The cryptocurrency market has been suppressed by many institutions for a long time. cryptocoin.com As we have reported, together with the actions initiated by the US Securities and Exchange Commission (SEC), a bill that the communities feared managed to pass the Senate committee and moved to the House. This situation, which many investors were worried about, has finally come true and is of great interest to Bitcoin miners! Here are the details…

Anti-Bitcoin mining law unanimously approved by Texas Senate committee

Cryptocurrency communities seem to be very worried as a result of the recent actions against the cryptocurrency market and the leading cryptocurrency. In particular, the communities panicked when a bill, which they feared would pass through the Senate and move to the House, was passed unanimously. According to Dennis Porter, founder of the Satoshi Act Fund, the Texas Senate Committee passed the anti-BTC mining bill on April 4. Porter tweeted, “The anti-Bitcoin mining bill in Texas passed unchallenged by the Senate committee without a single dissenting vote.” in his words.

With these comments on the cryptocurrency market, Porter stated that the bill sponsored by Texas State Senator Lois Kolkhorst passed without a single dissenting vote. The unanimous support of the committee sparked rumors that it could also pass the Senate before it goes to the House for a vote. Here are Porter’s words:

Unfortunately, the committee members came under the influence of the powerful bill sponsor. It is rumored that the bill could also pass the Senate. It will be crucial to fight against the bill in parliament to stop the bill.

The bill is being talked about a lot among investors! So what’s next?

The bill in question appears as Senate Bill 1752 and aims to reverse incentives aimed at attracting crypto miners to the state. Texas’ mining power consumption, on the other hand, has increased 75 percent in the last 12 months, mostly due to a demand response program for electricity run by the state. This reveals the interest in Bitcoin mining.

The program currently rewards miners for feeding power back into the grid when there is high demand. If the bill is passed, miners will not be allowed to participate in this program. In addition to eliminating rewards, the bill also aims to eliminate tax incentives and subsidies that currently support crypto miners. In such a case, it is said that many miners will quit their jobs.

Bitcoin (BTC) price situation

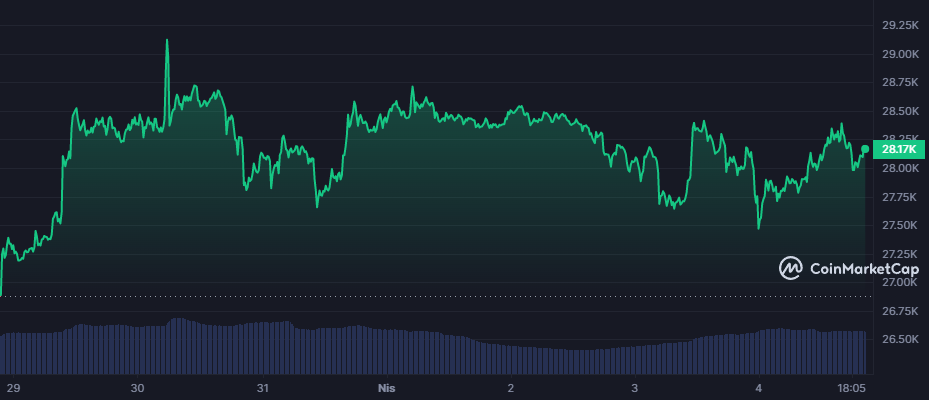

The cryptocurrency market has seen an increase of 1.15% in its total value in the last 24 hours, rising to the level of 1.23 trillion dollars. Especially with the rapid rise of the leading cryptocurrency Bitcoin (BTC), many altcoin projects have also increased, while BTC has gained 4 percent in the last week. On the other hand, while BTC gained 0.6 percent in the last 24 hours, it instantly rose to $ 28,173.45. While the market value of BTC is at the level of 545 billion dollars, the 24-hour trading volume is at the level of 18 billion dollars.

While many investors target the $ 30 thousand level for the leading crypto, experts say that the markets can quickly rise. This is an extremely important situation for many investors, especially after the increasing pressure on cryptocurrencies and stock markets.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.