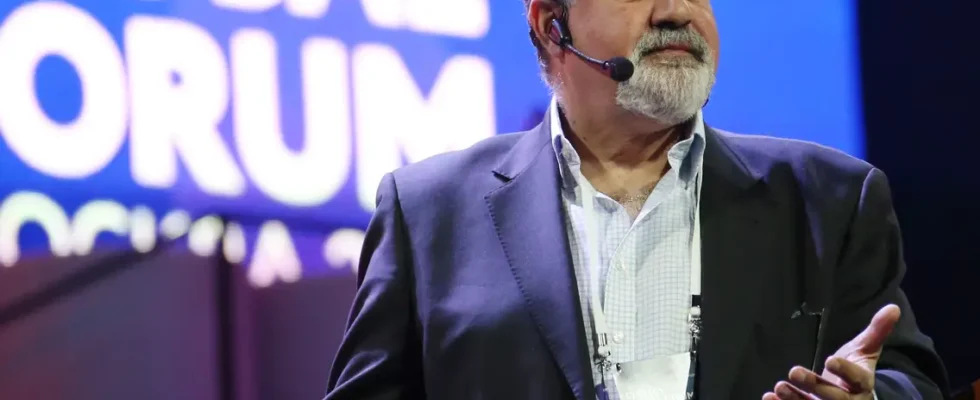

Black Swan author and famous economist Nassim Nicholas Taleb advised investors to withdraw their money as the US’s largest Bitcoin exchange sells $1.6 million worth of shares. A similar situation happened to FTX earlier in the month.

Famous economist revealed the Bitcoin exchange that will be the next FTX

Nicholas Taleb criticized CEO Brian Armstrong for selling more than $1.6 million worth of Coinbase shares. Amid these allegations, the exchange advised its clients and investors to leave immediately. Recently, reports have surfaced showing that Armstrong sold $1,625,102 worth of Coinbase shares on November 11. The data emerges from a Coinbase filing submitted to the US regulator SEC. Taleb says the reports reveal the danger surrounding Coinbase as it is a publicly traded company. In his tweets during the day, he stated:

Take as much as you can from the sinking ship. In the real world, pre-crypto, a CEO would never sell his own shares shouting “everything is fine”. A CEO who sells shares expresses such a loss of trust in the company that it is taken very seriously.

Taleb also says that the sale of a company’s stock by its CEO shows the CEO’s lack of trust in the company. He especially emphasizes that investors should take this very seriously. This is because the company is trying to hide some problems. Taleb also mentioned that this is a red flag. Their concerns arise in the midst of a crisis in the crypto market triggered by the FTX crash.

Vitalik Buterin: I strongly disagree

The Ethereum co-founder refuted what Taleb had said to Coinbase as the reason behind Armstrong’s sale. Buterin highlighted the “psychological stress” that comes with holding nearly all of one’s net worth in one illiquid asset. The Russian-born Canadian programmer also stated that it is prudent to diversify one’s portfolio. He said there’s no harm in doing this. Buterin adds that the mental peace that results from this kind of diversification can contribute to productivity in the workplace:

There’s absolutely nothing wrong with a little diversification, and the sanity boost from diversification can even improve business performance.

Coinbase was the first cryptocurrency exchange to go public on the Nasdaq. During this period, reports emerged that Armstrong sold approximately $291 million in shares on its first day. A filing with the SEC shows that Armstrong sold 749,999 shares in three lots. However, Armstrong announced last month that he plans to sell about 2% of Coinbase shares. He said he would direct the proceeds towards funding scientific research.

cryptocoin.comAs you follow, Shopify CEO Lutke Tobias, who joined Coinbase’s board of directors in January, has been on a Coinbase buying spree ever since. Coinbase (COIN) is currently trading at 48.33, down 1.02% against the dollar in the last 24 hours. It decreased by 86.52% compared to last year due to global developments.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.