Cryptocurrency billionaire says a major crypto exchange is set to launch in the Middle East. Moreover, he claims that this new exchange, which is compliant with regulations, will replace Binance. Binance currently holds the title of the world’s largest crypto exchange.

Is a giant crypto exchange coming to replace Binance?

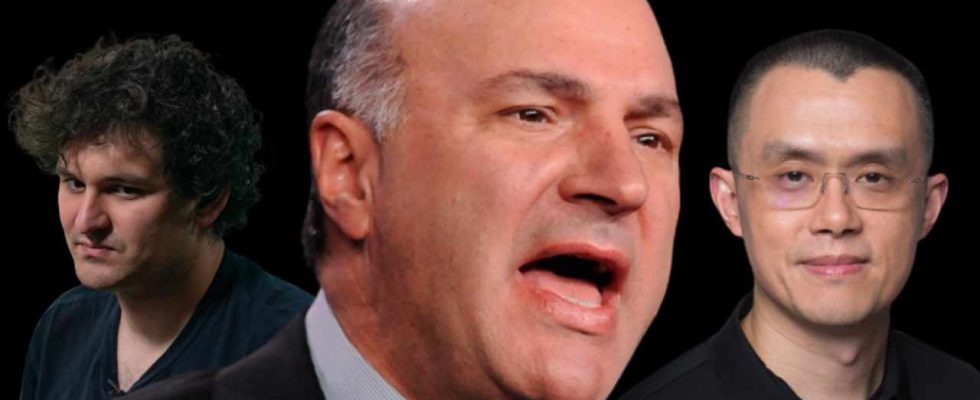

In a new Fox Business interview, Kevin O’Leary laments the hostile regulatory climate in the United States. O’Leary says this has allowed innovative crypto firms to flee the country. The Shark Tank star notes that major players choose not to develop in the US. He notes that they want to build this in other countries that are more friendly to the emerging industry. In this context, O’Leary makes the following statement:

This hasn’t been announced yet, but they are planning to launch a new exchange in Abu Dhabi to replace Binance, called M2, and will receive billions of dollars. It will be fully compliant, backed by billions of dollars, incredibly stable, have ownership transparency. Moreover, it will be able to be used by everyone in the world in a legally compliant manner… It will become the new standard in exchanges. Because you can’t hold Bitcoin without an exchange for liquidity.

““The Middle East is a candidate to become the capital of the crypto world”

According to O’Leary, Abu Dhabi is emerging as a major competitor in the digital asset space. This, in turn, should serve as a wake-up call for American lawmakers and regulators. Based on this, the Shark Tank star makes the following comment:

Gensler filed a lawsuit against Coinbase, the largest crypto exchange in the United States. That’s why Fidelity and BlackRock Hill were there, too. They were really unhappy because they couldn’t do their ETF (exchange traded fund). Abu Dhabi raises its hand and says, ‘We can do this here. If you can’t do it there, we can do it here. We are the new capital of capital and we are coming to compete.’ says.

Circle intervened in Binance and SEC case

Stablecoin issuer Circle has intervened in the Securities and Exchange Commission’s lawsuit against Binance. He also stated that financial trading laws should not extend to stablecoins, whose value is tied to other assets. cryptokoin.comAs you follow from , in June regulators accused Binance of multiple legal violations for facilitating trades in cryptocurrencies such as Solana’s SOL, Cardano’s ADA, and Binance stablecoin BUSD, which the SEC alleged constituted unregistered securities.

This has now become one of the most important cases in the field, as the world’s largest crypto exchange, along with rivals such as Coinbase, try to argue that crypto does not fall prey to existing burdensome US financial laws. Now Circle is arguing that dollar-linked assets like BUSD and its own USDC cannot constitute securities, in part because its users expect no profit from independent purchases.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!