According to Santiment reports, crypto whales are accumulating heavily on several Ethereum-based altcoins. Illuvium (ILV), Holo (HOT), and Lido Dao (LDO) are among the altcoins to watch out for.

Ethereum-based altcoins are gaining traction, according to Santiment

Brian Quinlivan, Santiment’s marketing director, gave an insight into the bullish state of Ethereum-based altcoins in a recent blog post.

According to Quinlivan, blockchain game Illuvium is falling sharply after hitting above $106 in February. The gaming coin was trading at $47 at the time of Quinlivan’s report. This has raised concerns among key players who believe their supply on exchanges has increased over time.

This usually means that the demand for a coin has dropped. However, the trading volume of the ILV token has increased significantly as a result of the recent $14.0 million transaction, which the analyst considers the largest in the last 10 months.

The analyst says the latest development is a bullish signal. He adds that it happened at a time that is considered a “reasonable sub-zone” especially for its price.

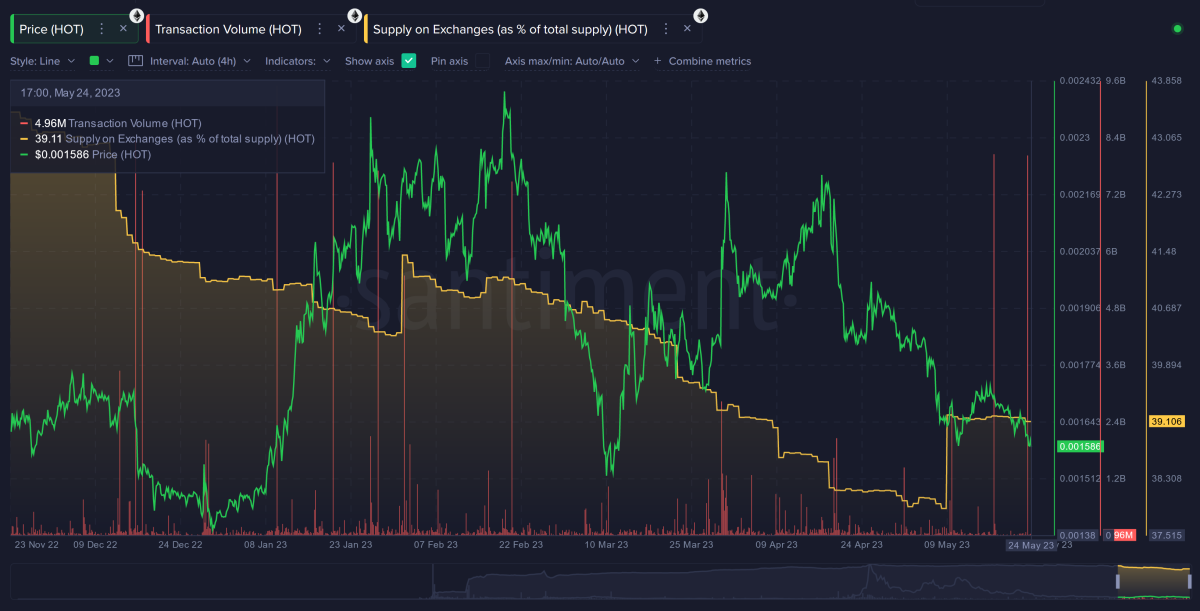

Brian Quinlivan wants the market to pay attention to Holo (HOT) and Lido Dao (LDO)

The analyst reported that on May 25, some major transactions took place in the crypto market. Sudden movements like this typically indicate a large outlier is in the works. Lido Dao (LDO) was one of the altcoins that recorded huge movements on its network throughout 2023. It is currently struggling to maintain this position.

The analyst also claims that Holo (HOT) has been on a “rollercoaster” for the past few months. The HOT network recently registered a $12.7 million transfer. The analyst says this is not an anomaly.

