The U.S. Bureau of Economic Analysis today released personal consumption expenditures (PCE) data for November. inflation will disclose the data. Annual PCE inflation is expected to decline to 2.8% from last month’s 3%, while the monthly rate is expected to not increase. On the other hand, Core PCE, the Fed’s preferred indicator to measure inflation, is expected to increase by 0.2% on a monthly basis, while the annual rate is expected to decrease to 3.3%, its lowest level since 2021.

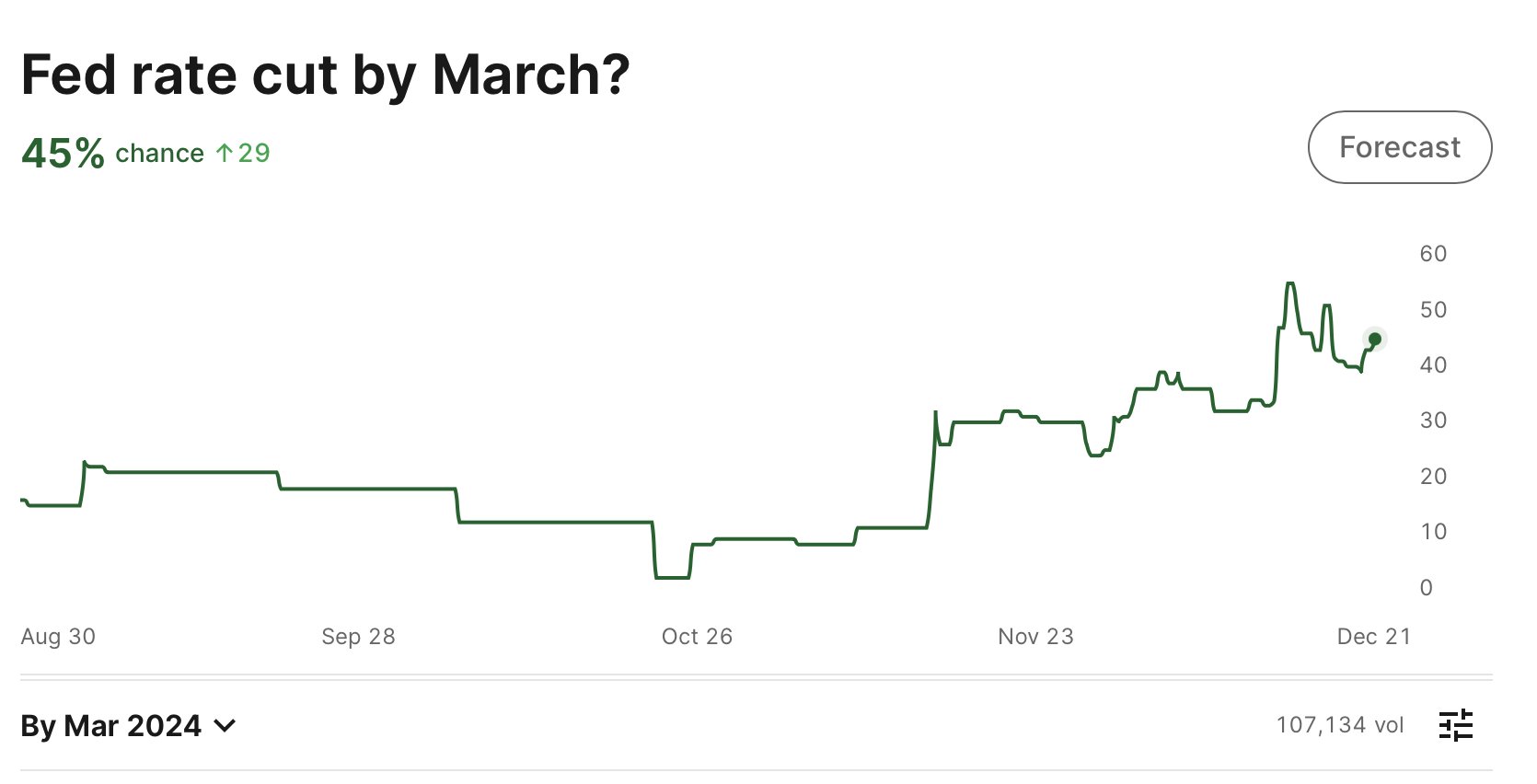

Forecasts from Wall Street experts are mostly in line with market expectations, with Fed Chairman Jerome Powell predicting three interest rate cuts in 2024. The market currently gives a 45% chance that the Fed will start cutting interest rates in March. Additionally, CME FedWatch puts the probability of a 25 basis point rate cut in March at 71%.

The monetary policy outlook remains dovish with the US Dollar Index (DXY) pegged around 101.8 on Friday, but is poised to decline for the second week in a row in anticipation of a Fed interest rate cut.

Moreover, the yield on the US 10-year Treasury continues to decline after falling below 4% last week. It is currently at 3.89% and has increased slightly as traders await inflation data.

Fed rate cuts and other macro factors are helping the Bitcoin price and crypto market recover. Traders and investors are also keeping an eye on spot Bitcoin ETF approval and Bitcoin halving factors in anticipation of a major bullish rally.