Chainlink (LINK), entered the first month of 2022 quite quickly and outperformed the leading crypto assets Bitcoin (BTC) and Ethereum (ETH).

LINK is approaching its next profit target at $30 but the rally can be seen taking a breather as the broader cryptocurrency market space begins to gain traction. Large investors who will support the LINK rally have increased their price target up to $ 40.

Chainlink (LINK) managed to stand out in the first ten days of 2022 when most cryptocurrencies were in the background, making huge gains, from a Chainlink perspective, 46% gains could be added to the current 50% gain if the trend continues .

As price action takes a breather at $29, new traders will want to mark a few technical levels to step in and enter a rally that could continue as far as $40. With global markets on the forefront today, a turnaround in sentiment could provide an additional tailwind to the rally and help fresh money come in.

Winds to Boost Momentum for LINK!

Chainlink defied the law as one of the few cryptocurrencies to rally in 2022 in a risky environment stifled by Omicron concerns and the Fed’s hawkish currency path.

These concerns sparked broad and aggressive selling in equities, resulting in investors cutting their positions in riskier assets. With this, chainlink progressed easily and turned a few basic technical levels into support; These levels come into play as the rally breathes after the Relative Strength Index (RSI) hits the overbought marker.

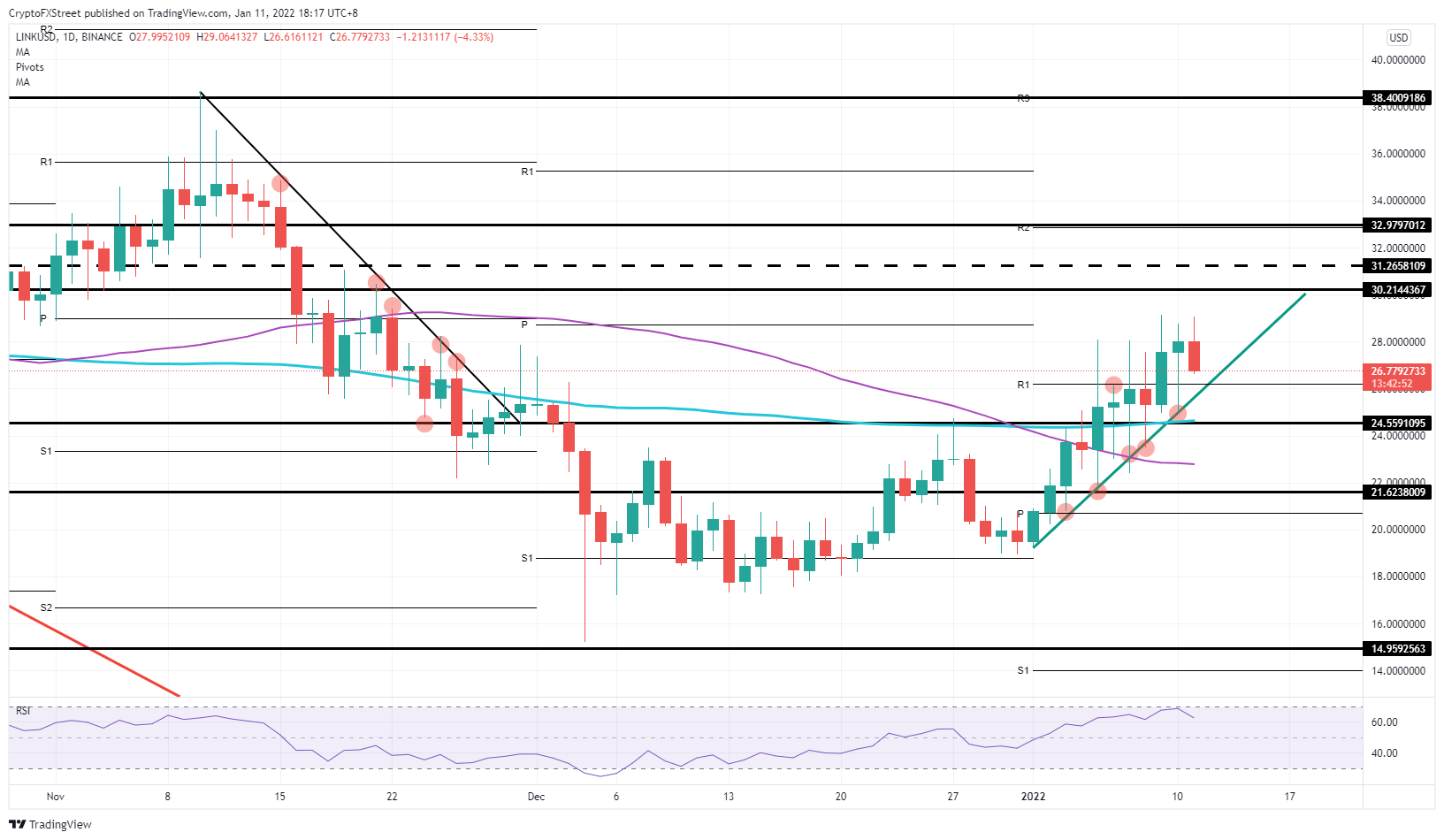

The first support line to support the uptrend is the intersection of the green ascending trendline, which acts as the backbone of the rally, and the monthly R1 resistance level at or around $26.

This will be the first major test and window of opportunity for new traders to join the rally. If that doesn’t happen, you could look for a false breakout with the 200-day Simple Moving Average (SMA) coming flat around $25 and the same level as a supporting historical line.

If the ‘disruptive’ sentiments in global markets return, a break from the green ascending trendline and an accelerated downward move with the 200-day SMA are likely.

Breaking this 200-day SMA opens the door to $21.60, which has already been cut in the past few weeks, and will therefore only slow the correction, but not stop it completely. Instead, it may be important to wait for the December 4 low of $15 to provide an end point for the pullback.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.