Analytical firm Santiment is the second-largest cryptocurrency by the world’s wealthiest crypto investors despite the market drop. Ethereum (ETH) continues to be on an upward trend in says.

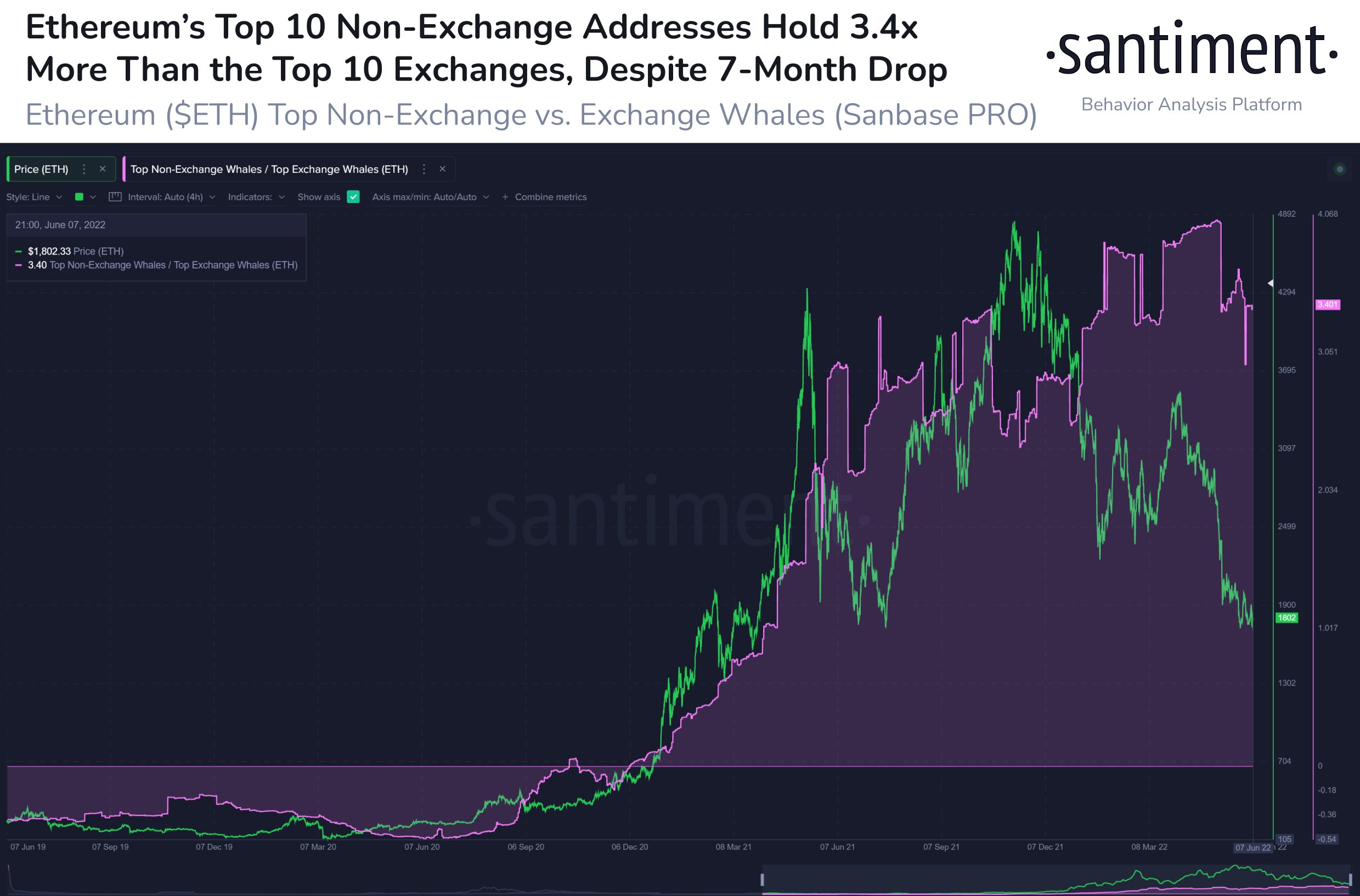

According to Santiment, the top 10 over-the-counter wallets maintain a high percentage of Ethereum in their portfolio and currently hold 3.4x more ETH than exchanges.

The firm says this shows that the biggest whales are holding the leading altcoin firmly.

Ethereum, which has dropped about 1% in the last 24 hours, is trading at $1,792 at the time of writing.

