Ripple powered XRP coin, has faced intense price fluctuations over the past week. This happened due to long-running legal battles. On-chain data trends offer some insights into the main bearish catalysts and how XRP prices may react in the coming days.

Whale Investors Reduced Assets to 30-Day Low Following SEC Fine

On March 25, Ripple CEO Brad Garlinghouse announced that the SEC had requested a $1.95 billion payment to Ripple. This request comes after the SEC acknowledged some allegations that Ripple engaged in illegal securities sales by selling its XRP Coin directly to institutional investors.

The SEC formally filed under seal in a U.S. District Court on Friday, sending the XRP community into a speculation frenzy and trying to highlight the potential impact of fines on traders.

Ripple CEO assured the community that the company is in a position to pay the fines. However, looking beyond the headlines, on-chain data shows that whale investors and institutional entities holding at least 1 million XRP (~$580,000) do not share this optimism.

The Santiment chart below tracks whale traders’ wallet balances in real time, providing insight into their current sentiment and trading activity.

After the SEC officially filed its $2 billion penalty request on Friday, March 29, XRP whale investors immediately went on a selling frenzy. As seen in the chart above, they disposed of more than 290 million coins between March 29 and April 3, reducing their balance to a 30-day low of 44.9 billion.

Considered at current prices, the 290 million XRP coins traded recently are worth approximately $170 million. Flooding the markets with such a large amount of coins is likely to put downward pressure on prices. Unsurprisingly, the XRP price has fallen 13% since the whales began selling on March 29.

Strategic retail swing traders may not want to go against deep-pocketed whales with over 44.9 billion XRP assets. If retail traders with small holdings also take a bearish position, the XRP price may have difficulty entering a major recovery phase in the coming days.

XRP Speculative Investors Fear the Downtrend Will Continue

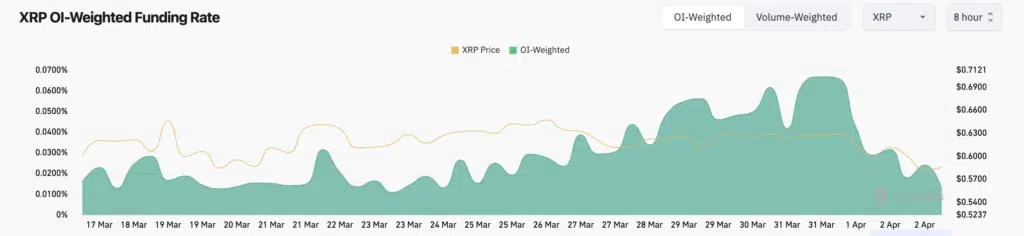

Additionally, recent trends observed in derivatives markets also show that speculative bull traders exhibit low optimism regarding XRP short-term price prospects.

Coinglass’s funding rate metric constantly tracks the percentage fees paid between long traders and short position holders in the futures markets. It essentially tracks the direction of investor sentiment and market participation.

At the time of writing, the XRP price is trading just below $0.58. On the other hand, the funding rate dropped to 0.013%, the lowest level in the last 10 days. Typically, a decrease in the funding rate indicates increasing negative sentiment among bullish traders who are betting on the price increase.

If bullish traders begin to reduce their long positions, it puts the XRP price at risk of falling further in the coming days.

XRP Price Prediction: Possible Drop Towards $0.55

The $170 million sell-off by whale investors and declining funding rates suggest that the XRP price may be on the verge of a major price drop below $0.55 in the coming days.

Following a 11.7% decline since March 29, XRP price has now fallen below its 20-day simple moving average price and is hanging precariously above the lower bound Bollinger band indicator at $0.58.

If this critical support buy wall collapses, the bears could seize the momentum to force a larger retracement below $0.55 as predicted.

On the other hand, if the XRP price rises above the $0.62 level, the bulls may regain a foothold in the markets. However, this seems unlikely at the moment, given the dominant sell preference among whale investors.

You can access current market movements here.