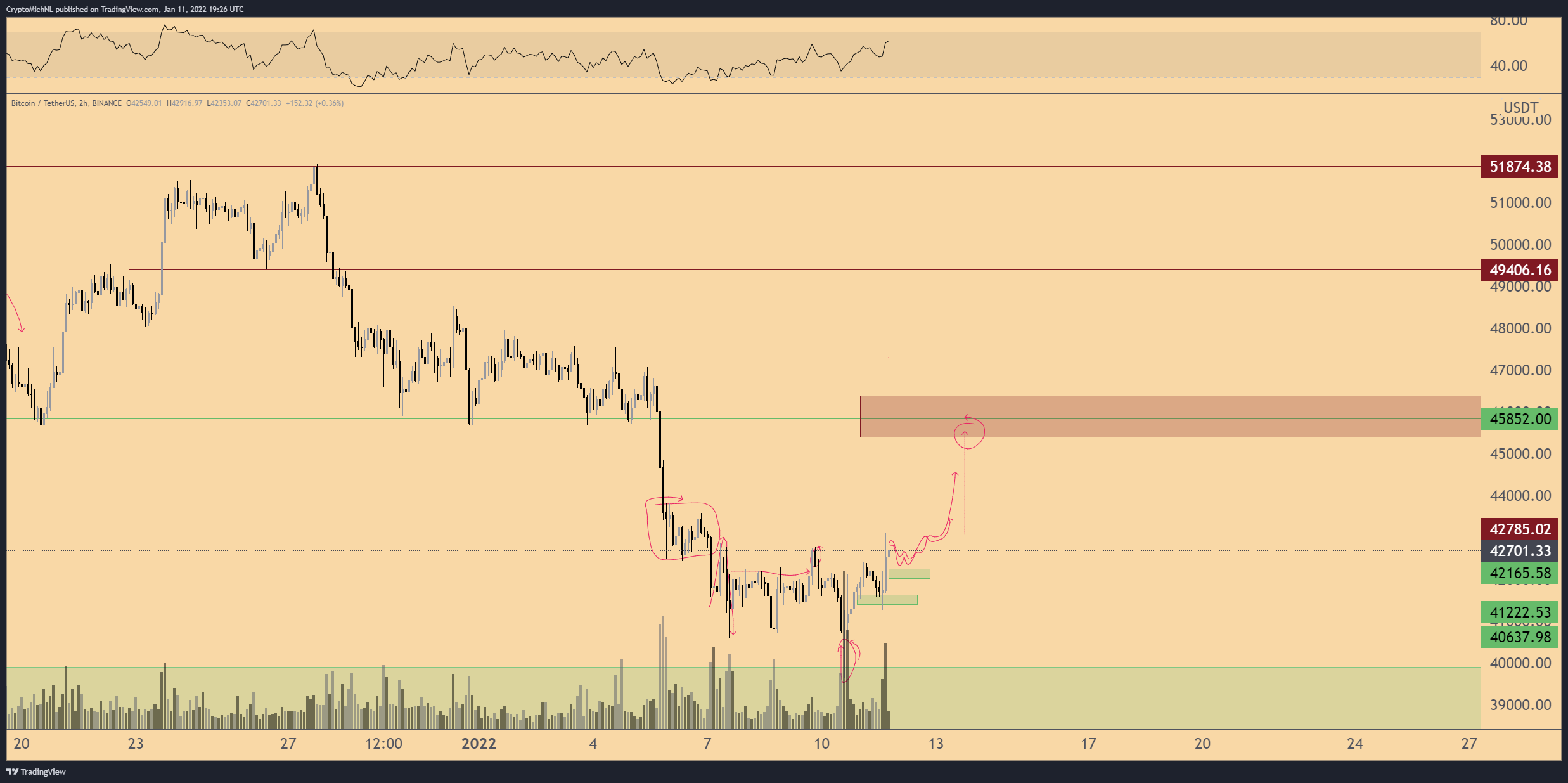

If the leading crypto asset can hold the $42,000 support level, Michaël van de Poppe shared in a tweet with 557,000 followers. Bitcoin (BTC) He thinks there may be better days on the horizon for him.

“If it can hold the $42,000 level, we can continue the upward move. Above $43,000, there isn’t much of a hurdle for Bitcoin, so we can quickly rise to $46,000.”

Currently, Bitcoin is up 2.32% and is trading at $43,639.

The analyst then pointed to the decentralized network that recently recovered from a one-month decline. Ethereum (ETH) He shared his opinions about it. Analyst focused on two key levels to see where the incoming smart contract platform is heading

“Good bounce from Ethereum. The levels I am watching are $3,350 and $3,600 for further bullish perspective and breakout.”

Ethereum is currently up 3.76% on the day and is trading at $3,345.

Van de Poppe’s distributed ledger, which last traded for over a dollar on Dec. Ripple (XRP) talked about. In his chart, the analyst highlights how XRP is trading in the same range as it was just before the breakout last summer.

“Honestly we are not in the worst place to look at XRP.”

XRP is trading at $0.79 at the time of writing.

Looking at the enterprise-grade scalable blockchain platform Elrond (EGLD) on the EGLD/BTC trading pair, Van de Poppe highlights the 0.004217 to 0.004834 range that the altcoin hit in November and December of last year before its latest big breakout.

“EGLD may have hit rock bottom,” he commented.

Elrond saw a volatile price action last month and dropped from the December 15 high of $338.55 to $186.88 on January 7th. ELGD is up 2.55% on the day and is trading at $211.93.

Van de Poppe completed his crypto predictions by reviewing the supply chain management project VeChain (VET) on the VET/BTC trading pair. The analyst thinks that the VeChain chart reflects the past price action and VET could explode after further consolidation in the support range.

“For VET, this shows movements comparable to the price action we saw in 2020-2021. It did not break a very important resistance. There will be some more consolidation until a new impulse move starts.”

VeChain has gained a nice 5% today and is trading at $0.08 at the time of writing.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.