It looks like it’s all about macroeconomic data this Valentine’s Day as Bitcoin bulls face a test. cryptocoin.com We have compiled for you the levels that Bitcoin will go to after the CPI report to be announced.

It is said that there may be fluctuation for Bitcoin

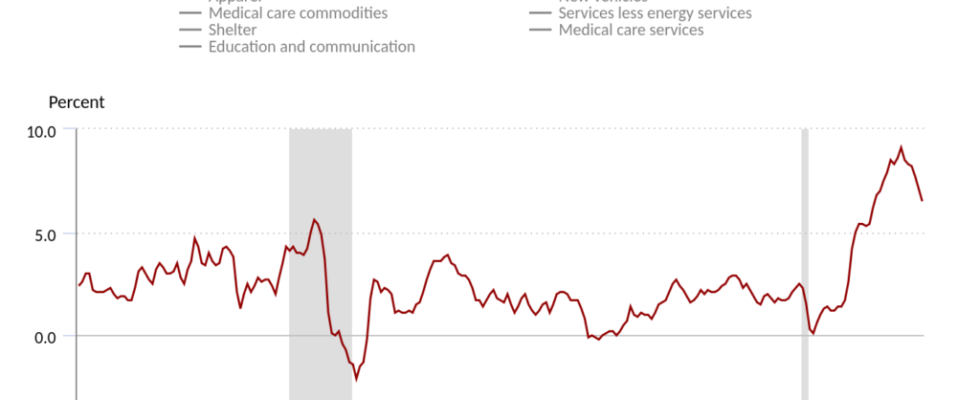

The data showed that the BTC/USD pair failed to rise above $21,800 ahead of the January US Consumer Price Index (CPI) pressure. The data, currently called the ‘most important’ CPI release, will be released at 8:30 am Eastern Time and is a classic volatility catalyst for risky assets.

As such, crypto market participants were expecting a busy trading day with both $19,000 and $25,000 as potential targets on the table, depending on how far the results were from forecasts.

“If tomorrow morning’s CPI number shows more positive disinflation, it will likely see a Bitcoin pump of $ 24-25k,” Venturefounder, a contributor to on-chain analytics platform CryptoQuant, said in a section of a Twitter update.

Annual CPI was expected to be 6.2% compared to 6.4% the previous month, and the monthly reading rose from 0.1% to 0.5%. ‘If you combine that with the previous trend, the expectations are relatively high,’ said analyst Michaël van de Poppe. Van de Poppe was already betting on the ‘final phase’ of Bitcoin’s current pullback with $20,500 as the key level for the bulls to hold.

CPI ‘important’ to identify crypto losses

In its latest market update, trading firm QCP Capital has flagged factors beyond the data as a cause for concern for crypto investors. Blockchain firm that issued the Binance stablecoin warned that recent legal actions against Paxos could be the tip of the iceberg regarding US regulatory policy.

“As the regulatory hammer is still against the industry (possibly until the 2024 elections), the surge in crypto’s market cap now looks even more subdued from this perspective,” the firm wrote afterwards.

The QCP maintained that, despite the conceptual decline in inflation, there was a mismatch between expectations for the Federal Reserve to lower interest rates and reality.

In the rate market, we are currently pricing in a 5.2% final interest rate followed by a 30 basis point cut by December 23; That’s a tremendous increase from the final rate of 4.9% and a 50 basis point cut from just 2 weeks ago.’ was stated. The Fed doesn’t need to hold a rate change meeting until the third week of March, and another CPI pressure will be in place before that.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.