The volume of crypto derivatives has increased, leaving behind some imbalances that can trigger liquidation events. In this context, it has been observed that short positions have increased in some cryptocurrencies, which will cause a ‘short squeeze’ if they are liquidated. Crypto analyst Vinicius Barbosa looks at 2 altcoin projects with ‘short squeeze’ potential.

Two altcoins stand out with increased Long/Short ratio

Meanwhile, the total capitalization of the cryptocurrency market reached $1.614 trillion, a 10-day high. If crypto total market cap exceeds this month’s highs, a ‘short squeeze’ will likely occur on highly shorted coins.

We look at open interest data for the last 12 and 24 hours from CoinGlass’ Long/Short ratio dashboard. Two altcoins stand out, especially where short positions have increased compared to long positions. These are: the popular meme coin Dogecoin (DOGE) and the decentralized exchange token dYdX (DYDX).

‘Short squeeze’ warning for Dogecoin (DOGE)

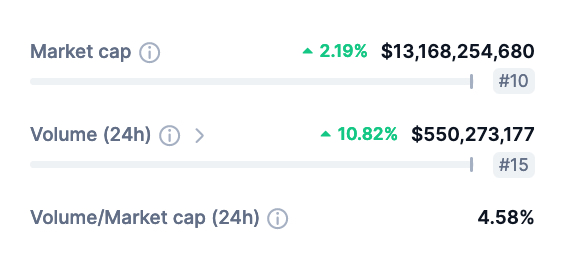

The leading meme coin was trading at $0.0926 at the time of writing, up 2.2% in the last 24 hours. Notably, Dogecoin has $514.56 million in 24-hour open short positions. This corresponds to 51.31% of the daily open interest.

This huge value corresponds to almost the same as DOGE’s 24-hour spot exchange volume of $550.27 million. Therefore, it is possible for a short-term liquidation event to have a significant impact on the altcoin price.

Short sales increased in DYDX

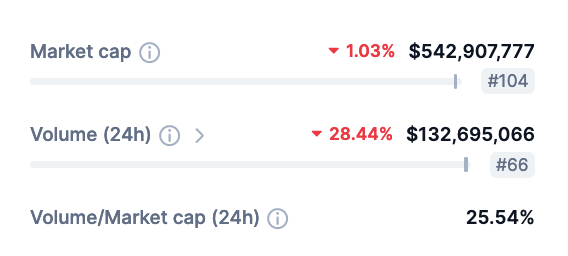

Meanwhile, traders opened $188.57 million (53.06%) short positions on DYDX on December 21. The altcoin was trading at $2,957 at the time of writing.

Interestingly, the decentralized exchange token has a 24-hour volume of only $132.69 million. According to CoinMarketCap, this means a larger amount of short positions for DYDX, which is currently traded on multiple markets.

However, for the ‘short squeeze’ to occur, the market must turn from a downward trend to an upward trend. cryptokoin.comAs you follow from DYDX has experienced meaningful changes in the last few days. The altcoin project has completed a major token unlock, accounting for more than 80% of its circulating supply. Such inflation may have affected cryptocurrency investors’ perception of the value of the crypto asset.

All things considered, there is no guarantee that such an event will occur with these cryptocurrencies. Investors need to do their own research and consider complementary data to make profitable financial decisions.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!