Popular investor Warren Buffett‘s assets by selling cash flow resonated in the market. Bitcoin price, which has a tight correlation with stocks, started to worry about a collapse. So is this really possible?

Warren Buffett-owned Berkshire Hathaway increased its interest in cash and U.S. Treasury bonds by selling $13.30 billion worth of stock in the first quarter, according to its latest quarterly earnings report. Meanwhile, it has channeled $4.4 billion into buying its own shares and $2.9 billion into shares of other publicly traded companies.

The market, on the other hand, closely follows the moves of the leading investors. The latest reports show that expectations for the US economy are relatively negative.

“The majority of our businesses will report lower earnings this year than last year,” Buffett said at an event last weekend. He added that the “incredible period” for the US economy has been coming to an end for the past six months.

NEWS CONTINUES BELOW

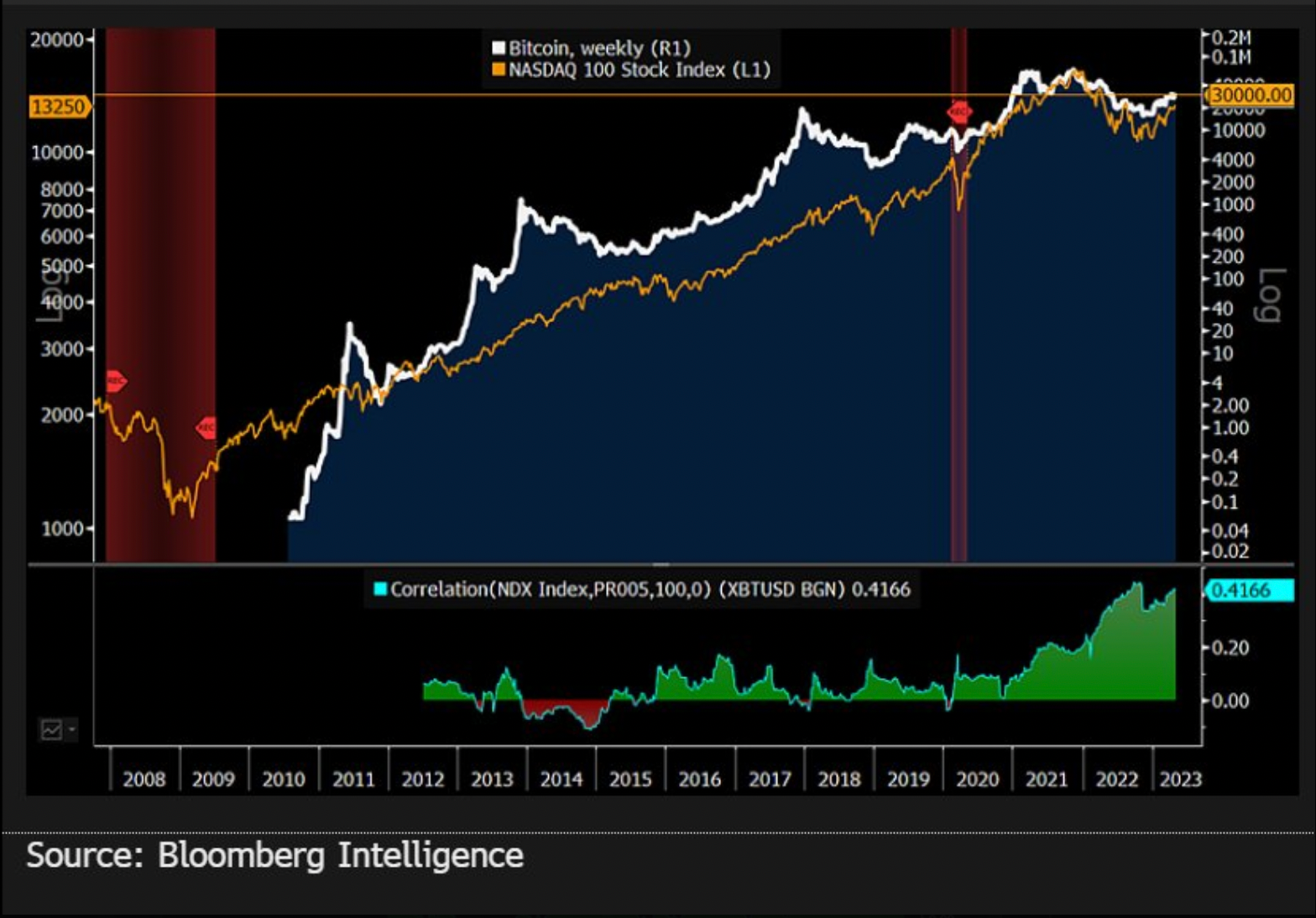

Bitcoin and Nasdaq Correlation Continues

Increase in global recession expectation, with Nasdaq reaching its highest 100-week correlation of approximately 0.42%. bitcoin It also risks putting downward pressure on it.

