Dusseldorf The monetary policy experiment in Turkey threatens to escalate. After President Recep Tayyip Erdogan tried to combat rising consumer prices with falling interest rates, contrary to current economic theories, the inflation rate rose to its highest level in almost two decades in December. The national statistics office announced on Monday.

Accordingly, the rate of inflation jumped last month year-on-year from 30 percent to 36.08 percent – the highest level since September 2002. The central bank’s target is five percent. This increased inflation much more than expected: Economists surveyed by the Reuters news agency had expected an average of 30.6 percent. From November to December alone, the rate of price increase was 13.6 percent.

The Turkish inflation rate has more than doubled since the summer – and an end to this development does not seem to be in sight at the moment. Because producer prices even increased by 79.89 percent year-on-year in December. The prices that producers charge for their goods will likely, with some delay, at least partially affect consumer prices and further fuel the development.

For this reason, experts have long been recommending Turkey to radically shift its monetary policy. “The key interest rates should be raised immediately and aggressively,” said Özlem Derici Sengül, co-founder of the consulting firm Spinn Consulting, on Monday. “In March inflation is likely to reach 40 to 50 percent.”

Top jobs of the day

Find the best jobs now and

be notified by email.

Özlem Bayraktar Göksen, chief economist at Tacirler Yatirim in Istanbul, expects consumer prices to continue to rise. “We expect headline inflation to accelerate by May / June,” Göksen told Bloomberg news agency.

At Erdogan’s instigation, the Turkish central bank has lowered the key interest rate by more than 500 basis points to 14 percent since September. Contrary to popular economic theories, he is of the opinion that low interest rates dampen inflation, and has several times fired high-ranking central bankers who opposed his course. At the turn of the year he again admitted this approach: “We have fought to save the economy from the cycle of high interest rates and high inflation,” he said.

So far, however, Erdogan’s policy has achieved the opposite: In 2021, the lira lost around 44 percent of its value against the US dollar. As a result, imports, fuels and everyday goods have become more expensive. Some of the around 84 million inhabitants can only pay for food and other important things with difficulty. Erdogan referred on Monday, however, to the positive effect of the weak lira: exports would have increased by 32.9 percent to the equivalent of 198.1 billion euros in 2021, and this record amounts to a 7.8 percent reduction in the foreign trade deficit.

The Turkish opposition leader Kemal Kilicdaroglu criticized Erdogan again sharply on Monday. The “economic genius” in the presidential palace screwed up everything it touched, he wrote on Twitter. The opposition has long questioned the official inflation figures and is assuming an even higher rate of inflation.

Support measures threaten to fizzle out

The Turkish president tried to counteract this development. In December, he ordered support measures to stabilize the lira. In order to protect savers, the state should in future settle the difference between lira investments and comparable dollar investments from the treasury.

That stabilized the lira exchange rate shortly before Christmas. The Turkish currency then appreciated against foreign currencies, but has since been on the decline again. On Monday after the inflation figures, the dollar and euro appreciated against the lira by around two percent each to 13.646 and 15.423 lira, respectively.

Even before the turn of the year, stockbrokers pointed to the dwindling confidence of investors in the measures taken by the Turkish central bank to stabilize the lira. According to official data, the citizens of Turkey keep around half of their savings in foreign currencies and gold.

Erdogan therefore called on the population in his New Year’s address to hold on to their savings in lira. “I want all of my citizens to keep their savings in our own currency and all of their business to do in our own currency.” Given the high inflation and the loss of purchasing power, it will be difficult to maintain confidence in the lira.

The downside of Turkish monetary policy is also evident on the bond market. Since the central bank began cutting interest rates on September 23 last year, the yield on ten-year government bonds has risen by more than eight percentage points. On Monday, it approached its record level of 24.910 percent.

