After the long-awaited Ethereum Merge update, stock market volumes have seen huge increases.

According to data from The Block research team, the last 7-day average of crypto trading volume on exchanges was $18 billion on September 6, while volume has increased to $28.6 billion as of today.

The main source of the rise in exchange volumes is estimated to be the Ethereum Merge update.

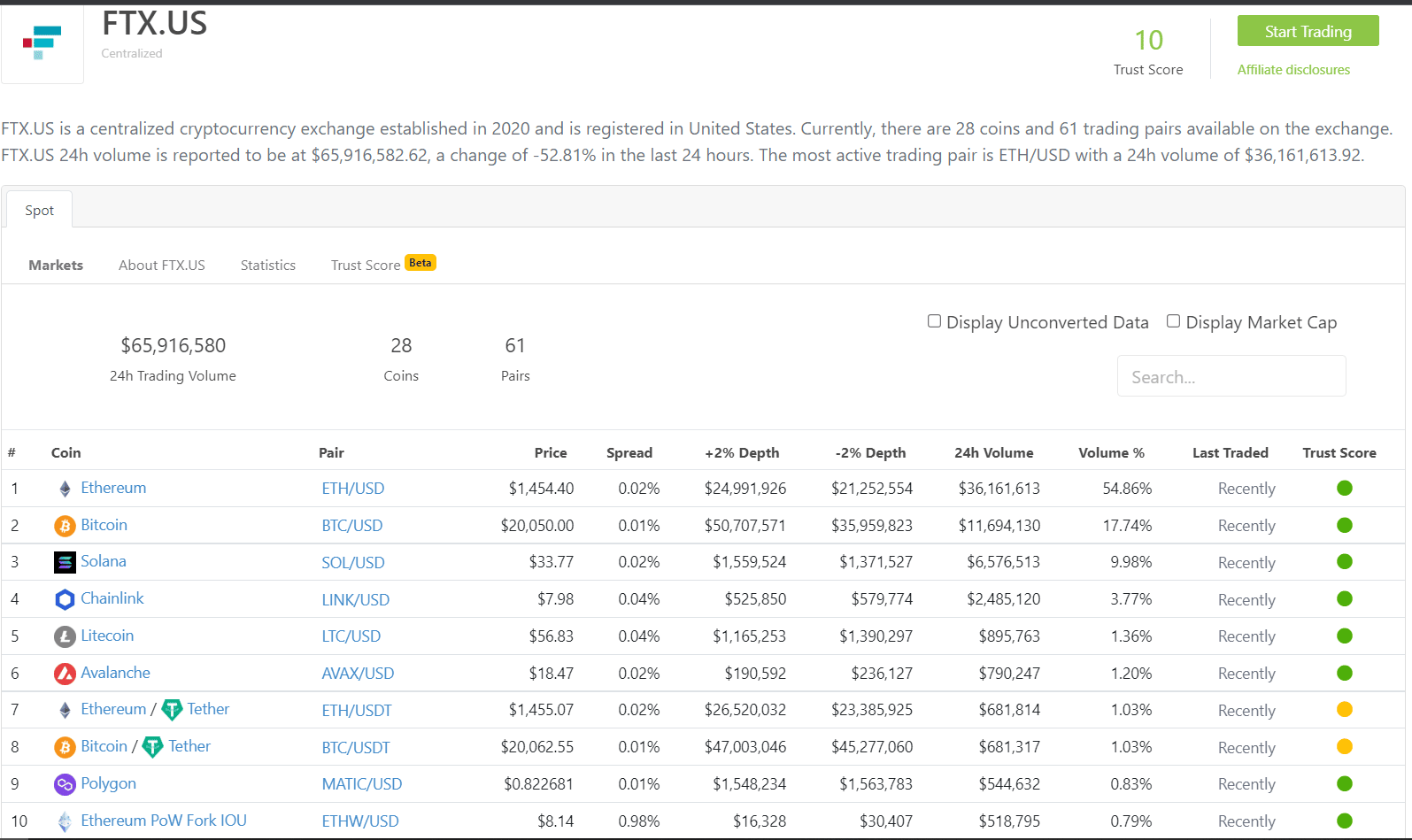

ETH/USD made up 55% of the spot market trading volume of the FTX.US exchange in the last 24 hours. The rate of the BTC/USD trading pair remained at 17%. Bitcoin is followed by Solana, Chainlink and Litecoin with 10%, respectively.

A similar picture prevails on the Coinbase exchange. Ethereum trading pairs account for 34 percent of the exchange’s total trading volume.

The main source of income of exchanges is the commissions taken from user transactions. cryptocurrencies even if it drops sharply, volume, not price, determines the revenues of the exchanges. Therefore, the increase in volume also increases the income of the exchanges.

Merge Update Successfully Performed

expected for months Ethereum Merge The update was successfully completed on the morning of September 15, Turkey time. How the network works Proof-of-Work from the system, Proof-of-Stake system, Ethereum mining has become history. The amount of energy consumed by the ETH blockchain has decreased significantly.

$ETHIt is currently trading around $1450.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!