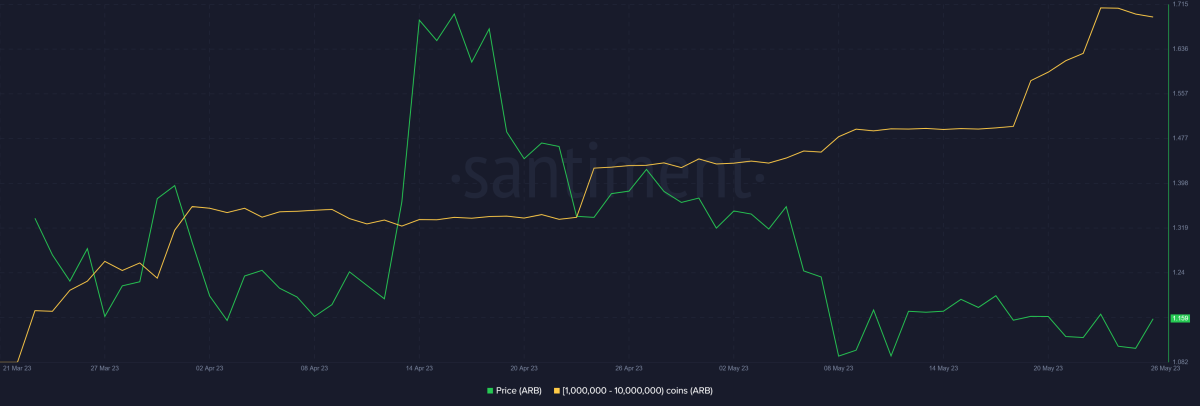

Arbitrum (ARB), another altcoin on whales’ radar

Arbitrum price is currently trading at $1.20, up more than 3.5%. For most of this month, it has consolidated in the $1.22 and $1.08 range. Testing the second price as support many times in the last few days, ARB has been able to bounce back every time.

Meanwhile, the ARB price surge found support from whales. The class of whales with over 1 million and less than 10 million ARBs has been steadily accumulating over the past few days for the price to rise.

In the week since May 18, this group has amassed approximately $208 million worth of ARBs. Thus, its total assets increased from 385 million to 563 million ARB. Interestingly, individual investors do not exhibit similar behavior. This shows that they are still afraid of broader market bearish cues.

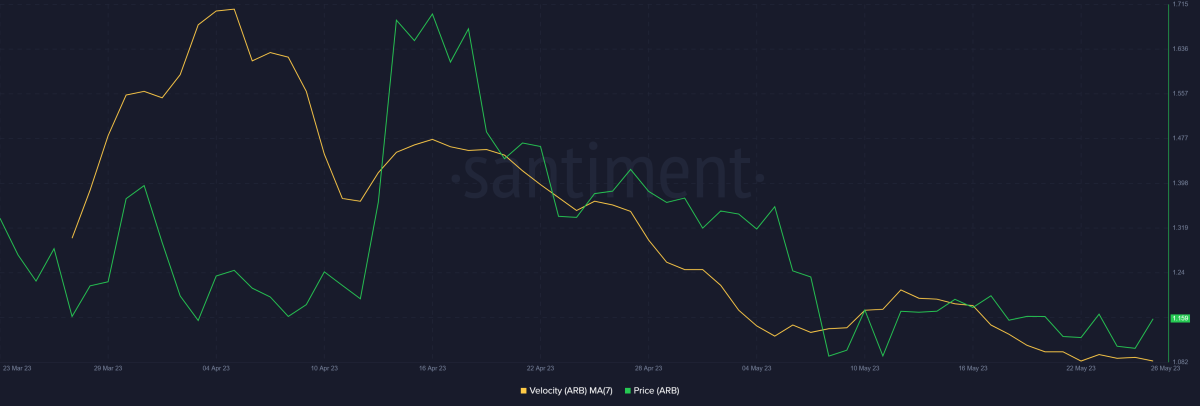

On the other hand, long-term trust can be confirmed with ARB address change rate metrics. The speed indicator, which has been on the decline since the beginning of April, shows that most of the investors find HODL suitable for now. Not wanting to carry their altcoins exhibits fear of losses, so investors are waiting for a recovery.

When the Arbitrum price starts to recover, individual investors will become active again. This will give the whales a chance to turn their profits into cash. However, it should be noted that if the whales take a profit, the ARB price may take a hit again. cryptocoin.comAs you follow, a limited number of altcoin whales were able to price their accumulation during the month of May.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.