The group now expects adjusted EBIT of at least two billion euros for the year as a whole, instead of the previous 1.5 to 1.8 billion euros.

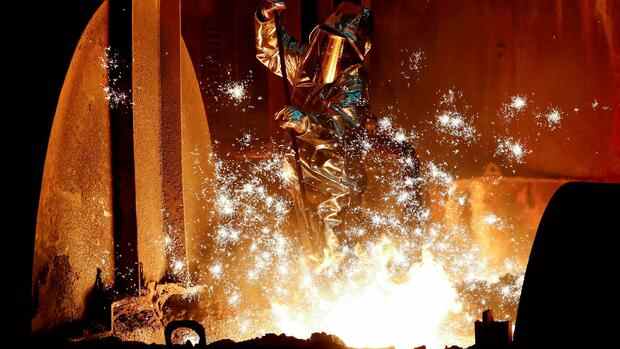

(Photo: Reuters)

Dusseldorf The Essen-based industrial group Thyssen-Krupp is benefiting from record steel prices. As the company announced on Wednesday, earnings before interest and taxes (EBIT) rose to 792 million euros, after a loss of 69 million euros in the same quarter last year. A large part of this was contributed by the steel division, which was able to significantly increase its result from minus 161 million euros to plus 495 million euros.

Chief Financial Officer Klaus Keysberg explained that the market environment was “continued to be challenging” due to the consequences of the war in Ukraine, although the steel division and materials trade had achieved rising revenues and improved margins thanks to higher steel prices. However, the higher purchase prices also weighed on the free cash flow before acquisitions and sales of parts of the company, which at minus 772 million euros was still below the previous year’s figure (minus 750 million euros).

For the ThyssenKrupp Executive Board, free cash flow before M&A is an important target, which can be used to assess whether the company is capable of paying a dividend. Due to the ongoing restructuring, the shareholders of the Ruhr group had to be satisfied with several zero rounds in recent years. This puts a particular strain on the major shareholder, the Krupp Foundation (21 percent), which relies on regular dividend payments for its sponsorship activities.

In view of the war in Ukraine, it is difficult to predict when Thyssen-Krupp will be able to pay a dividend again, according to a letter to shareholders signed by Keysberg and CEO Martina Merz. “But we won’t give up. We do what is in our own hands.” That primarily means improving the performance of the individual businesses and opening up new growth prospects.

Top jobs of the day

Find the best jobs now and

be notified by email.

The group also has high hopes for its subsidiary Nucera, which produces electrolysers for the production of hydrogen. The group wants to list a minority share of the business as part of an IPO up to and including June, CFO Keysberg confirmed in a conference call with journalists. “We are preparing the IPO as planned, but taking into account the current framework conditions.”

Decarbonization will be expensive

On the other hand, the decarbonization of the steel business is a major burden, which is likely to cost several billion euros in the coming years. The group’s blast furnaces must be gradually replaced by so-called direct reduction plants, which can be operated with green hydrogen or natural gas instead of coal. As early as 2025, the first blast furnace is to be shut down as part of the transformation.

>> Read also: Thyssen-Krupp in the balance sheet check – This is how the group fights its way out of the crisis

However, this is only possible if politicians create secure framework conditions, according to Keysberg. It is about subsidies for the construction of the new plants, but also about government support for operating costs, which are significantly higher than today’s level. “We demand that vehemently,” said the CFO. Thyssen-Krupp must approve investments for the construction of the first reduction plant before the end of the year in order not to jeopardize its own schedule.

The group initially wants to use natural gas to operate the plant until sufficient green hydrogen is available. However, the currently high natural gas prices did not change anything about this strategy, according to Keysberg: “In the end it is a question of the pricing of the steel.” The company’s current plans assumed that the steel division would achieve a positive cash flow despite the transformation.

In view of the positive price situation for steel, the Ruh group has raised its forecast for the current year. Instead of an EBIT adjusted for special effects between 1.5 and 1.8 billion euros, the result should be at least two billion euros. In terms of free cash flow before M&A, Thyssen-Krupp now expects a negative three-digit million amount. A balanced figure was expected at the end of the past financial year.

“The dynamic development in raw material prices is currently having a negative impact on our cash flow,” explained Chief Financial Officer Keysberg. However, the group assumes that the situation will improve in the following quarters. “The return to a positive free cash flow before M&A remains our primary goal.” It is therefore important to further improve the performance of the businesses.

More: Steel location Germany in danger – How the war endangers the restructuring of Thyssen-Krupp