The tighter control of the tech sector in China has not yet deterred venture capitalists and start-ups. On the contrary: 146 new unicorns were created in the People’s Republic in 2021.

This increased the number of Chinese start-ups valued at at least one billion dollars to 301. For comparison: The USA has 487 unicorns, India ranks third with 54. Germany ranks fifth with 26 unicorns. This is shown by the recently published Hurun Global Unicorn Index 2021.

The most valuable unicorn in the world is the Internet company Bytedance, known in this country for its short video subsidiary Tiktok. The Beijing company is valued at $ 350 billion. This puts it at the top of the ranking, ahead of Alibaba’s financial subsidiary Ant and Elon Musk’s space company SpaceX.

Bytedance announced its split into six business areas at the beginning of November, probably also to avoid stricter regulation. And Ant has been in the process of restructuring since the 2020 banned IPO at the behest of Chinese financial regulators.

Top jobs of the day

Find the best jobs now and

be notified by email.

The Hurun ranking shows the unbroken drive of the Chinese start-up scene despite this regulatory headwind: Nine start-ups, which were only founded in 2020, already achieved a billion-dollar valuation in 2021. The young companies come from segments as diverse as e-commerce, health technology, semiconductors, artificial intelligence, logistics and space travel.

One thing is particularly noticeable: while international investors were withdrawing their money from listed Chinese tech companies such as Alibaba and Tencent, the sum of investments in Chinese start-ups already exceeded the value for the entire previous year at the end of September.

The financial subsidiary Ant Group is just one of two Alibaba spin-offs in the top ten most valuable start-ups in the world.

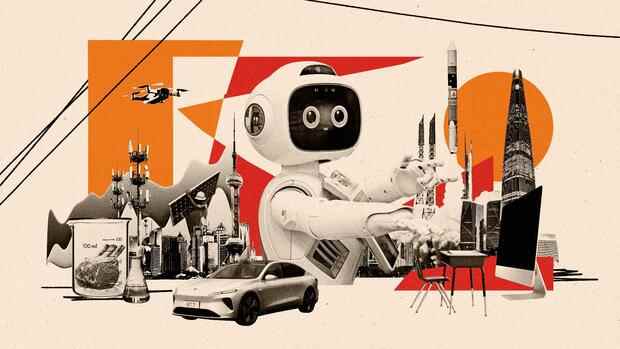

(Photo: imago images / VCG)

The venture capital and private equity investments amounted to 165 billion US dollars in the first three quarters, as the market research company Zero2IPO found. This could even drop the previous record of around 190 billion US dollars from 2017 in 2021.

By far the most successful financier in the Chinese start-up scene is the Chinese subsidiary of the US venture capitalist Sequoia Capital. According to the Hurun analysis, she is involved in 96 Chinese unicorns. Other important donors are the Chinese investor Hillhouse, IDG Capital from the USA, the tech group Tencent and the semi-public investment company CICC from China.

Tech corporations as a breeding ground for start-ups

Another “unique feature of China’s start-up ecosystem” is that the major Internet platforms such as Alibaba, JD.com and Baidu regularly succeed in founding new unicorn daughters, emphasizes Hurun founder Rupert Hoogewerf. 48 unicorns have been created in this way so far.

The e-commerce group Alibaba practices this most successfully. With Ant and the logistics subsidiary Cainiao, two of his spin-offs made it into the current top ten most valuable start-ups.

It will be exciting to see how the ongoing wave of regulations will affect this. After all, China’s government wants to limit the market power of the conglomerates and redirect investments from Internet platforms to high-tech sectors. However, Beijing is unlikely to want to forego the innovative strength of its successful ecosystems.

More: Risky China connection could become a problem for Nokia for Europe