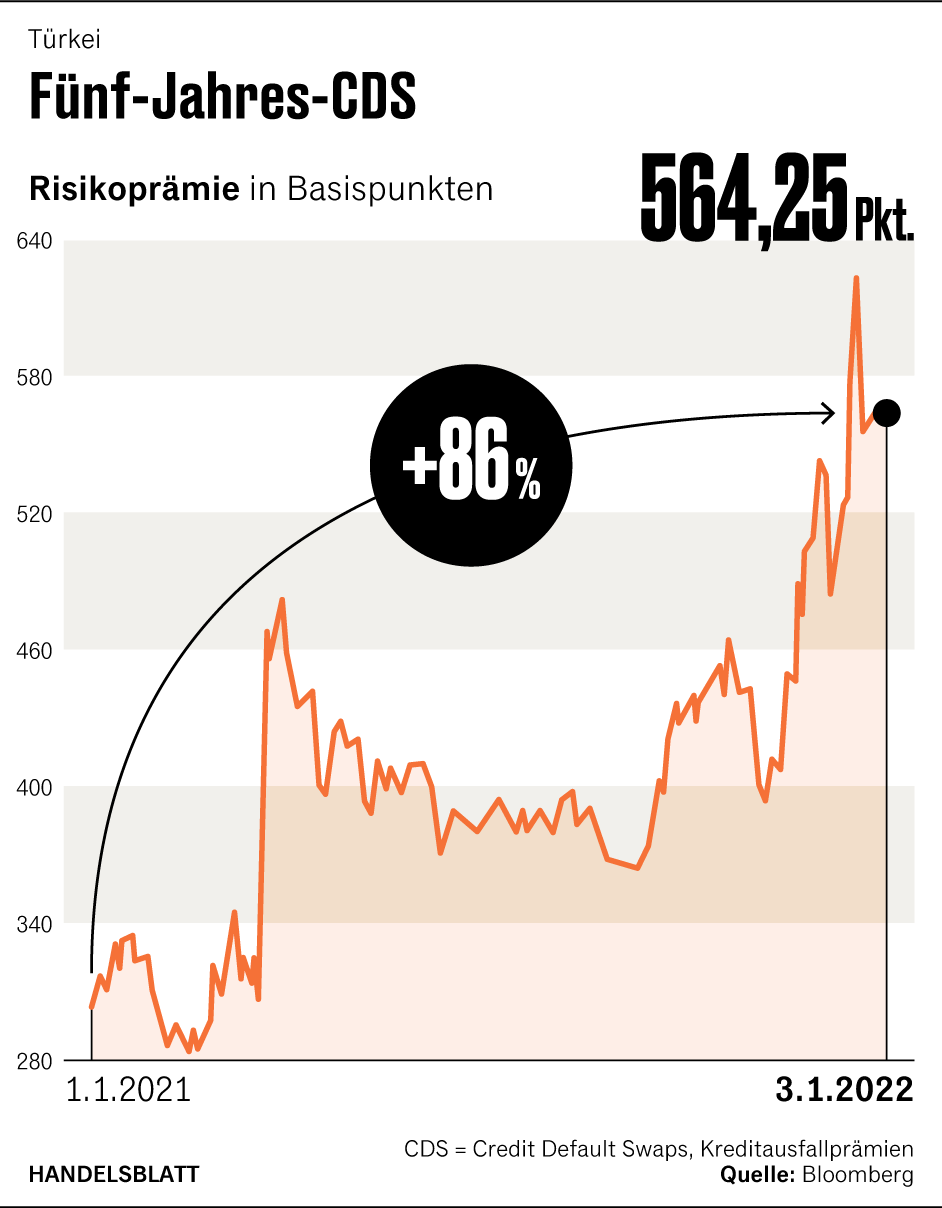

This trend shows that investors are concerned that monetary policy is too loose to contain inflation. This can also be seen in the rising costs for credit default insurance. With these, professional investors can hedge against the risk of default on Turkish government bonds.

The annual premium for credit default swaps (CDS) is traditionally given in basis points, based on bonds with a five-year term. The CDS for Turkey bonds was 566.45 basis points on Monday: professional investors paid 5.66 percent of the nominal value of their bonds per year to hedge against default. For comparison: For the Federal Republic of Germany this value is 0.08 percent annually.

With material from Reuters and dpa.

More: President Erdogan calls on citizens to save in Turkish lira.