In a recent market analysis, Santiment revealed various data for some altcoins. In particular, he reported that the top five stablecoins have seen a decline in their overall market value over the past three years. Here are the details…

Santiment reveals key data for five altcoins

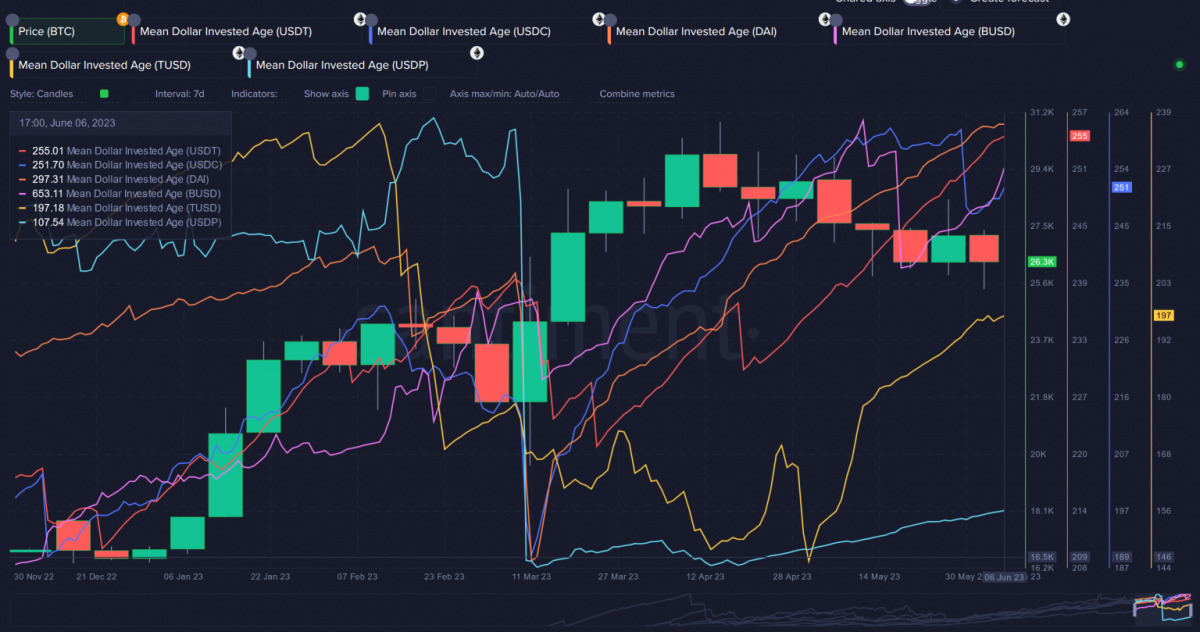

Market analysis firm Santiment made important statements. USDT reported a decline in the combined market value of USDC, BUSD, DAI and TUSD over the past three years. However, despite this decline, closer inspection reveals interesting information regarding the health and potential recovery of the cryptocurrency markets. The stablecoin market cap serves as an indicator of increased purchasing power for future investments in Bitcoin (BTC) and altcoins.

If stablecoins market cap rises while BTC and altcoins suffer a decline, it indicates the likelihood of the market recovering when stablecoins are reinvested. This was evident between June and August 2021, when BTC prices fell but the stablecoin market value rose. Afterwards, a significant recovery was seen in prices in September. Next, cryptocoin.com As we have also reported, all-time highs have been reached in the crypto space.

Alternatively, a higher market cap for stablecoins could mean that Bitcoin and altcoins are being sold. This shows that large addresses are making significant profits. It also reveals that it is no longer supporting the markets as it did during the previous bull run. A positive trend emerges when examining stablecoin holdings from major investors, often referred to as “sharks” and “whales.” Tether (USDT) holders have accumulated more than 40 percent of the supply, the highest amount since November 2021.

Why are investors shifting their assets to stablecoins?

Similarly, holders of USD Coin (USDC) and Dai (DAI) saw their holdings reach over 37 percent and nearly 40 percent of the supply, respectively. Assets in these coins reached their highest levels since February 2023 and December 2020. These statistics indicate that notable investors have not completely exited the crypto market. But it does show that they are shifting their holdings to stablecoins while waiting for the right moments to reinvest.

As the whale transactions show, stablecoin accumulation by major investors is constantly underway. There were no notable anomalies or sudden large stablecoin movements, especially during market downturns. Such significant moves, especially during market downturns, can indicate a potential market bottom and a promising sign for a market rise. Another factor to consider is the movement of dormant stablecoins. A falling average dollar investment age of an asset indicates that older addresses are about to make a move, potentially triggering market activity and signaling large purchases of BTC or altcoins.

Although there were some encouraging movements in USD Coin at the end of May that pointed to potential market firing, there was no significant increase comparable to the stagnant stablecoin boom witnessed in mid-March. This sparked the next bullish rally. While stablecoin market values have been experiencing a recent dip, it should be noted that whales and sharks are not the cause of this drop.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.