During the week, the minutes of the March FED meeting were announced, and here, in fact, information about the roadmap for the coming period, about monetary tightening, which I attach great importance to, was given.

At the same time, we can say that the markets are beginning to understand that the FED is a little more aware of the seriousness of the situation. But since I have a lot of articles on these subjects, I will go straight to the point.

I will focus on the critical role that 111DMA used by the PI Cycle top indicator will play for BTC in the coming days. Let’s take a quick look at past cycles.

2013-2014

In the chart above you will see: The blue line is 111DMA. As you will notice, whenever the price enters a downtrend after the peaks, whenever it breaks the 111DMA, then we see the moments when the market, which we call capitulation, intensifies the sales to the detriment of the market and panics.

These moments have always been faced with hard purchases in the long run, but making the decision to invest in this region has not been the moments that the psychology of every investor can handle.

As long as the price moved above 111DMA, it worked as a support, but there were also critical decreases at the points below it.

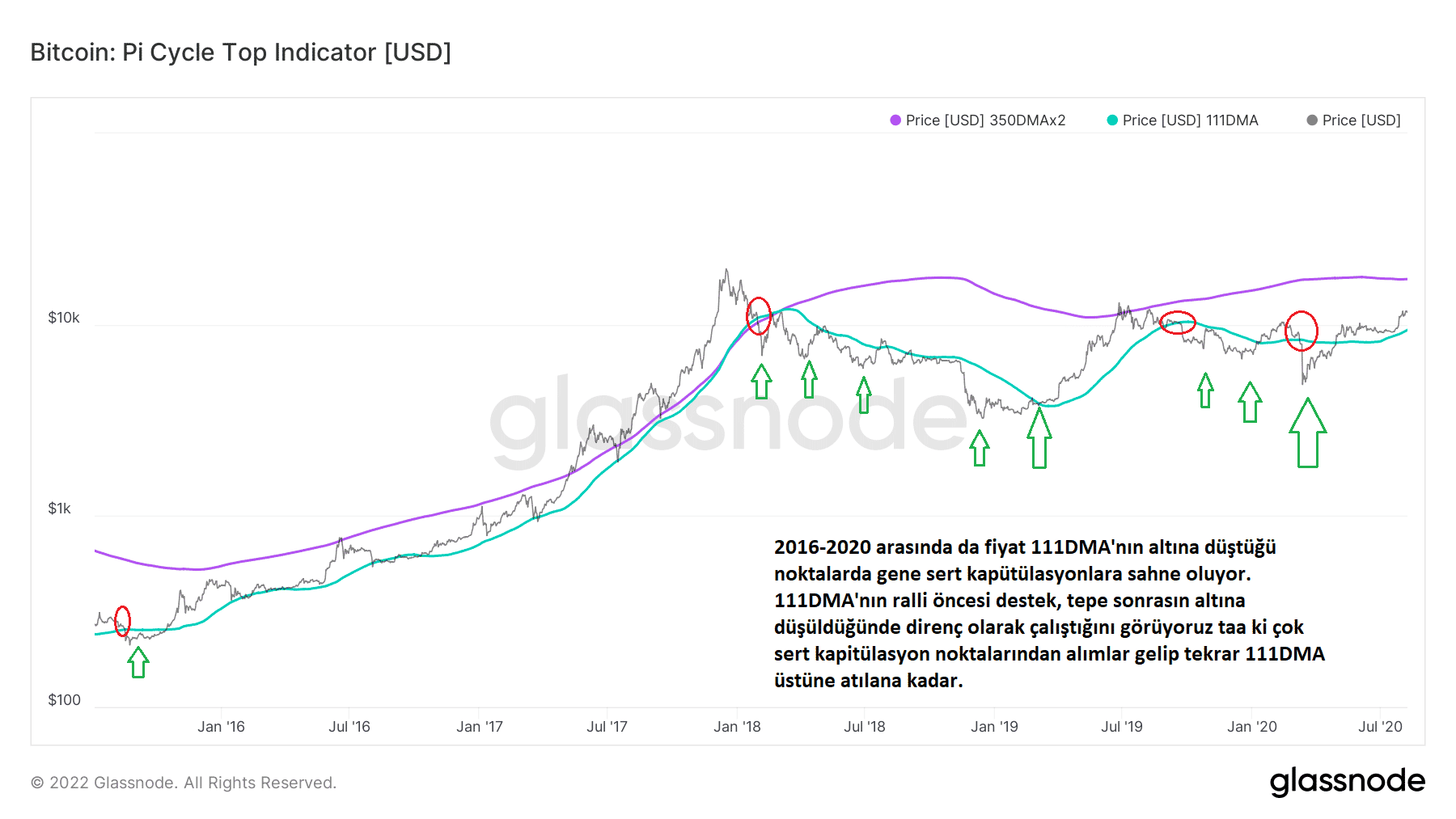

2016-2020

You will see the same graphic between 2016-2020. 111DMA supported before the peaks, but after the peaks, it caused sharp drops at the points where it could not hold in the falls, that is, capitulations.

