The November report on US producer prices indicated that wholesale costs continue to rise. It also showed that inflation could last longer than investors previously thought. Crude WTI hit the lowest level of the year at $71.10. Thus, oil prices continue to be the focus of investors. In such an environment, traders made predictions about BTC. Bitcoin predictions made frightened. Here are the details…

Analysts drew attention to liquidations while making Bitcoin predictions

US Dollar Index (DXY) holds 104.50. However, the index traded at 104.10, a 5-month low on December 4th. Analyst Gutsareon said volatile activity is causing leverage longs and shorts to be liquidated. He also noted that this was followed by an unsuccessful temporary drop below $17,050. According to the analysis, stagnation of open interest in futures contracts indicates low confidence from the bears.

Regulatory uncertainty could have played an important role in limiting Bitcoin’s rise. On December 8, the SEC released guidance showing public companies’ exposure to crypto assets. The SEC’s Corporate Finance Division said the recent crisis in the crypto-asset industry has “caused widespread disruption.” He also said that U.S. companies may have obligations under federal securities laws to disclose whether these events will affect their business.

Bitcoin long positions face sharp rise

Margin markets provide insight into how professional traders are positioned as they allow traders to borrow cryptocurrencies to strengthen their positions. For example, exposure can be increased by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only short the cryptocurrency as they bet that its price will drop. Unlike futures contracts, the balance between margin long and short is not always matched.

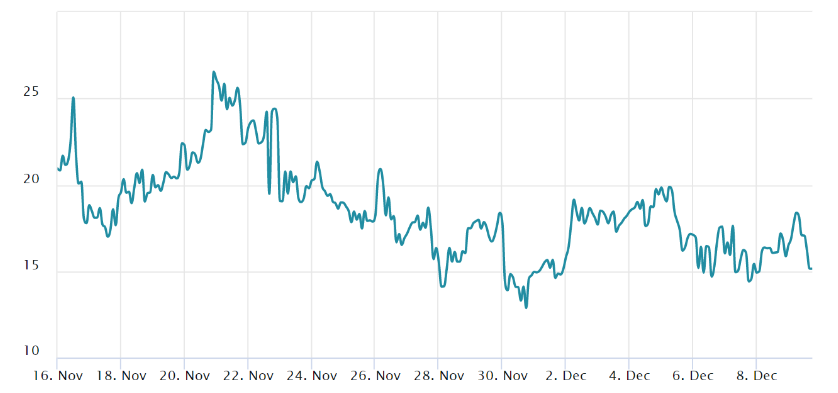

The chart above shows that OKX investors’ margin lending rate increased from December 4th to December 9th. This signals that professional traders are increasing their leverage even after multiple unsuccessful attempts to break through the $17,300 resistance. The metric, currently at 35, supports stablecoin borrowing by a wide margin. It also shows that shorts are unsure about creating leveraged bearish positions.

Bitcoin predictions continue to scare

As shown below, the improved 25% delta shift between December 4 and December 9 indicates that options traders have reduced their risk aversion for unexpected price drops. However, the current 15% delta skew indicates that investors’ fears remain as market makers are less involved in offering downside protection.

Excessive margin usage indicates that buyers may have to reduce their positions during surprise bearish moves. The longer it takes for Bitcoin to recapture $18,000, the riskier it becomes for its leverage margin. Traditional markets continue to play an important role in determining the trend, as we have also reported as Kriptokoin.com. Therefore, the possibility of retesting up to $16,000 cannot be ruled out.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.