Current technical analysis shows that AXS, ZIL, FLOKI, HBAR and ATOM are gathering strength on the upside. The following levels can be followed in a potential altcoin season.

AXS price aims for more gains as altcoin bulls grasp opportunities

Axie Infinity price is on track to post more gains, largely attributed to the bulls’ successful efforts to maintain the lead. According to the daily chart, AXS has been rising since March 10 and has risen 25% so far to $9.49.

If the bulls continue the same accumulation pattern, Axie Infinity price could rise to the next resistance at $10.10. It could retest early March highs. In a bullish case, AXS could climb 28.70% to $11.26 and then $11.73.

The bullish outlook for AXS is receiving support from the Awesome Oscillators (AO), which is positive and flashing green to indicate that the bulls are leading the market. Likewise, the RSI at 57 showed more room to the upside.

Further supporting the bullish thesis is that AXS has strong support at $9.04 and $8.81, respectively. These levels of supplier congestion provide ideal recovery points or entry points for investors who are being sidelined.

On-chain metrics support bullish argument for Axie Infinity price

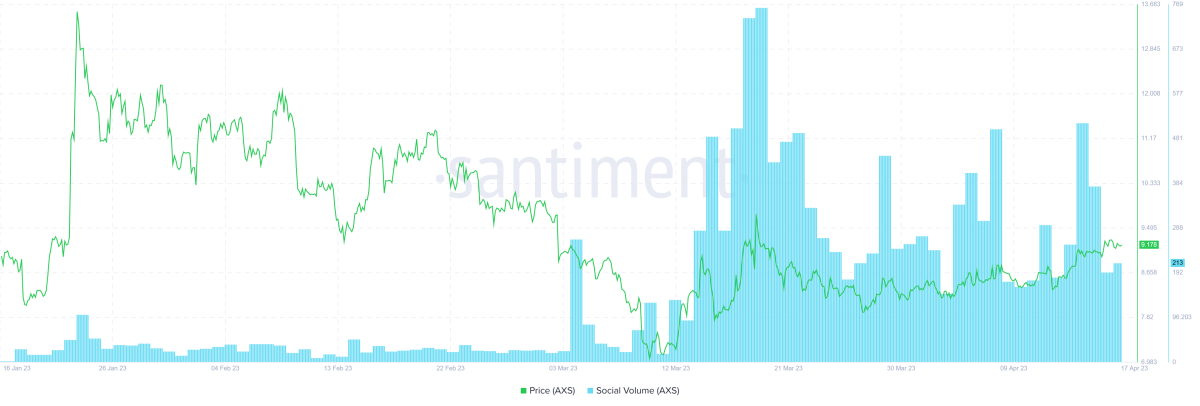

Santiment data social volume metric supports bullish status for Axie Infinity price. The data shows that AXS social volume has increased steadily since the beginning of March, rising from 21.83 on 3 March to 760 on 19 March. The social volume metric is currently around 213, marking a nearly 900% increase from March 3 to April 17.

Conversely, AXS bears could seize the opportunity to lower its market value if buying momentum declines. In such a scenario, Axie Infinity price could dive below the 50-day EMA at $8.81 and settle below the uptrend line. A close daily candlestick below this level will invalidate the bullish argument.

Also, AXS price could extend a foot south to reach the $7.78 support level or, in the worst case, revisit the $5.98 support flow before collecting sell-side liquidity below that level.

Zilliqa prepares to put on one of the best altcoin performances of 2023

ZIL price is showing signs of strength for 2023. It has become clear that long positions are one of the busiest trends, as traders have plenty of time to assess the current situation in the financial markets. The evidence is seen on the ZIL chart with clear bullish pressure set to break the bearish strength near $0.033.

ZIL bulls have already tried to break $0.033 earlier this week and have pulled back around 4% instead. Ideally, the cap will be removed on Thursday and the bulls will move up to $0.045 for a 55% gain. For a safer position, the price can be expected to return to $0.025 again.

Cosmos price pattern offers 15% or more gains

Cosmos price gave a very bullish signal to the markets last week as it made significant gains with several other altcoins. Although the alt season has started in the opposite direction, the sentiment seems to have changed since last week and should continue this week for a bit longer. According to analysts, more bullish action can be expected until the end of this week, supporting further upside potential.

ATOM traders will first watch for the red descending trendline near $15 with the monthly R2 resistance level as the second bearish element around that area. This marks a definite win with almost 15% gain and will definitely see the bulls take profits in that area. If the bullish sentiment continues, a breakout trade could see a quick spike towards $20, with a full 65% gain with it.

Since the pennant is clearly defined, so is the downside risk. If sentiment collapses further below this take-profit and the decline extends further, a test near $11 will signal distress to the bulls. After taking the losses on their position, further selling is possible by breaking the supportive green ascending trendline and seeing a blade drop towards $6 to test the June 2022 low.

Floki Inu price ready to make hay as the sun shines

Floki Inu price is up 230% from February 13-16 to hit a local high of $0.0000681. This bullish move was followed by a pullback that resulted in a 62% pullback as investors rushed to record their profits.

As the Floki Inu price attempted a recovery, the altcoin was forced into a range move where it is currently trading. This range extends from $0.0000419 to $0.0000334 and the recent increase in bullish momentum has pushed FLOKI to retest the higher range.

Traders can expect one of two things to happen for the Floki Inu price: a recovery or a continuation of the uptrend. A pullback to the $0.0000359 level gives it a chance to re-accumulate. If this move occurs, traders should wait for the higher range at $0.000419. A successful development could see FLOKI reach the midpoint of the 62% collapse at $0.000468.

Floki Inu promises 30% gains for altcoin investors

Although the outlook for Floki Inu price looks optimistic, investors need to be careful with Bitcoin price. Should BTC bounce back, it will take the weaker altcoins with it.

Therefore, a correction may be in the works for FLOKI, but if this correction produces a four-hour candlestick below the $0.0000334 level, it will invalidate the bullish thesis. In such a case, Floki Inu price could drop 23% to visit the $0.0000255 support base.

HBAR price poised to break $0.08 accompanied by altcoin bulls

Hedera Hashgraph price is taking a small step back earlier this week after the bulls gained close to 8% last week.

A potential bull is targeting the $0.08 zone, which is slightly above the highs of past weeks and March. This performance will translate into an 18% gain for bulls currently buying the dip. With the monthly pivot and the 55-day SMA supporting the price action, even a higher leg around $0.085 might be possible if more bulls get a chance to enjoy the rally.

There is a small downside risk at the lower end of the candle based on last week’s performance. The wick of the candle there broke below the previous week’s low and may indicate a downtrend rather than a consolidation. According to technical analysis, a drop in HBAR price below $0.063 could accelerate the downside momentum. When this happens, further declines can be expected with a possible break below $0.060 towards $0.050.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.