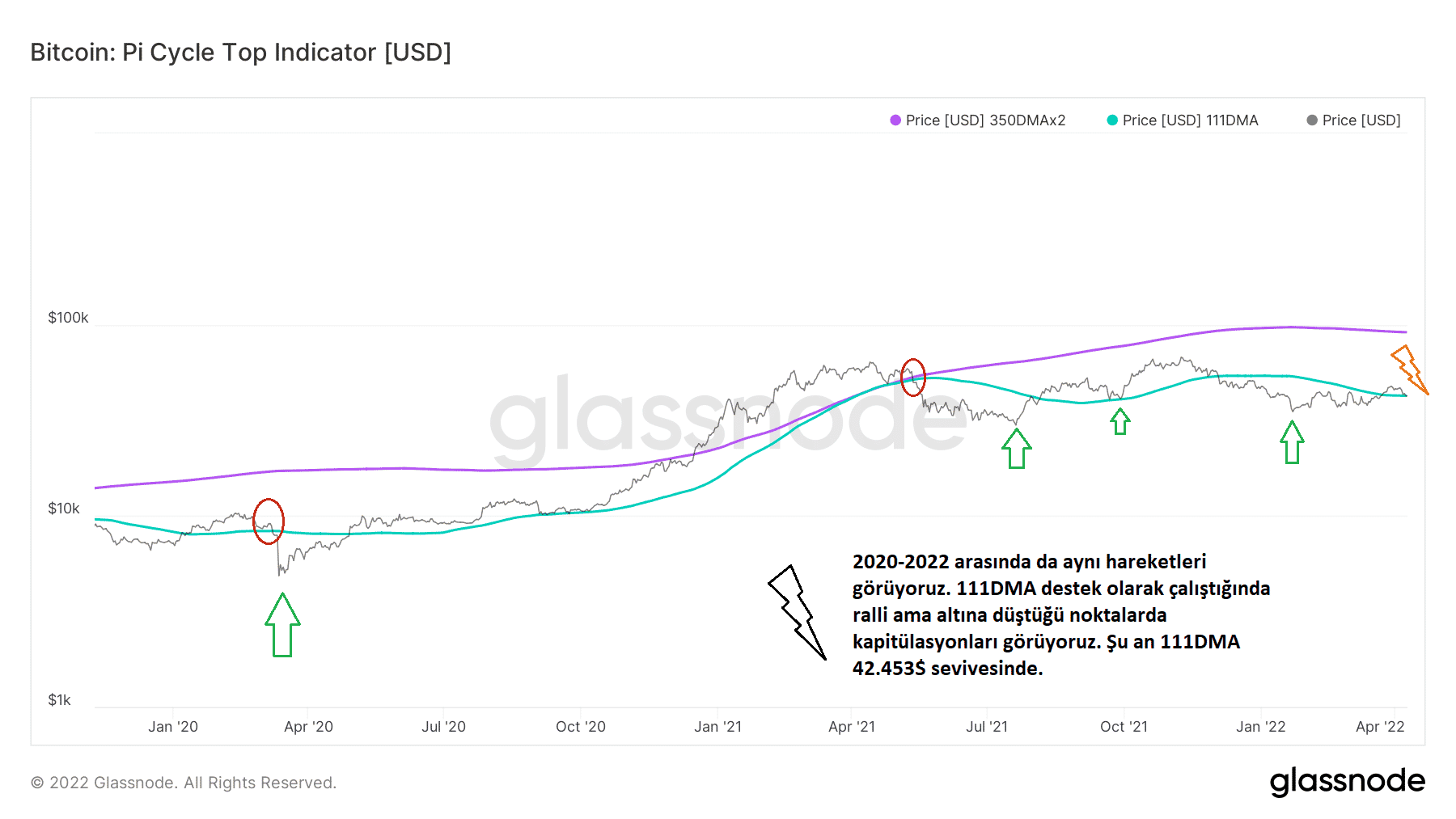

2020-2022

We face the same situation in 2020-2022. When the price broke below 111DMA, then it fell sharply, but we witnessed sharp rises at the points where it went above it and took it as support.

At the moment, the price has made exactly 111DMA support itself. The intervening weekend may enable us to act in parallel in this region, but the market will start to move as of midnight on the market.

Since CME is closed in the 42700 region, we can probably move up and down in the 42-43K region until Sunday night, but if this level cannot be held at the 111DMA $42,453 level, we may experience the same sharp decline scenarios. Even if the price holds on, there will be no need to panic, at least for now.

That’s why I think these levels should be followed carefully in order to understand the coming period and take the right position in the market.