A remarkable event took place in the cryptocurrency world today. One of the most famous meme-based cryptocurrencies dogecoin, today witnessed massive whale transactions, which attracted the attention of investors. These transactions, which occurred after DOGE fell to the $0.18 level, started a wave of speculation about the price movement of Dogecoin in the coming period.

Following large-scale liquidations and market corrections, Dogecoin has experienced a significant decline recently. Now, with on-chain whale activity developing for the token, investors are speculating on the price of Dogecoin as Bitcoin’s halving event approaches. Interestingly, Bitcoin’s pre-halving correction affected Dogecoin’s price, in addition to the overall market downtrend that altcoins like DOGE were also experiencing.

DOGE Whale Activity Leads to Speculation on Mixed Market Sentiments

According to data highlighted by blockchain tracker Whale Alert, a rather remarkable 583.75 million DOGE was recorded to have moved in the last 24 hours. These whale transactions specifically showcase the dumping on stock markets and savings by whales who have mixed emotions about the market.

According to the data, 229 million DOGE worth $42.95 million was accumulated by an unknown wallet from Robinhood, while 60.26 million coins worth $11.14 million were dumped on the same exchange by another whale. Similarly, 58.81 million DOGE worth $11.03 million was accumulated from Coinbase, a leading exchange, while 234.68 million DOGE worth $43.61 million was dumped on the same exchange by another whale. These mass transactions indicate mixed emotions among whales and set the trajectory for an uncertain scenario ahead of Dogecoin’s price action.

Meanwhilememe coin The market dynamics for are even more noticeable and show a bearish trend on the token.

Dogecoin Price Falls

At the time of writing, the Dogecoin token price has dropped 1.37% in the last 24 hours and currently stands at $0.184. This massive decline is surfing the tide of recent market corrections, as mentioned above.

Simultaneously, Coinglass announced that there was a 4.47% decrease in the token’s open interest and the OI-weighted funding rate decreased to 0.0197%. The token was trending downwards as of press time, as investor interest in the asset waned, indicating a reduced readiness among investors to invest more in long positions.

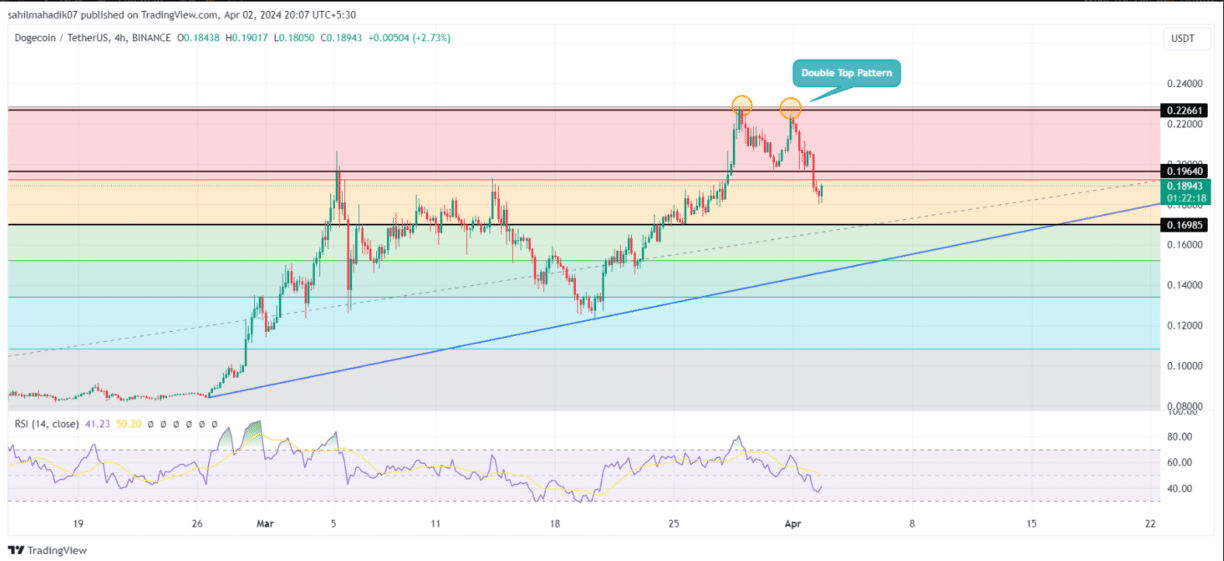

Moreover, the analysis highlighted another interesting phenomenon where the meme coin witnessed a significant selling pressure at the $0.22 mark, leading to an extraordinary price decline to currently trade at $0.18. In the analysis, in line with the 4-hour chart, DOGE’s top formed a double-top pattern, strengthening the bearish sentiment among traders.

If supply pressure continues, DOGE price could post another decline of around 8%, hitting the combined support of the ascending trend line and the 38.2% Fibonacci retracement level at $0.17. However, crypto market enthusiasts continue to scrutinize the token extensively due to BTC halving and historical data showing altcoins mimicking BTC’s price movements.