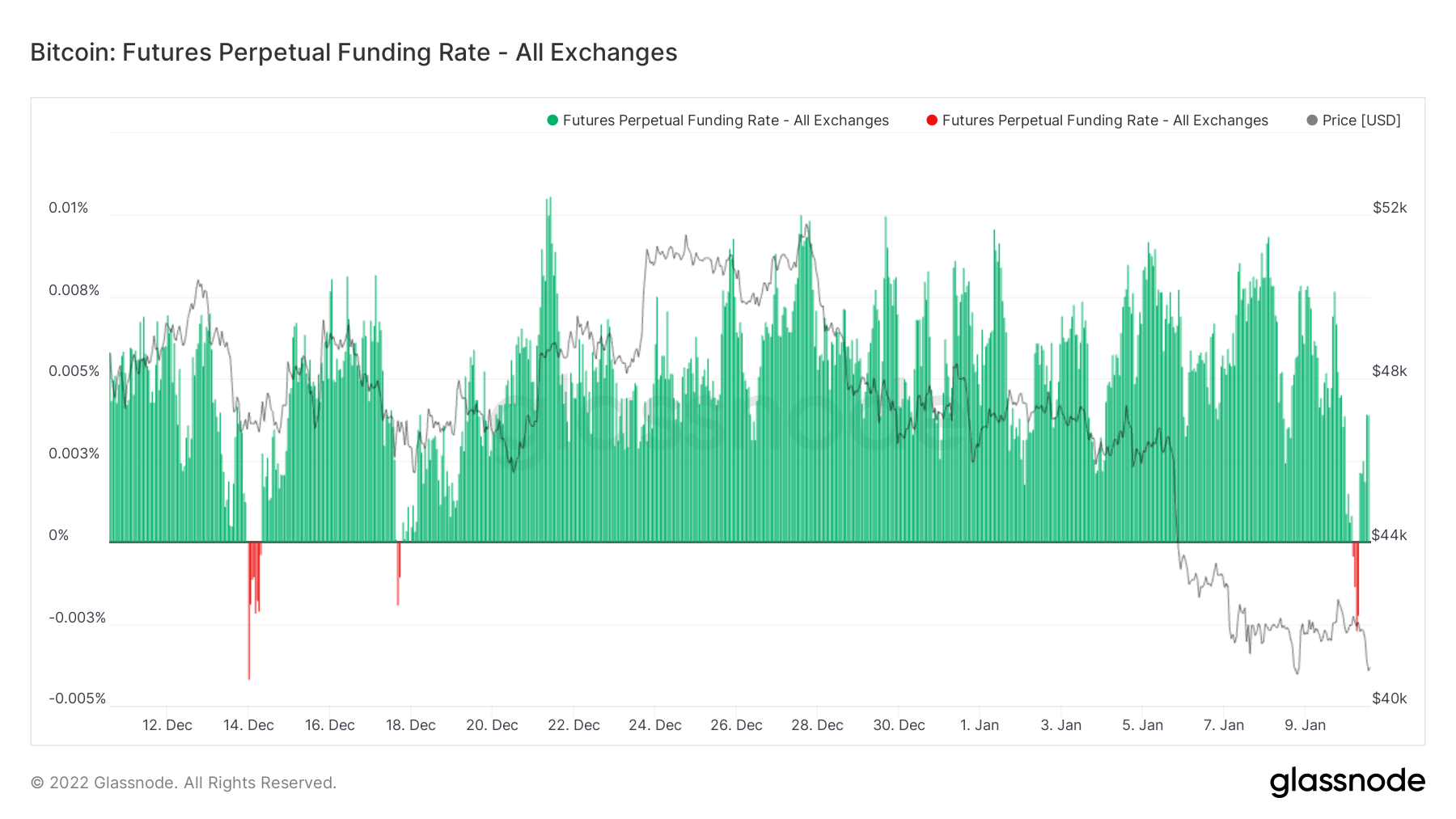

We have mentioned in our previous news that there may be another bottom in Bitcoin. Despite the retracement in the price, the fact that the funding did not turn negative in any way showed that the investors did not surrender to the market.

The move we expected below $40,000 came today.

When we look at the data provided by Glassnode, we see that the funding in futures transactions turned negative for a short time and became positive again.

We will be able to see if the funding rate is reset on a daily basis after the data is updated. Stay tuned for this.

Maintaining the response from $39650 will be important in the coming hours. Unless we see a 4-hour close below $40,830, we will maintain our bullish outlook.

We see that the positive dissonance in the RSI we mentioned in our news above continues. This strengthens the possibility of seeing a reaction rise in the short term.

When we look at the global markets, we see that the US stock markets started the week with sellers. Especially the fact that the losses in the S&P 500 and Nasdaq are over 1%, increasing the selling pressure in Bitcoin.

With the sharp opening in the US stock markets, Bitcoin hanging below $ 40,000 caused many leveraged players to be liquidated.

When we look at ByBt data, we see that 152 million positions were liquidated in a short time like 1 hour.

*Not Investment Advice.