Berlin Entrepreneurship and professional sports have long gone hand in hand in the USA. Athletes like ex-basketball star Michael Jordan have been making targeted and lucrative investments for decades. Jordan won multiple NBA titles and two Olympic gold medals on the field, while off the field he became the world’s richest athlete with investments like sports betting company Draftkings. Forbes magazine estimates his fortune at $1.6 billion.

Jordan is not the only example, his athletic successor LeBron James was the first active basketball player to become a billionaire through investments. Tennis icon Serena Williams has even launched her own investment fund. In Germany, they are being emulated, albeit on a much smaller scale, by more and more professional athletes who are still building up a second mainstay during their active career.

They are led by national soccer player Mario Götze, who, according to the Crunchbase data service, is now involved in 19 start-ups. “Venture capital is fun for me,” says Götze to the Handelsblatt. Others, such as his national team colleagues Kevin Trapp and Emre Can, founded it themselves. In the case of Trapp, it is Oatly competitor Moelk, which he started with friends. At Can, the bag and cosmetics brand Aece.

“I don’t want to stop at some point and only then start thinking about which areas I could still see myself in,” explains goalkeeper Trapp, who, like Götze, currently plays for Eintracht Frankfurt. He already wants to try things that could appeal to him after his football career.

Professional athletes as start-up investors: US professional network comes to Europe

“I find it very exciting to get an insight into how a start-up works, how it is set up and managed,” says handball player Steffen Weinhold, who, like FC Bayern basketball player Niels Giffey, has invested in the fitness band provider Staffr. “As an athlete, I can give Staffr professional feedback on the product.”

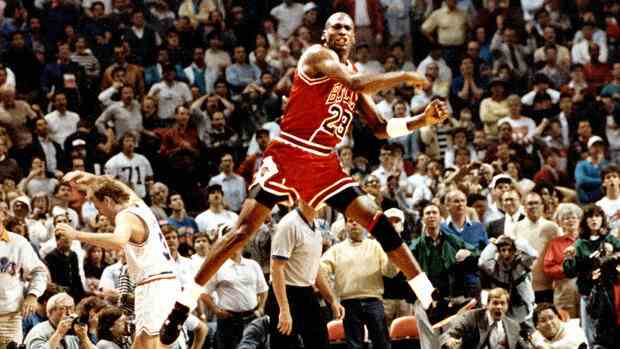

World champion, successful footballer – successful investor.

(Photo: IMAGO/Laci Perenyi)

The professional network “The Players Impact” (TPI), which has been active in the USA since 2017, is there to help athletes who do not want to acquire all the knowledge and contacts in the scene themselves. It gives members the opportunity to slowly become familiar with the start-up world and its cycles dominated by funding rounds. And then go professional. “As a member of TPI, you get access to investment opportunities,” says European manager Irg Torben Bührer. Two to three start-ups pitch there every month.

TPI now wants to offer more networking events and workshops on topics such as financing rounds and angel investments in Europe. From 5000 euros you can participate in deals. Typical of these so-called “angel investments” by private individuals usually start at tenfold. The TPI portfolio now includes well-known start-ups such as Stripe and Robinhood. Giffey has also made use of this and participated in two investments through TPI.

Bührer knows the scene in the USA and in Europe and sees major differences. On the one hand, many more professional athletes are active as investors in the USA. On the other hand, there is a greater openness towards the athletes, and people also trust them more in the business world. In Germany, on the other hand, it is often said: “You are only an athlete.”

>> Read here: The man who sold the football

Kathrin Steinbrink from the Campus Founders startup center gained similar insights in her dissertation: “In Germany, professional athletes often have a career disadvantage after the end of their sporting career.”

Sports and entrepreneurship: Mario Götze also invests in sports-related start-ups

According to Steinbrink, sport and entrepreneurship go well together: “Competitive athletes and successful founders have a lot in common – greater emotional stability, conscientiousness, extraversion and greater willingness to take risks.” Mario Götze confirms this from an athlete’s point of view. Like many athletes, he invests his money in young sports-related companies, but also thinks beyond that, as recently with the Hamburg-based cybersecurity provider Secjur.

There is no shortage of opportunities to bring sports expertise into sports companies. WHU Professor Sascha Schmidt says: “In Europe, the number of start-ups in the sports sector has increased significantly over the past few years.” Compared to the USA, however, Europe plays in the regional league.

According to the data service Sportstechdb.com, around ten billion dollars were invested in sports-related start-ups last year. Well over half of the sum went to the USA, and almost 17 percent went to Europe. Germany received the largest part of this. This is due to the financing rounds of the football app OneFootball and the Munich start-up Kinexon, whose sensor technology was also used in the World Cup ball in Qatar.

The soccer professional is currently expanding the range at Moelk. The offer can now also be found in Rewe branches.

(Photo: IMAGO/students)

Of course, even prominent investors cannot guarantee the success of a start-up. On the contrary, on average, nine out of ten start-ups don’t make it. The high level of uncertainty in the business world makes it difficult for athletes to make well-balanced investment decisions, says Bührer.

Ex-soccer player Philipp Lahm, who has invested heavily in the past but had to sell his personal care products supplier Sixtus quickly after numerous layoffs, has also experienced roller coaster rides. But even volatile success is something that athletes know well.

The same applies to Michael Jordan: When asked about his relationship to failure and problems, he likes to refer to the more than 9,000 missed shots in the course of his career.

More: The German economy is struggling with the World Cup in Qatar – not only because of the early exit