Second largest cryptocurrency by market cap Ethereum (ETH) While the price continues to fluctuate, ETH inflows to liquid staking platforms do not slow down.

Decentralized finance tracker deFiLing According to the data, the amount of ETH that Ethereum holders have invested in staking pools has approached 9 million. According to today’s market value, this figure is $ 16 billion.

When we compare the TVL value with the last day of April, we see a difference of 440 thousand. To simplify, we can say that liquid staking pools have grown by 5% in just 2 weeks.

Lido Retains Leadership

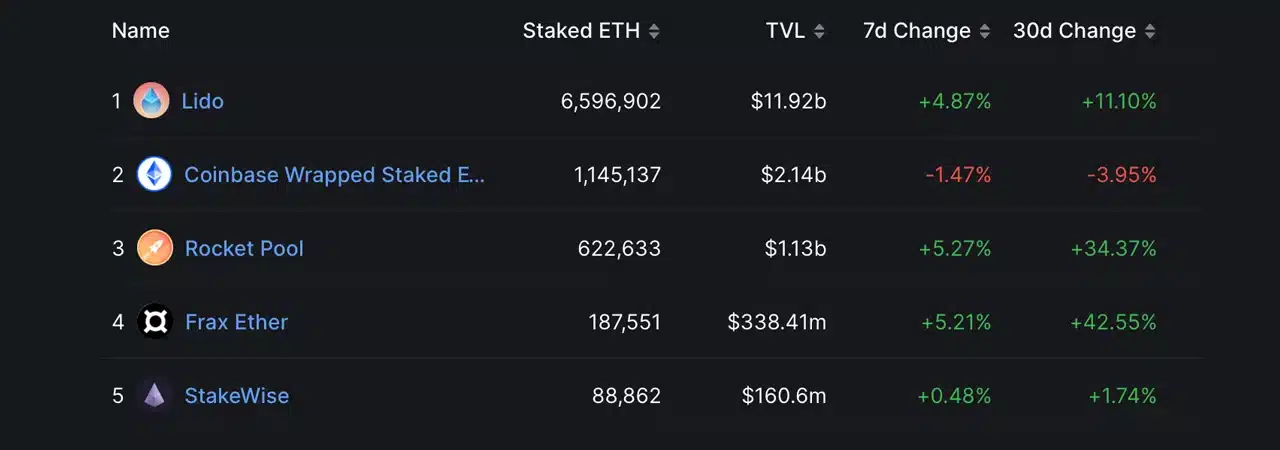

The DeFi tracker also instantly shares how much Ethereum is in which pool.

On-chain data staking solution of Lido Finance With 6.6 million ETH, he revealed that he had an overwhelming advantage over his competitors. With 2.1 million ETH after Lido coinbase and 1.1 million Rocket Pool is coming.

While the Coinbase pool has shrunk in the last 30 days due to regulatory pressure from the USA, Rocket Pool and Frax Ether attracted attention with increases of 35-40%.

Staking pools are likely to continue to grow unless the crypto market drops too quickly.

The more Ethereum staked, the smaller the amount of ETH waiting to be sold in circulation, so the increase in the number of stakes is a factor that has a positive effect on the price.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!