Bitcoin The market started to have very active days at the beginning of January with the excitement of ETFs. Commenting on the current dynamics, CryptoQuant stated that the main reason for the current selling pressure is Grayscale Bitcoin Trust (GBTC).

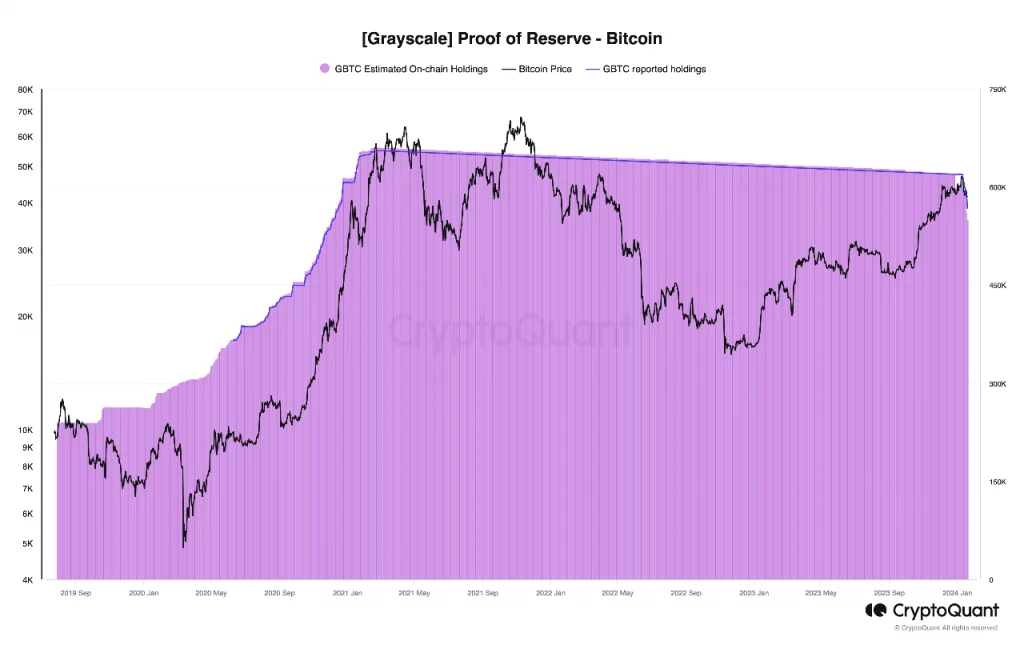

GBTC is recording a large outflow of Bitcoin in its holdings as investors opt for more liquid and efficient ETFs. CryptoQuant estimates that GBTC has lost 10,000 BTC per day since the ETFs went live, reducing its holdings from 620.9 thousand BTC in December 2023 to 551 thousand BTC as of January 20, 2024. This represents an 11% drop in just one month.

According to CryptoQuant, continuation of this trend will result in GBTC depleting its holdings in early April 2024. However, these exits will proceed depending on investor preferences and market dynamics.

GBTC has been the choice of institutional investors, especially hedge funds, since 2013. The fund was trading at a significant premium over Bitcoin’s spot price, reflecting the high demand and limited supply of its shares. However, the premium had returned to a discounted price in early 2021 as the market awaited approval of BTC ETFs. This created an opportunity for savvy investors to buy GBTC shares at a discount and then sell them at a higher price or convert them into BTC.

CryptoQuant suggests that some of the GBTC outflow is hedged in perpetual futures contracts, which explains the increase in funding rates and Bitcoin’s price weakness. As Koinfinans.com reported, there are rumors that some of the GBTC selling pressure is related to the bankruptcy of Sam Bankman-Fried, the founder of FTX, a leading crypto exchange.