Solana has added a new one to the shower of news in recent days. Analysts are confident that these partnerships will explode the SOL price.

Solana announces partnership with Circle

Crypto payments company Circle has announced that it will launch a Euro-backed stablecoin in Solana in the first half of 2023. News of this emerged during a speech by Circle engineering director Marcus Boorstin during the Solana Breakpoint conference in Lisbon, Portugal. Boorstin announced that FTX will support deposits and withdrawals of Euro Coin on Solana at launch. Additionally, Solana-based DeFi protocols Radium and Solend have announced that they will support it.

Boorstin summarizes what awaits the ecosystem in their statement on the Solana and Circle collaboration:

“We are really excited about the use cases Euro Coin will unlock on Solana’s ultra-fast, ultra-low-cost network.” Trouble-free payments in Euros will be made with Solana Pay.

Analyst thinks these news will explode SOL price

cryptocoin.com We have discussed the latest developments from the Solana ecosystem in this article. Now, many analysts are predicting that the SOL price will recover due to important collaborations such as Google Cloud. One of them was popular Twitter analyst Cantering Clark. In his current analysis, Clark says Solana is in a position to rally towards its target after building a multi-moon base and taking on the diagonal resistance:

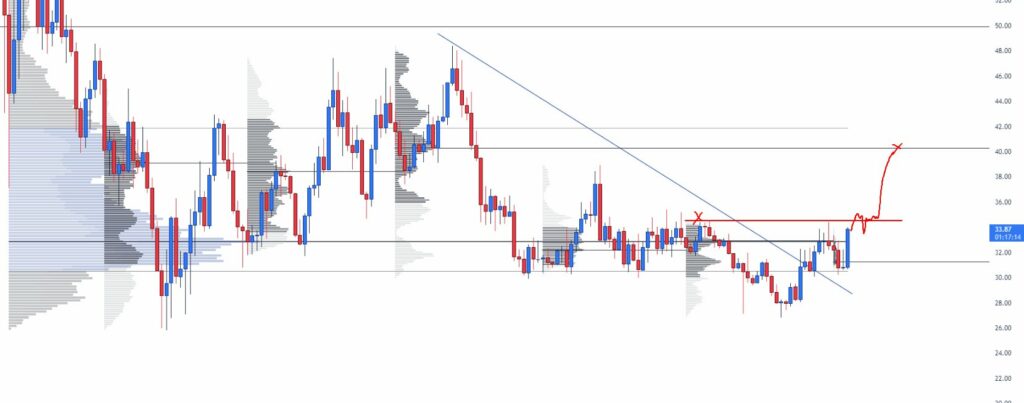

Solana has five months to support the declines and hence the checkpoint slipped to the lowest. If we retrace last month’s highs ($34.50), it’s safe to say that enough people are determined to stay lower or on the edge, as we can easily see $40.

Another mystery analyst, Inmortal, is also bullish on Solana. The analyst with 180,000 Twitter followers shared the chart below suggesting that SOL is likely ready to hit its target of around $50.

The third crypto analyst, Altcoin Sherpa, also says that Solana is on track for a good rally in the coming weeks. The analyst expressed his bullish expectations on Twitter today:

I still believe we will see $40 in the coming weeks.

Solana’s weekly chart points to higher highs

Technically speaking, Solana’s weekly chart shows a double bottom pattern. This bullish pattern is usually known for trend change. In other words, it offers the opportunity for long positions to interested investors. Therefore, a break from the $38.65 resistance will intensify the bullish momentum for a rally to $47.5.

The $47.5 level stands as a neckline resistance for the above pattern. It also holds great growth potential upon breaking. Conversely, a daily candle closing below the $34.5 support would weaken the bullish argument. Analyst Brian Bollinger says the SOL chart is set to break above $38.6.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.