A long-awaited event in the cryptocurrency market Bitcoin An exchange-traded fund can provide a large flow of capital into the asset and the market. Glassnode, one of the leading platforms, offered its own analysis on ETF approval, signaling that there will also be changes in BTC’s integration into mainstream markets.

glassnode A report dated November 20, 2023 published by , commented that demand flow will face a relatively limited supply of liquid Bitcoin (BTC), potentially increasing volatility. According to studies, there is currently a suppressed demand around ETFs.

Analysts claim that up to $70.5 billion could flow into the Bitcoin and cryptocurrency market from stock, bond and gold investors allocating just a fraction of their assets. Even more conservative estimates predict tens of billions of dollars will enter the market in the first years.

The anticipated spot BTC ETF will pave the way for institutions to direct and regulated investment in the asset, unlike existing investment vehicles. This will pave the way for large inflows even if there is some capital shifting from existing proxy funds. Historical data shows that new access has unleashed demand for assets.

According to Glassnode’s study, it is necessary to examine the current supply of BTC to understand the innovations that will emerge with the launch of the ETF.

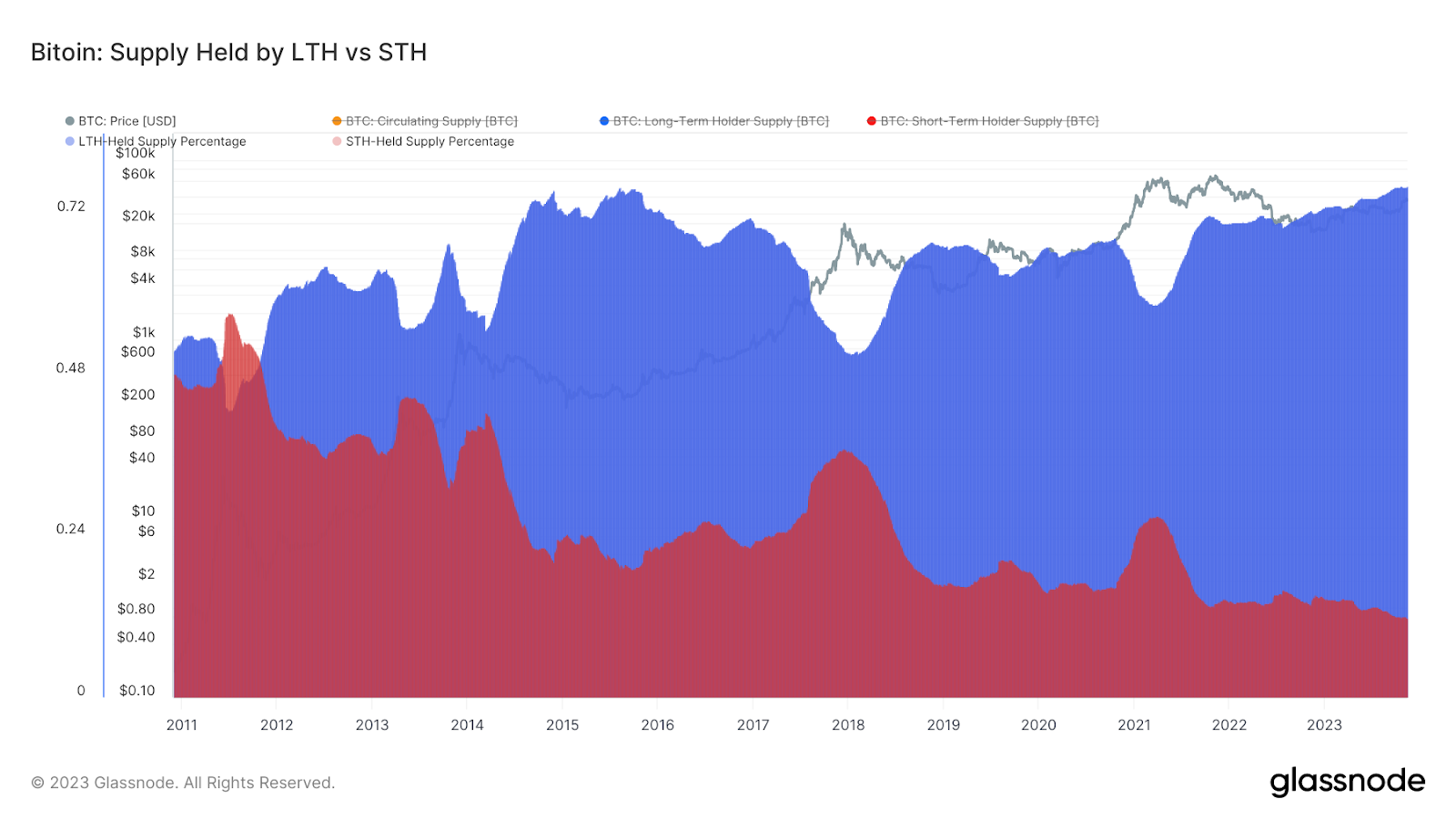

The analysis underscores how prolonged accumulation is shrinking Bitcoin’s circulating supply. Currently, more than 76% of assets are held long-term, which concentrates coins in holders who are less sensitive to price fluctuations. Glassnode’s research shows that short-term and active trader supply has recently reached multi-year lows.

The growth in illiquid supply is evident as investors move assets into their wallets. In contrast, stock market balances reflect the opposite trend, indicating limited market liquidity even with recovering trading volumes. According to information obtained from Glassnode’s research, despite the increasing interest of institutions, the tradable Bitcoin supply remains limited.