Renowned analyst Michael van de Poppe shares his expert thoughts on the current state of the cryptocurrency market and the potential movements of altcoins. The analyst also highlights the importance of rebalancing positions in various altcoins such as Chainlink, Curve, and RSR. Another analyst thinks that XRP, BNB, and ADA may take the offensive soon.

Why are altcoins falling? What should investors do?

Bitcoin dominance: Consolidation and potential change

According to Michael van de Poppe, Bitcoin’s dominance is consolidating with a rejection at the resistance level. Although the weekly timeframe points to a bullish trend, there is a possibility of a bearish Bitcoin dominance, which could result in altcoins taking over. The analyst suggests that the market could witness a trend change from bullish to bearish and Bitcoin dominance could potentially drop by 3-4%.

The analyst also underlines that a breakthrough is needed in the overall market cap, which is currently facing significant resistance of $1.25 trillion. The weekly trend is unbroken and there is a possibility of sideways movement before an upside break.

Altcoins: Consolidation before continuing

The crypto analyst points out that altcoins still face a crucial resistance point. He emphasizes that there is no reason to panic as the weekly trend is still up. Van de Poppe believes the market is currently consolidating before continuing its upward trajectory. However, it is essential to keep significant levels for the market as a whole.

Ethereum’s performance and support levels

The analyst states that Ethereum has reached a new year high, reaching $ 2.14 thousand. Even if it drops to $1,800 on a corrective move, the trend remains upside and the rally is not over yet. It highlights the importance of finding support in the gap area on the daily timeframe, without breaking the overall trend.

Strategies for Chainlink, Curve and RSR

Michael van de Poppe highlights the importance of rebalancing and managing positions in various altcoins such as Chainlink, Curve DAO (CRV) and Reserve Rights Token (RSR) in his portfolio analysis. With support ranges reached for many altcoins against Bitcoin, there is potential for consolidation and recovery.

For example, Chainlink against Bitcoin showed bullish divergence, running towards resistance and consolidating. The rally could continue if it maintains the high low without creating a new low low. Similar dynamics are seen in other altcoins such as Avalanche (AVAX) and Curve.

Best altcoins to watch next week: BNB, XRP and ADA

cryptocoin.comAs you follow, in a week of dramatic changes in the crypto world, the market witnessed a fluctuating volatility in leading digital assets. These fluctuations shaped market sentiment and left investors on their toes. Currently, the entire crypto market is churning in a sea of red, and future action prospects remain unclear. However, the sharp drop in Bitcoin price from $30,000 gives hope for a possible alt season next week. While several altcoins have made huge gains recently, traders are now waiting for the next altcoins to explode.

According to crypto analyst Shayan Chowdhury, the halt in the rise in the dominance ratio, which refers to Bitcoin’s share of the overall cryptocurrency market, indicates that altcoins are likely to outperform in the near future. Investors have recently shifted their focus to leading altcoins as Bitcoin’s sudden price drop failed to meet its bullish targets and caused a surge in altcoin demand. The analyst thinks that XRP, BNB, and ADA may take the offensive soon.