Moreover, Bloomberg Intelligence analyst Mike McGlone thinks that the BTC price will likely be a leading indicator for a stock crash.

“Bitcoin could accelerate declines for risk assets – If the worst for risk assets does not end, Bitcoin could lead the decline,” McGlone said.

Bitcoin is up about 70% from 2023 to May 2, while the stock index is up 20%, and these are perhaps jumps within the broader bear markets. The Fed’s continued tightening in May and its tendency to keep its course unless risk assets fall to reduce inflation may create a lose-lose situation.

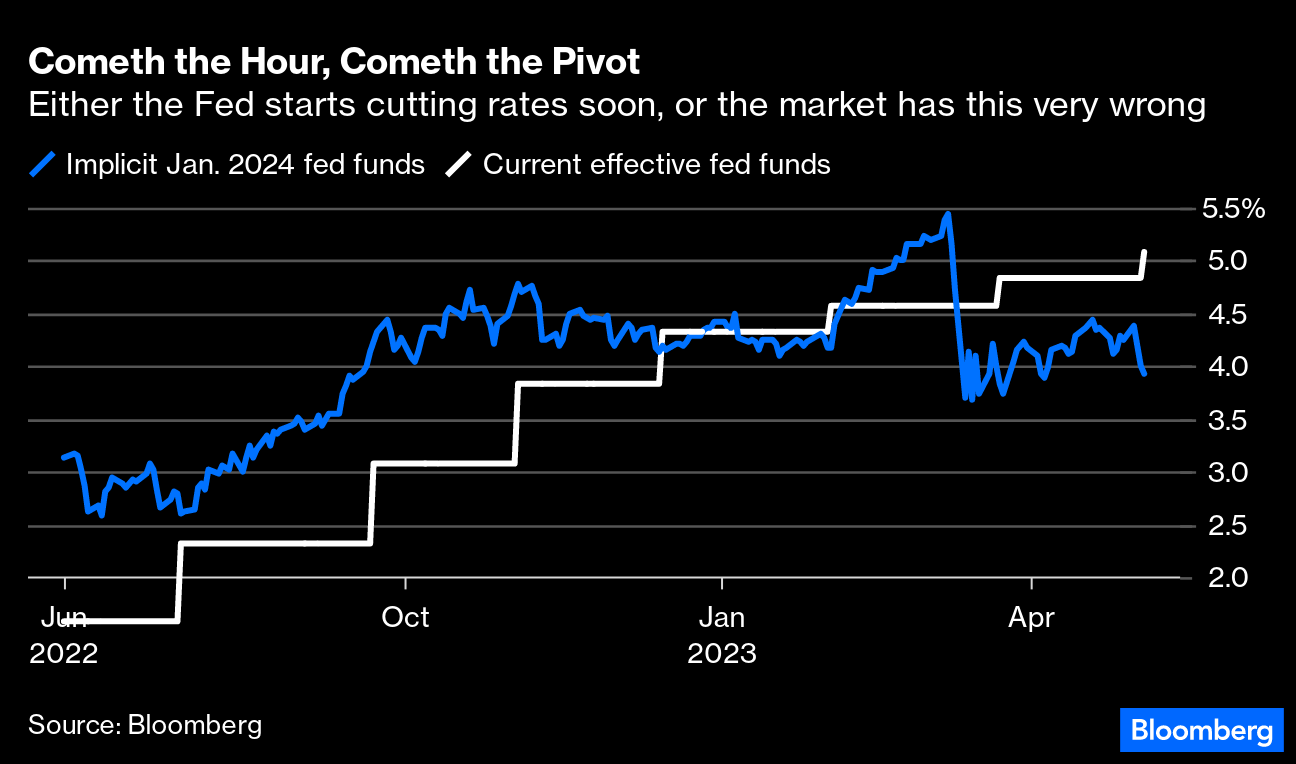

After the US CPI report to be announced on May 10, inflation is not expected to ease. According to Bloomberg’s survey, economists expect the core CPI to remain unchanged at around 5%, which means more rate hikes.

On the other hand, a major fall in inflation may bring the Fed to suspend interest rate hikes, or even lower interest rates in an extreme scenario. Currently, Fed funds futures data shows that at least five rate cuts are likely between May 2023 and January 2024.

As we reported as Koinfinans.com, the Bitcoin price dropped to $ 27,350 last week. This caused the price to fall below the 50-day exponential moving average at these levels. The bears, on the other hand, seem to be targeting $27,000 right now.

Things could trigger a decline to the $24,600 levels if the continued interest rate hike in the US triggers a strong decline below the $27,000 support. This means a 10% chance of an additional drop by June.

Conversely, if there is a recovery at $27,000, a test of the $30,000 levels will likely happen.

You can follow the current price action here.