solana has achieved significant success in the cryptocurrency market. The altcoin has surpassed Binance’s BNB token to become the fourth largest cryptocurrency by total capitalization.

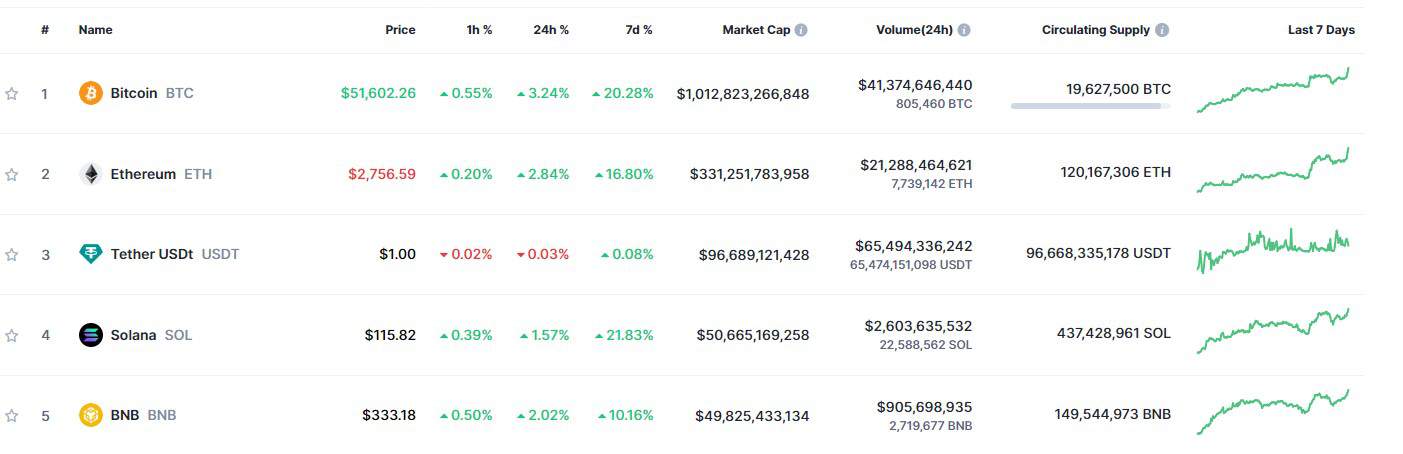

This success occurred as SOL reached the $116 level with a significant price increase of 22% in the last 7 hours. According to CoinMarketCap data, SOL’s market value is around $50 billion and BNBIt has surpassed ‘s value of 49.8 billion dollars.

The increase in Solana’s price in line with the general trend of the market means that SOL cryptocurrency It reflects its strong position in the world and the trust of investors. This milestone demonstrates the rapid growth and continued adoption of the Solana ecosystem.

Solana’s rise, leaving BNB behind, draws attention with the flexibility the network showed despite the outage it experienced on February 6. This outage was attributed to a bug that caused transactions to enter an endless loop, resulting in a five-hour downtime. However, Solana continued its rise by performing strongly despite such difficulties.

Likewise, Solana’s total value locked (TVL) reached $1.92 billion on Wednesday, an increase of over 500% since October 2023. Solana-based DeFi protocols have seen double-digit increases in TVL thanks to successful airdrop campaigns and their growing popularity. This shows that the Solana ecosystem is growing and continues to play an active role in the DeFi field.

The rise in the price of SOL coincided with a significant rise in the Crypto Fear and Greed Index, surpassing $74 on Tuesday, causing the index to enter the “extreme greed” zone. This is noteworthy as being the first time this has happened in more than two years.

Notably, this metric has reached its highest level since Bitcoin peaked at $69,000 in November 2021. This increase in SOL also coincides with Bitcoin rising above $50,000 for the first time since December 2021 and most recently surpassing $51,000 today.

However, not all analysts and market observers approach this rise from the same perspective. Some are concerned that long-term investors are taking profits and upcoming liquidations could increase selling pressure. Therefore, as uncertainty continues in the market, investors should be careful and manage risks in a balanced manner.

BNB Has Difficulty Taking Off

While major coins and tokens are trending upwards, BNB seems to be struggling to attract attention. The main reason for this is the ongoing regulatory issues facing Binance.

Binance CEO Changpeng Zhao is under regulatory scrutiny and legal action in the US, creating uncertainty about BNB’s future path. Additionally, Zhao, who is currently out on a $175 million bond, had his sentencing date postponed until April 30.

These uncertainties could shake investors’ confidence in BNB and affect the token’s price. However, it is not yet clear how the situation will develop and how Binance will overcome regulatory hurdles.