Before the FED’s meeting to be held on January 25-26, it is seen that the risk appetite in the markets has completely subsided. Although the FED is not expected to increase interest rates before March, it is still noticeable that the markets are nervous.

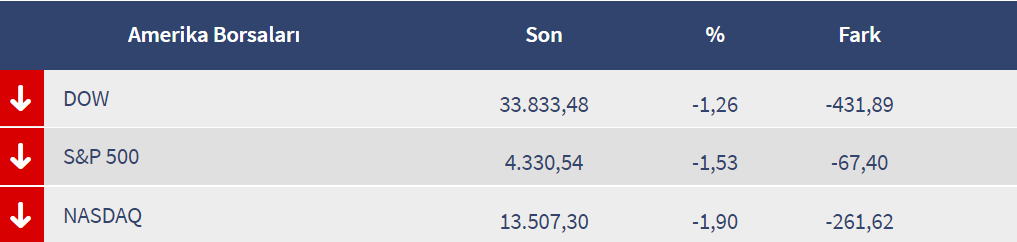

US stock markets, which closed last week with losses, started the new week with a decrease. As of the moment, the table on the stock markets is as follows:

Especially in the last period, moving in parallel with the US stock markets, bitcoincontinues its downward trend today. Having fallen to the levels of $ 32,900 In BTC, the most important support is now $ 29,000.

Because Bitcoin, after seeing the peak of 2021 at $ 64800 in April, experienced a decline to $ 29,000, then found support here and broke a new record by rising to $ 69,000 in November.

The BTC price, which has been gradually falling since November, is falling “without breathing” to investors, so to speak. The downtrend without much correction from its peak. BTC If $29,000, which is the most critical level for the economy, is also broken, the $24,000 levels seem to be the next support point.

In particular, the RSI indicator has fallen to previously rare levels. BTC, which generally moves upwards after falling to these levels, stands out as the asset most affected by the rush of escape from risky products all over the world.

At this stage, the interest rate decision to be announced by the FED on January 26 will be followed closely.