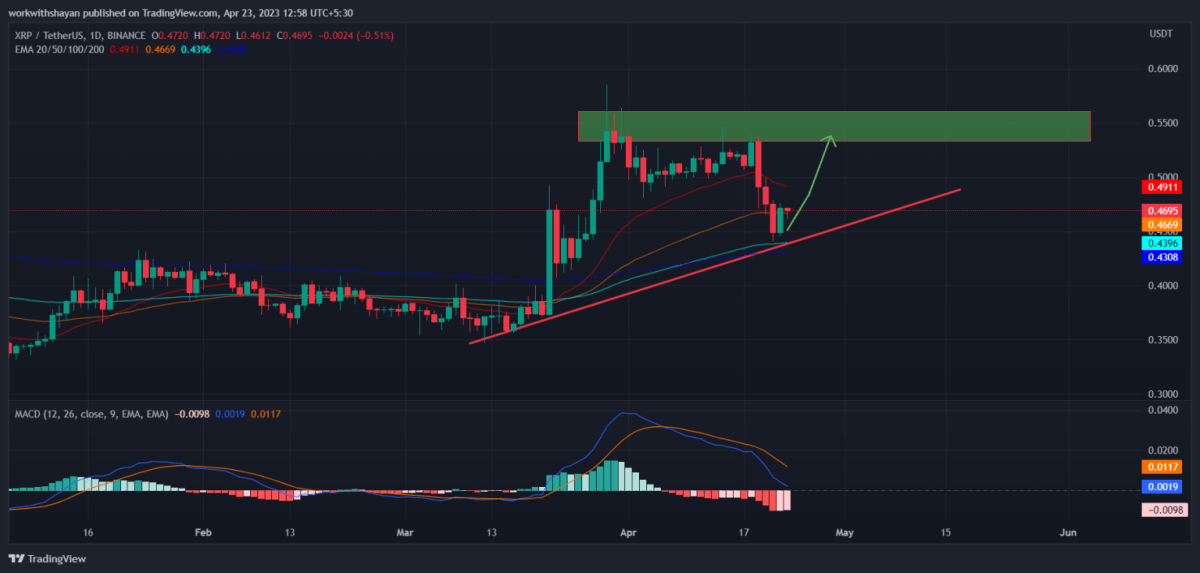

Ripple (XRP) price analysis

Recently, the bulls tried to push the XRP price above the EMA-20 resistance, but the bears created significant selling pressure and formed a resistance around $0.473. On the hourly chart, the price of XRP suffered a deceptive break from the local support level at $0.4412. Traders are now carefully watching the bar close as its closeness to resistance could signal further growth towards the $0.48 region.

At the time of this writing, the XRP price is up over 3.7% in the last 24 hours to trade at $0.47. After a sharp decline, the bulls checked the price chart and XRP took support near the EMA-100 at $0.44. XRP has since climbed above the 23.6% Fib level and breaking above the critical level of $0.49 will send the altcoin into the initial bullish consolidation range of $0.51-0.53.

Binance Coin (BNB) price analysis

BNB had a notable recovery from the $318 support level near the EMA-50 and crossed the 20-day EMA. This shows that the bulls are struggling to prevent further declines and maintain the $318 threshold. The market will be watching closely whether their efforts successfully sustain the value of the crypto.

Currently, the price of BNB is trading at $330, up over 2% from yesterday’s price. BNB price is facing minor resistance to protect $330 and it could correct to the downside soon. However, if the bulls rise above the 23.6% Fib level, it could climb smoothly to the next resistance at $344.

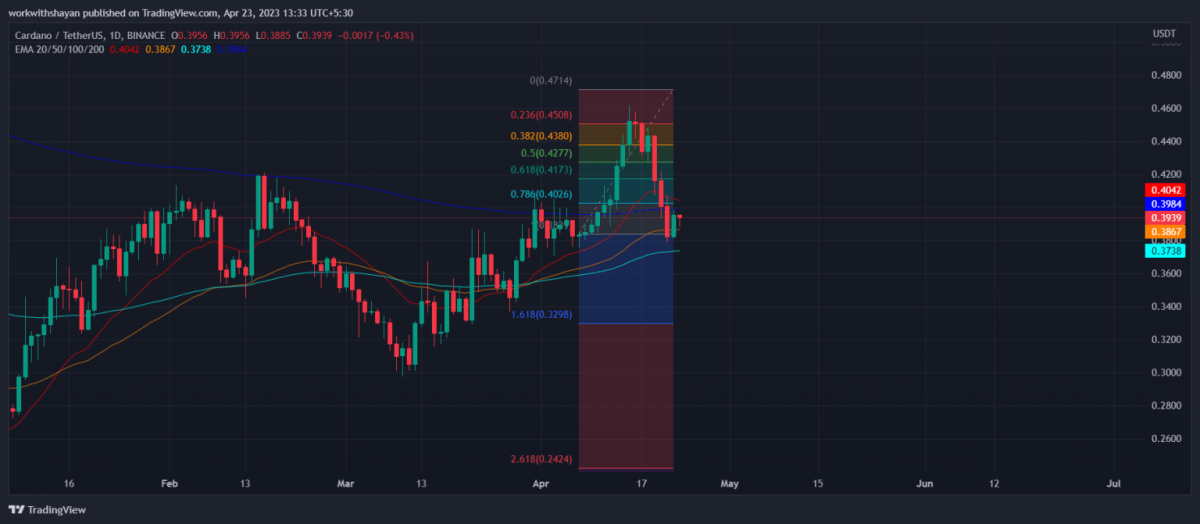

Cardano (ADA) price analysis

The ADA price has taken a steep plunge lately after it was triggered by massive sell-offs in the crypto market. The bears managed to pull Cardano’s ADA below the neckline of the inverted head and shoulders (H&S) pattern on April 20. However, the altcoin has recovered somewhat and is trading at $0.39, gaining over 2%.

ADA price climbed above the 38.6% Fib channel after gaining support at $0.37 and is currently facing minor resistance at the EMA-200 on the daily price chart. If the bulls send ADA price above $0.4, a rally to $0.45 is expected next week.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.