Spot trading volumes of cryptocurrencies on centralized exchanges dropped significantly in the second quarter of 2023, falling to the lowest level since 2020.

On-chain analytics platform Kaiko shared a market report for the second quarter of 2023. According to the report, spot trading volumes of cryptocurrencies on centralized exchanges averaged over the past quarter. 4.7 trillion at dollar level $1.8 trillion regressing 60% of on experienced a decline. The report also includes the total spot cryptocurrency trading volume. from 2020 since lowest level regressed highlighted.

Binance seriously injured

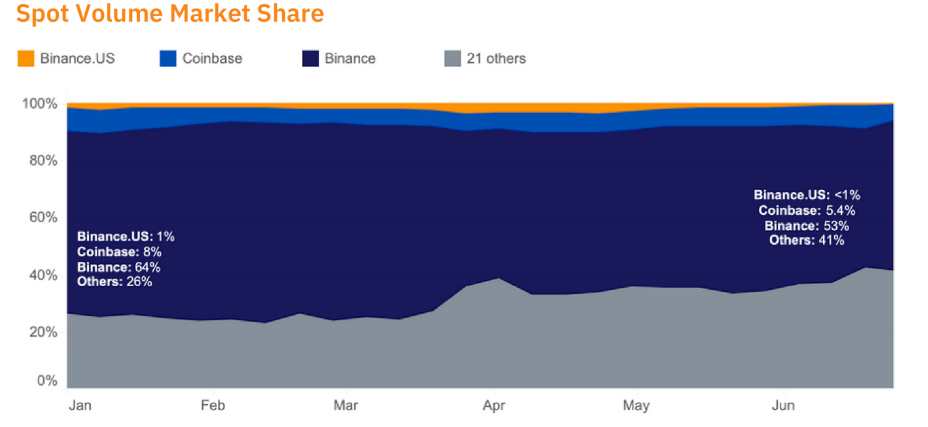

Binance, approximate volume of transactions 70% of while losing most lost became a living cryptocurrency exchange. As the reason for Binance’s loss of volume From the zero commission policy for bitcoin pairs giving up and US regulators with being in a legal fight shown.

Binance also announced at the beginning of the year. of 64% market share record worth a loss by stopping by to 53% declined. US subsidiary of the stock exchange Binance.US in hand, the total market at the end of the quarter from 1% less left.

Binance’s downfall Coinbase, OKX, Kraken And Huobi followed. The said exchanges spot cryptocurrency trading volumes exceed 50% on suffered a loss.

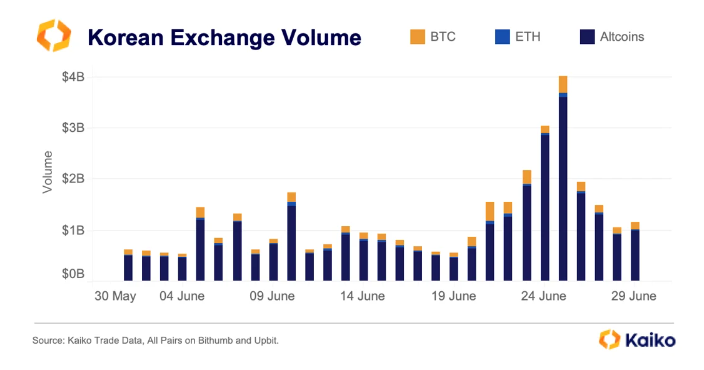

Despite the loss in global trade volume South Korea In spot cryptocurrency trading volumes, there was a notable increase in the last week of June. rise was observed. Volume in the last week of June 4 billion rising above the dollar 3.6 billion your dollar due to altcoins attention was drawn. The rise in volume Waves (WAVES) And Bitcoin Cash (BCH) He led

Cryptocurrency prices did not accompany the volume drop

Despite the massive drop in spot trading volumes Bitcoin (BTC) and the cryptocurrency market in general. positive One in the frame watched.

bitcoin last in 90 days, $28,500 from the levels $31,020 rising to the levels to 9% close gained value. In this process, greening was seen in altcoins in general. Some altcoins rallied in the aforementioned timeframe.

On the other hand, in June Bitcoin options trading volume end three months reaching the highest level 20 billion closed the quarter above the dollar. Purchase The trading volume of options on the 65% of created.

In addition, the world’s largest asset management company Starting with BlackRock spot Bitcoin ETF (exchange-traded fund) application process Bitcoin ETFs in terms of volume positively Impressed. In trading volumes of Bitcoin ETFs upwards with great changes ProShares Bitcoin Strategy ETF (BITO)since its establishment in June 4 times 500 million over the dollar daily trade volume reached.