“Ethereum’s top ten over- and over-the-counter addresses maintain a strong ETH ownership ratio among the top ten over-the-counter whales.” With 3.4x more tokens being held, there still seems to be a belief that prices can stabilize.”

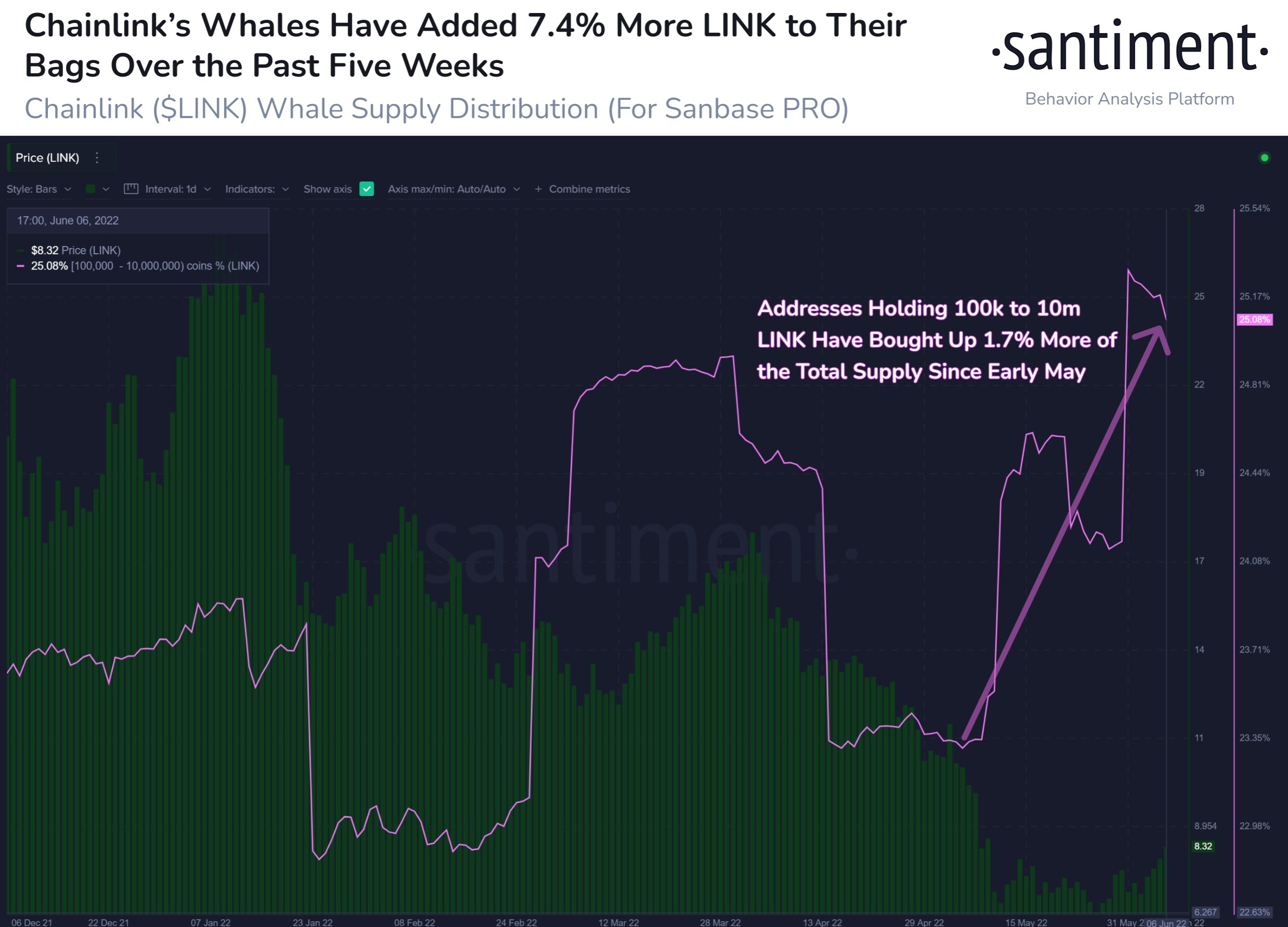

Rich investors are accumulating Chainlink

Santiment is also heavily invested by investors with deep pockets. Chainlink (LINK) He claims to have collected. The firm says whales have been stockpiling the asset since last month, when the price of its decentralized oracle network fell below $6.00.

Chainlink, which has experienced an increase of about 5 percent in the last 24 hours, is 9.08 at the time of writing.

traded in dollars.

