Maintaining an uptrend for a long time and reaching the highest level in history (ATH) at the end of this trend. Bitcoin (BTC), faced a significant level of support. As Bitcoin faces this level of support, what levels and developments should investors pay attention to? Request October 24 Bitcoin (BTC) analysis.

Falling below a critical support level, Bitcoin is facing a new support level. Bitcoin (BTC), which has been on a downtrend recently, is experiencing a decline towards the $56,568 support level.

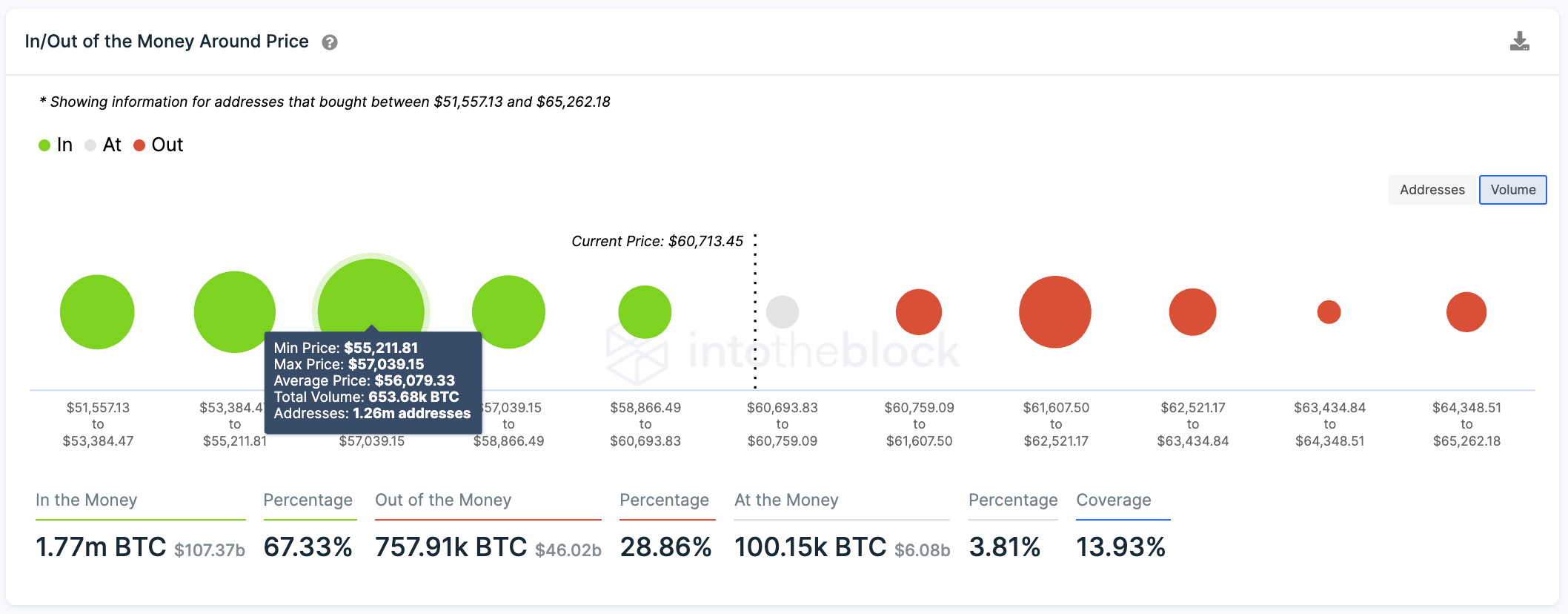

The BTC IOMAP pattern shows that it is unlikely that the leading cryptocurrency will drop below $56,000.

Reaching its new ATH on October 20, 2021 BTChas continued to decline since then. Looking to retest critical support levels after the majority of traders took profits, BTC could decline towards $56,000.

Price May Drop By 7%

Falling below an important support level on October 22, BTC fell to test new support levels as it could not maintain this support level.

