Bitcoin, which has been out of the downtrend for 60 days, is trading at the $42,000 limit today after retesting $40500 yesterday.

We see that the volume is decreasing due to the weekend. Of course, investors who do not want to wake up to a bloody Monday and wait for tomorrow also have an effect on this.

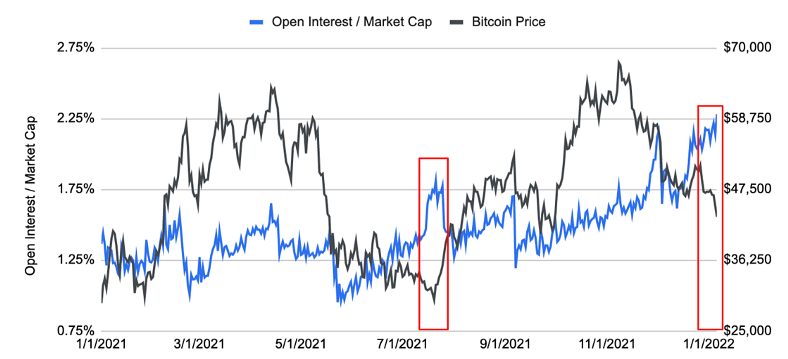

“We may see a potential short squeeze going forward,” said data analytics company IntoTheBlock, sharing a chart showing the ratio of open interest to market value.

When we look at the shared chart, we see that the increase in the said ratio while the price is rising indicates a correction to squeeze the longs. Inversely proportional to this, we see that while the price decreases, the increase in the rate triggers a rise to tighten the shorts.

While the price of Bitcoin fell to the levels of $ 40,000, the ratio of open positions to market value reached the highest level of the last 1 year. Looking at the similar movement in July, this data gives us a signal that we may be at a potential bottom and a rise may come to squeeze the shorts.

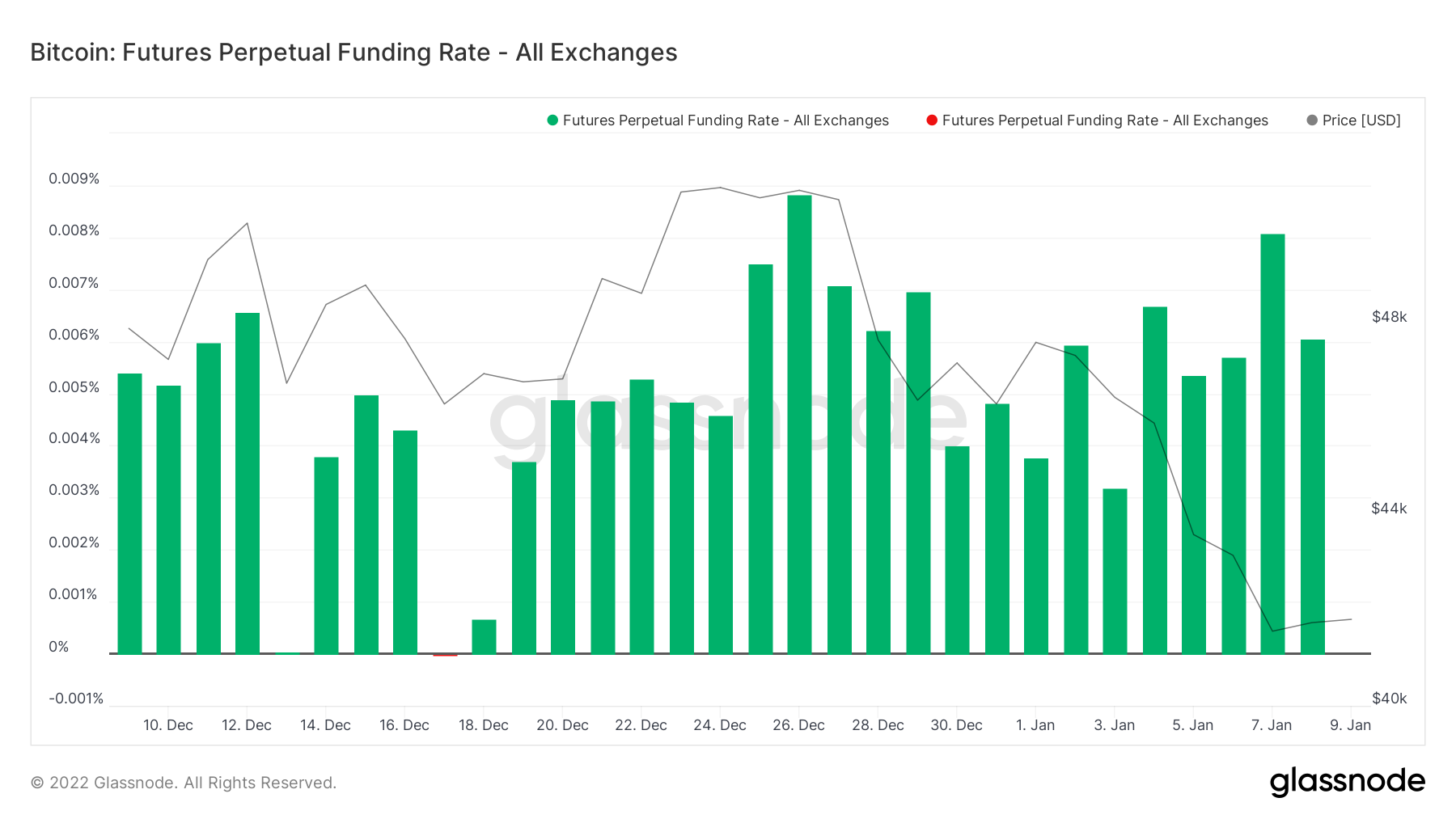

However, we still find it useful to approach this data with caution. Because, according to the data provided by Glassnode, the funding rate in the market shows that long positions are still higher.

When we evaluate the two data together, according to the result, we can see drastic downward and upward movements in order to tighten both longs and shorts in the coming days.

Therefore, it may be a little more important this week to stay away from high leverage and not panic trade.

*Not Investment Advice.