“Chainlink has gained +9% in the last two hours and the whales that have been hoarding are starting to profit. After the start of sales on March 30, they started to accumulate again as prices fell in early May. They hold more than 25 percent of the supply for the first time since November.”

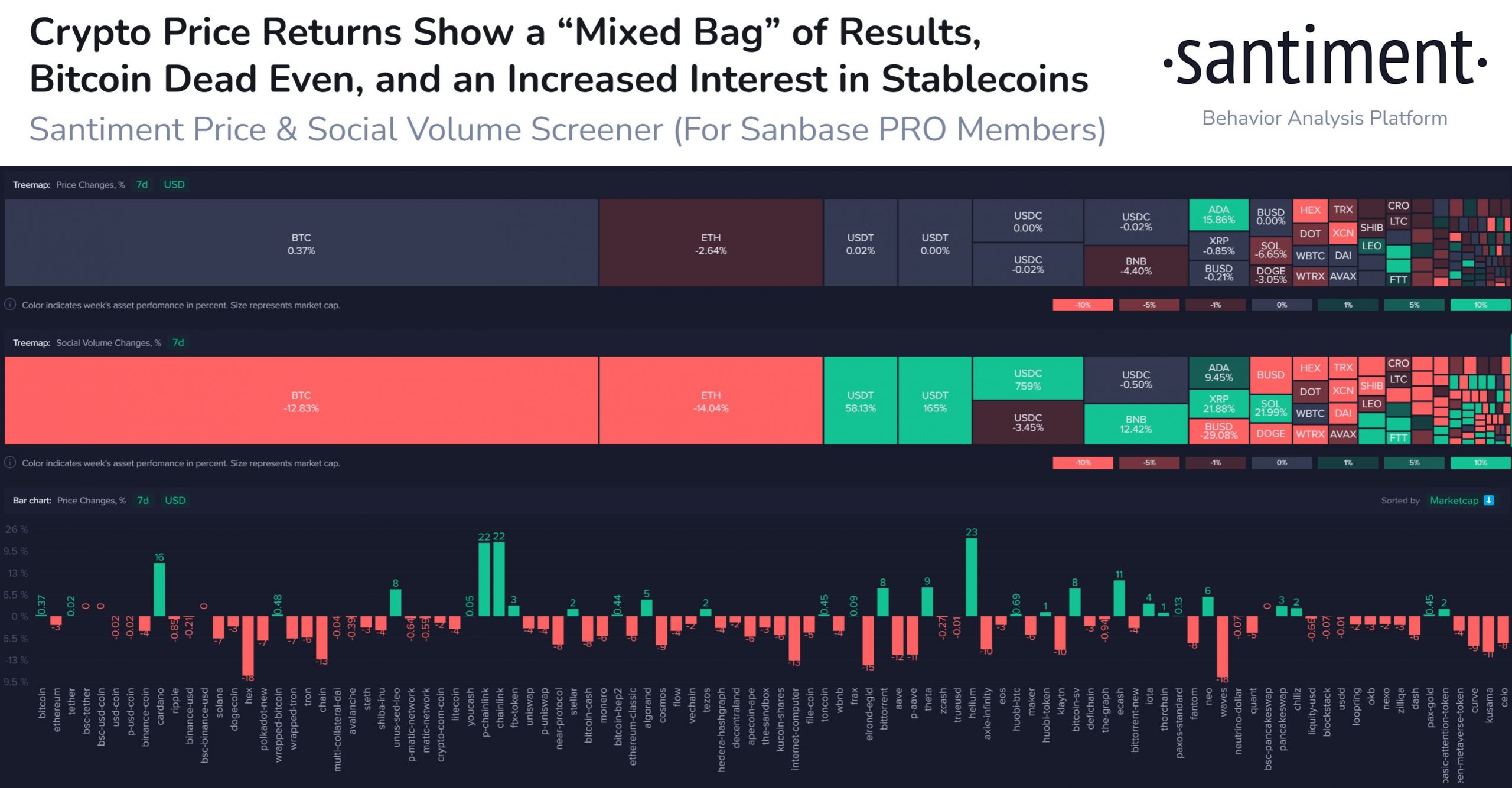

Despite the high volatility in the crypto market in early June, the analytics firm; of LINK Cardano (ADA) and Helium (HNT) He says it performs well with him. In this process, Bitcoin (BTC) and Ethereum prices are still moving sideways.