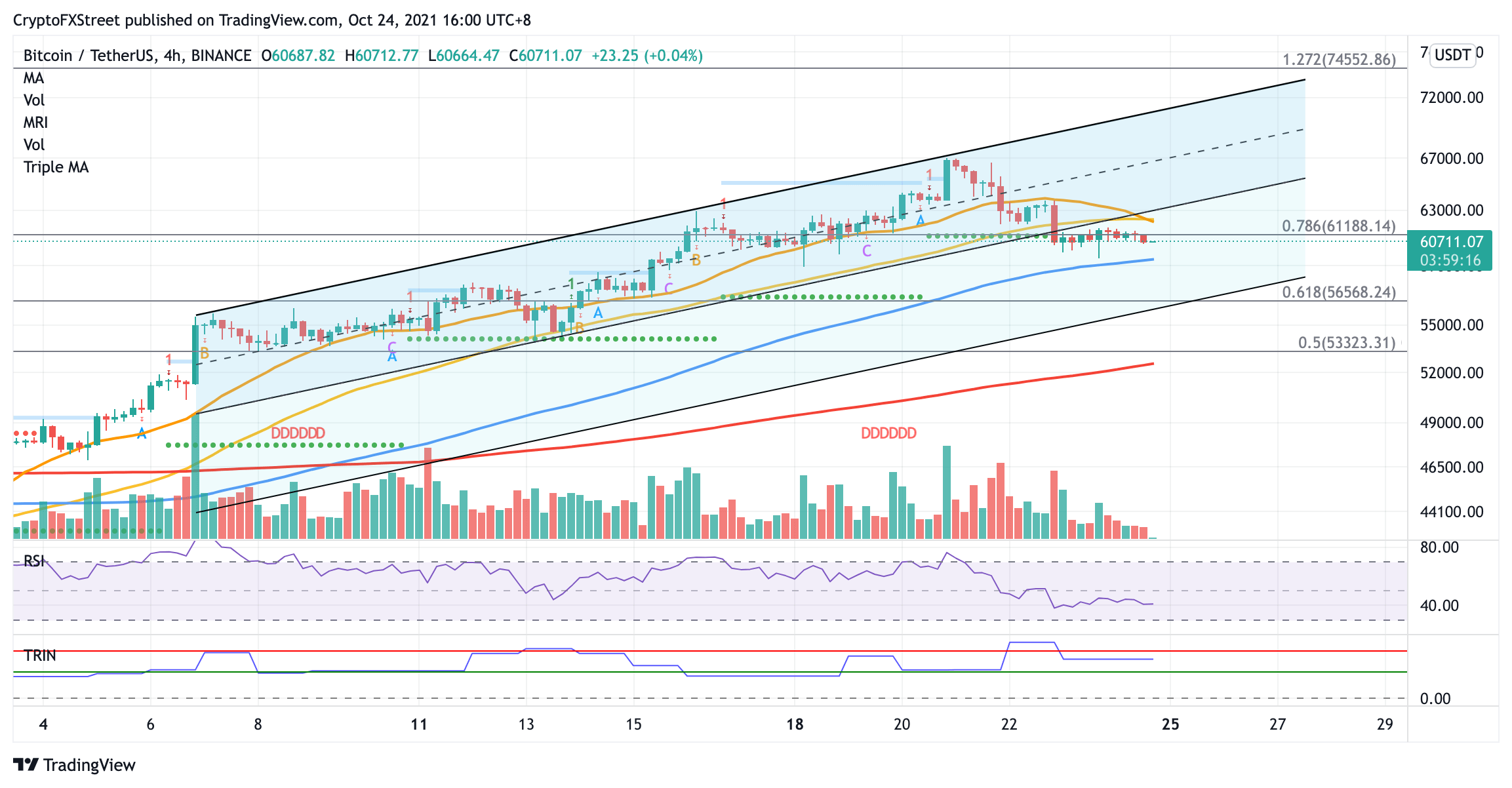

If selling pressure increases in Bitcoin, bitcoin priceIt will seek support at the “100 four-hour Simple Moving Average (SMA)” at $59,452 before falling towards the bearish target given by the “executive technical pattern” at $56,568, which coincides with the 61.8% Fibonacci retracement level.

It should be noted that this level is important as the Momentum Reversal Indicator (MRI) shows a support line.

IntotheBlock’s “Money In/Out Around Price (IOMAP) model” also shows that the price of Bitcoin will remain above $56,000, with the largest set of addresses 652,680 BTC totaling 1.26 million purchased, i.e. an average price of $56,079.

On the other hand, if buying pressure builds, bitcoin price will face a resistance level of $61,188 at the 78.6% Fibonacci retracement level. If it manages to hit the $62,442 level, where the 21 and 50 “four-hour SMAs” converge, it will face an upside there.

The downtrend line ($63,057) in the parallel channel will act as a major hurdle in the bulls’ attempt to control the markets to ensure BTC continues its uptrend. BTC Until it rises above this important level, it may continue to consolidate.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.