In a rising cryptocurrency environment, every long position pumped and opened leaves behind pools of liquidity. This may cause long squeezes. Therefore, investors should keep an eye on cryptocurrencies where long position volume is increasing to prepare for pullbacks. Crypto analyst Vinicius Barbosa draws attention to 2 cryptocurrencies with high ‘long squeeze’ potential.

‘Long squeeze’ alarm went off for two cryptocurrencies!

Cryptocurrencies have moved into a dominant bullish sentiment amidst a notable rally. cryptokoin.comAs you follow from , the leading crypto Bitcoin made a run reaching over $64 thousand. To analyze the derivatives market, we looked at data from CoinGlass. Bitcoin (BTC) and Ethereum (ETH) in particular made huge gains. However, they now face the threat of a correction.

Essentially, traders tend to open long positions when the market is rising and short positions when it is falling. However, long positions are trading contracts that require deposited collateral. Therefore, it sets a downward liquidation price. If this liquidation price is reached, the contract closes and sells the collateral, liquidating the trader’s position. This could push prices even lower, liquidating more trading contracts in a cascading effect called a ‘long squeeze’. Thus, market makers use high liquidity pools as targets to increase volatility and profits.

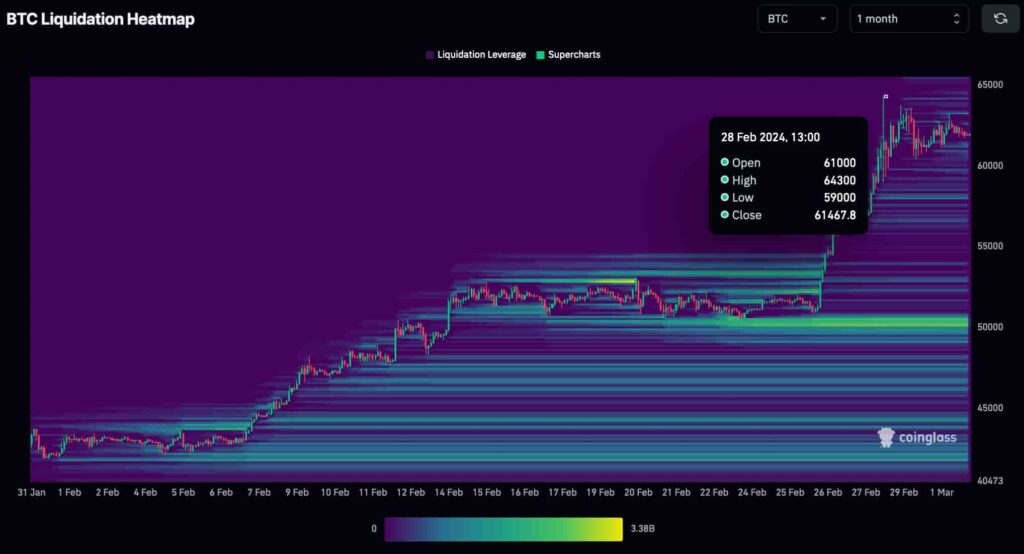

‘Long squeeze’ warning for Bitcoin (BTC) at $50,000

Interestingly, Bitcoin has accumulated corresponding long liquidity in the $50,000 region, which plays the role of an important psychological support and resistance. There are eight liquidity pools on the monthly chart, each with over $1 billion, from $50,700 to $49,700. At least half of them have long liquidity of over $2 billion, totaling over $12 billion.

However, there are smaller pools of liquidity on the upside with a candlestick wick at $64,300. It is possible for professional traders to use this wick as an impulse to draw more liquidity into the $50,000 region before moving into a long squeeze.

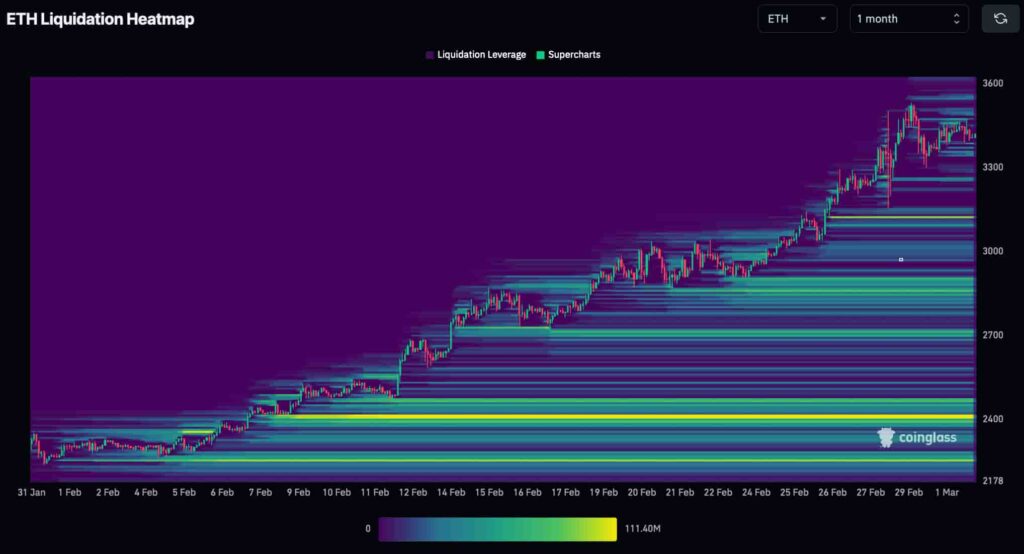

There is a possibility that ETH may drop to $2,400!

Ethereum, on the other hand, has even larger liquidity pools on the downside from its historical perspective. These pools indicate a possible long squeeze up to $2,400. It also forces many investors to liquidate at previous levels. Like Bitcoin, ETH is likely to visit the local top near $3,500 first to accumulate more long liquidity before the big move.

In summary, it is possible that Bitcoin and Ethereum may soon decline lower with a correction following the recent rally. ‘Long squeeze’ is likely to cause losses of 18% and 29% respectively from current prices. In particular, these are historically common in the highly volatile crypto market during bull runs. Still, a brief pump to local tops is possible for the two cryptocurrencies before a move lower.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!