“While the prices of cryptocurrencies fell wildly in the first week of June, there was not much movement in Bitcoin and Ethereum. Altcoins, on the other hand, showed great divergences with ADA, LINK and HNT outperforming others.”

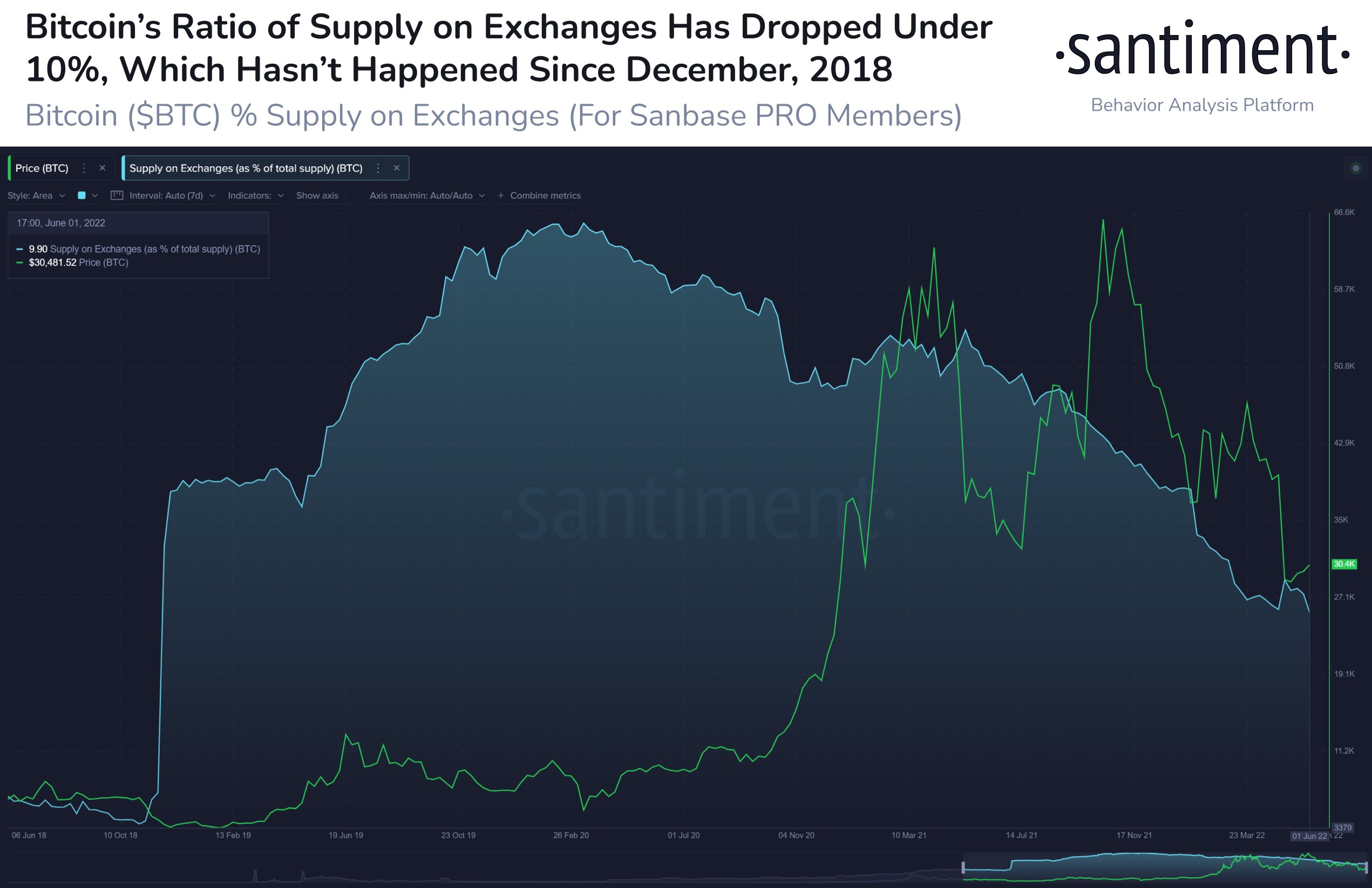

Santiment also reveals that the ratio of Bitcoin supply to exchanges is currently at 10 percent, the lowest rate since December 2018, which could be a sign of a bullish stance among long-term investors.

“After May’s volatility created an influx of BTC resulting from the sending of coins to exchanges for panic selling, the percentage of Bitcoin supply sitting on exchanges dropped to 9.9 percent. This reflects hodler confidence, and stock market supply has never been lower in 3.5 years.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.