When we look through the dusty pages of history, it is possible to see periods when people were slaves to their crazy passions rather than their financial logic. In this content, we will talk about Tulip Mania, the first economic bubble in history.

The concept we call an economic bubble is actually a rapid increase in the price of an asset and this Situations that result in a rapid rise followed by a rapid decline means. If we look at today’s examples, it rises with great interest and then falls sharply. NFT market We can say that it is also described as a balloon.

Economic bubbles, of which there are many examples from past to present, first and most interesting The one is “Tulip Mania”. Before going into the details of this economic bubble called Tulip Mania, we should consider how this phenomenon can be compared to current examples such as cryptocurrency and NFT markets. in some ways We can also say that they are similar.

Tulip Mania This economic bubble, which occurred in the Netherlands in the mid-17th century, has a place in history as an interesting example of how people’s emotional impulses and financial goals intertwine.

The story begins with tulips traveling from the Ottoman Empire to the Netherlands.

Dutch ambassador During the reign of Suleiman the Magnificent The Netherlands became acquainted with tulips when he took tulip bulbs with him when he returned after his visit to the Ottoman Empire.

Not long after the Dutch were introduced to tulips, tulips became popular among the public. very loved and it becomes a flower that attracts a lot of attention from the Dutch.

Tulips attract great attention and become a symbol of status and luxury.

So much so that the rich people of the Netherlands love tulips for their wealth and an indication of their status They see these tulips as their own and start displaying them in their homes.

With the increasing demand, tulips begin to attract the attention of the middle class and turn into an investment tool.

With the ever-increasing demand, tulips are becoming a sector and markets are starting to form.

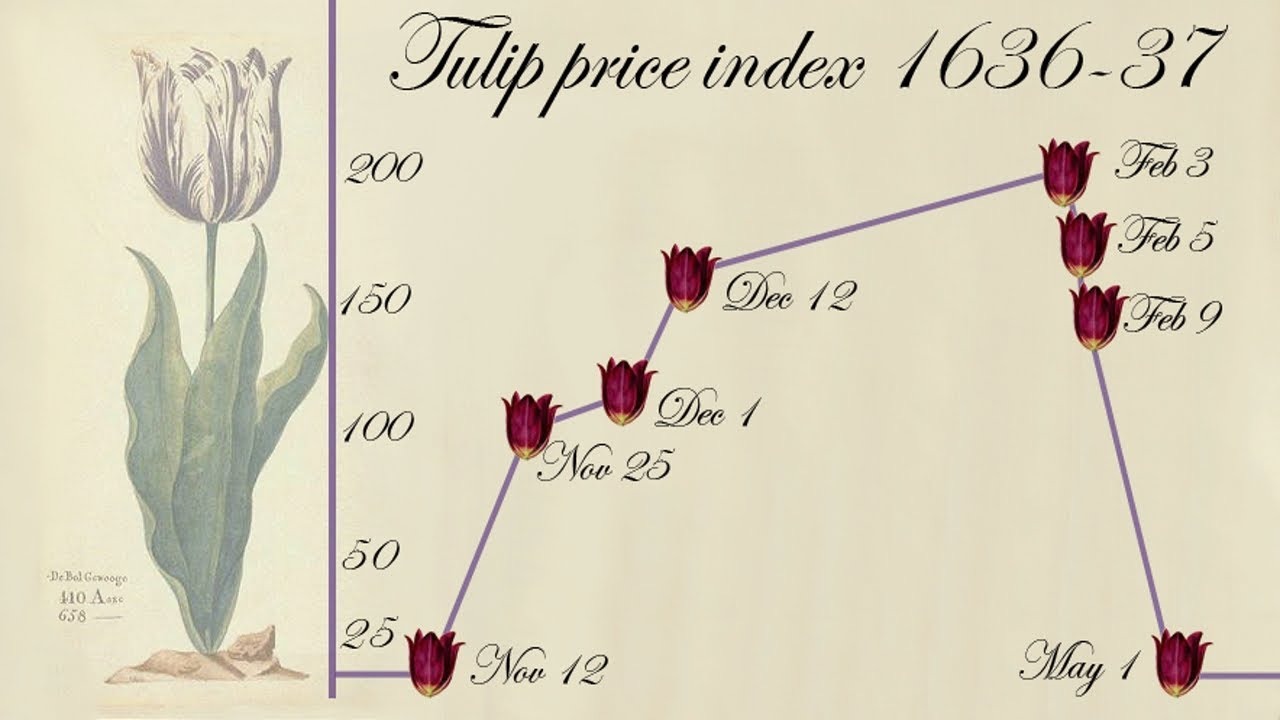

Tulips, which have become a kind of commodity, are traded on stock exchanges, and the interest in them as an investment tool is increasing so much that investors think that the price of tulip bulbs will increase even more. long term transactions He even does it.

Prices are increasing so much that, as the end of the tulip craze approaches, the price of a tulip bulb is now the entire annual salary of an employee reaches up to equivalent levels.

Of course, the tulip market also encounters the tragic end that every economic bubble encounters, and the bubble bursts!

In other words, in the market recession prevails It’s starting to happen and those who have tulip bulbs are starting to be unable to find buyers.

As everyone in the market wants to dispose of the tulip bulbs in order to avoid loss, the decline in prices prevails and those with tulip bulbs in their hands Investors face huge losses. So the tulip bubble bursts and the tulip market crashes…

Does Tulip Mania remind you a bit of the cryptocurrency and NFT markets?

Especially in recent years NFT market You may remember that investors are very interested in markets related to virtual assets, especially virtual assets.

This situation had become such that many people had positive feelings that prices would rise and saw these markets as opportunities and hoped to get a share of the cake; have invested in the virtual products in question, some of them have won, while many others have He had suffered great losses.

So much so that even virtual works of art called NFTs, from virtual plots of land, found buyers at very high prices. Currently the price of most of them is well below expectations remained…

RELATED NEWS

The Last Bid for the NFT of the First Tweet in History, Purchased for 78 Million Liras, Was 100 TL!

So what does the research say?

Research has shown that although there are some similarities between Tulip Mania and Bitcoin, this There is no relationship between the two markets and it was concluded that it was not correct to identify the two markets in question.

Since today’s conditions and the 17th century conditions are not the same, the markets in question according to the conditions of the period According to researchers who state that it should be evaluated, it would not be correct to say that these two markets are similar in every respect.

When we look at the irrational behavior of investors, it is possible to say that there are some similarities.

So tulip bulb market and crypto asset markets although not qualitatively related It has some similarities in terms of investor behavior.

For example, a person who buys tulip bulbs for as high as a worker’s annual wage to display in his home buys a “Bored Ape” NFT for $1.3 million. Justin Bieber lost nearly 90% of his investment It seems to exhibit somewhat similar behavior. What do you think?

RELATED NEWS

You May Be the Sucker of the Market: What is the “Greater Fool Theory” That Is a Clear Indicator of Capitalism’s Cruelty?

RELATED NEWS

35 Basic Concepts That Those Who Will Enter the Cryptocurrency Market for the First Time Must Learn Urgently

RELATED NEWS

Sales Dropped 97% in the Last Nine Months: Is the NFT Craze Ending?

RELATED NEWS

NFT Sales Decrease 92 Percent: Is the Billion Dollar Market Crashing?

RELATED NEWS