solana (SOL) was the best-performing cryptocurrency of the week, with a price increase of over 34% in the last seven days. However, the most significant increase was in spot exchange and derivatives volume during the day, with both more than doubling on November 2.

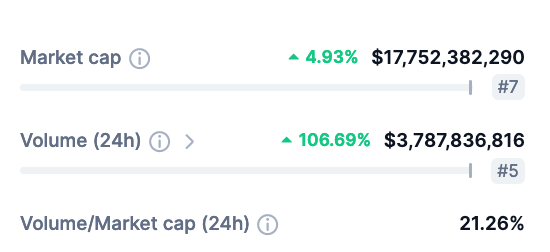

At the time of writing, data from CoinMarketCap and CoinGlass show impressive increases in both volume indices over the past 24 hours; a 106% increase in first-source spot exchange volume and an over 110% increase in derivatives trading volume for SOL.

Notably, Solana recorded a 24-hour volume of $3.78 billion. This corresponds to 21% of the $17.75 billion market cap of its native token, as SOL is trading at $42.9 at press time.

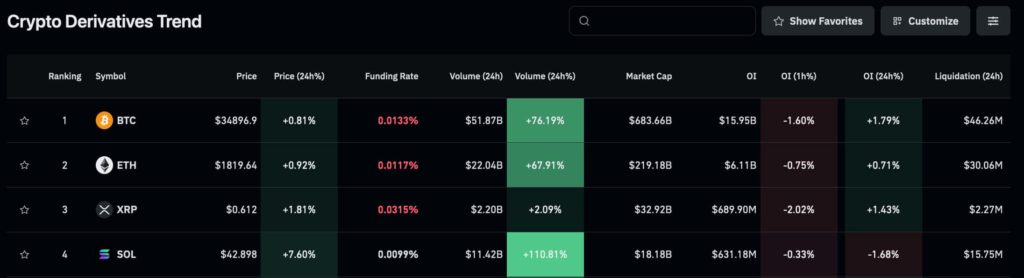

Despite this high volume of SOL traded in the spot market, cryptocurrency The unit is currently seeing a huge increase in demand for derivative contracts. This is also BitcoinIt makes more sense as derivative volumes of both (BTC) and Ethereum (ETH) increased at a slower pace over the same period.

Solana saw a 110% volume increase in derivatives contracts, while the two leading projects by market cap also saw increases of 76% and 67%, respectively, in CoinGlass’ crypto derivatives trend index.

Therefore, it means that crypto traders are mostly shifting their derivatives transactions towards Solana’s native token rather than other competitors.

At the time of publication, SOL derivatives recorded a total flow of $11.42 billion, which is three times the volume of the spot exchange currently highlighted. This amount also corresponds to half of ETH’s 24-hour derivative volume.

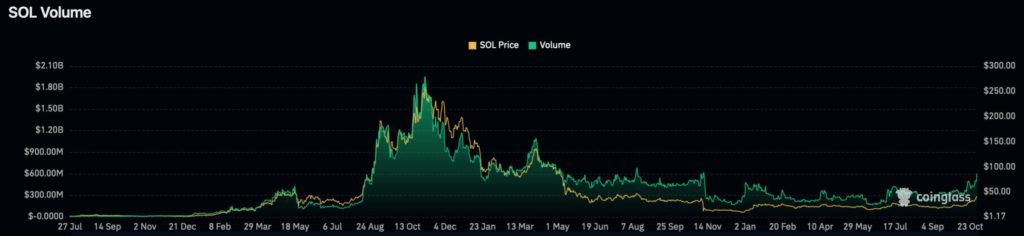

Interestingly, as derivative volume increases, Solana investors can likely expect another price increase for the token, as both metrics appear to be highly correlated, according to a chart also sourced from CoinGlass.

However, historical correlation does not mean that price will continue to follow this metric. Derivative data also shows that the number of traders currently opening short positions is higher than those opening long positions.

You can access current market movements here.