When assessing inflation, the central bank must also take into account the rise in real estate prices, says ECB Director Isabel Schnabel.

(Photo: imago images / photothek)

Frankfurt From today’s perspective, the European Central Bank (ECB) could start raising interest rates in the fall. This can be concluded from an interview with ECB Director Isabel Schnabel.

She mentions that the markets appear to be signaling rate hikes from the summer. Schnabel told the Financial Times because the positioning of investors simply reflects a certain amount of caution.

She then emphasized that the central bank’s actual rate depends on the data. In addition, she repeated the already known position that before an interest rate increase, bond purchases should be set to zero, i.e. only expiring papers should be replaced.

This fits in with statements made by the head of the French central bank, François Villeroy de Galhau, who announced such a halt to the bond purchase program known by the abbreviation APP on Tuesday. Schnabel and Villeroy are members of the Governing Council whose assessments can be decisive, especially in situations of upheaval.

Top jobs of the day

Find the best jobs now and

be notified by email.

All in all, Schnabel’s interview shows very clearly the shift in monetary policy, which was already mentioned in the press conference after the last ECB meeting. Schnabel acknowledged that inflation is far more stubborn than previously thought.

She also mentioned that unemployment is “at a historically low level”, so the hitherto moderate wage growth could accelerate. ECB President Christine Lagarde recently emphasized that one must keep an eye on wage developments.

The ECB has no direct influence on energy prices, which are currently driving inflation very strongly. However, it must prevent the price increase from taking on a life of its own.

The German ECB director also mentioned the increase in production prices, which will have a delayed impact on consumer prices. All in all, the prerequisite for a withdrawal of the expansive monetary policy, which was defined earlier when price increases were low, has been met: medium-term stabilization of inflation close to the inflation target of two percent.

Schnabel concludes: “We should think about a gradual normalization of our monetary policy.” According to the general understanding, this should mean: no negative interest rates, no inflation of the balance sheet total through bond purchases.

Help for indebted countries

Schnabel said about the risk premiums on government bonds of highly indebted euro countries: “The spreads have increased, but they are well below those that we saw in the years before the pandemic.” She repeated the ECB’s promise to intervene flexibly if they increased Returns are not fundamentally justified.

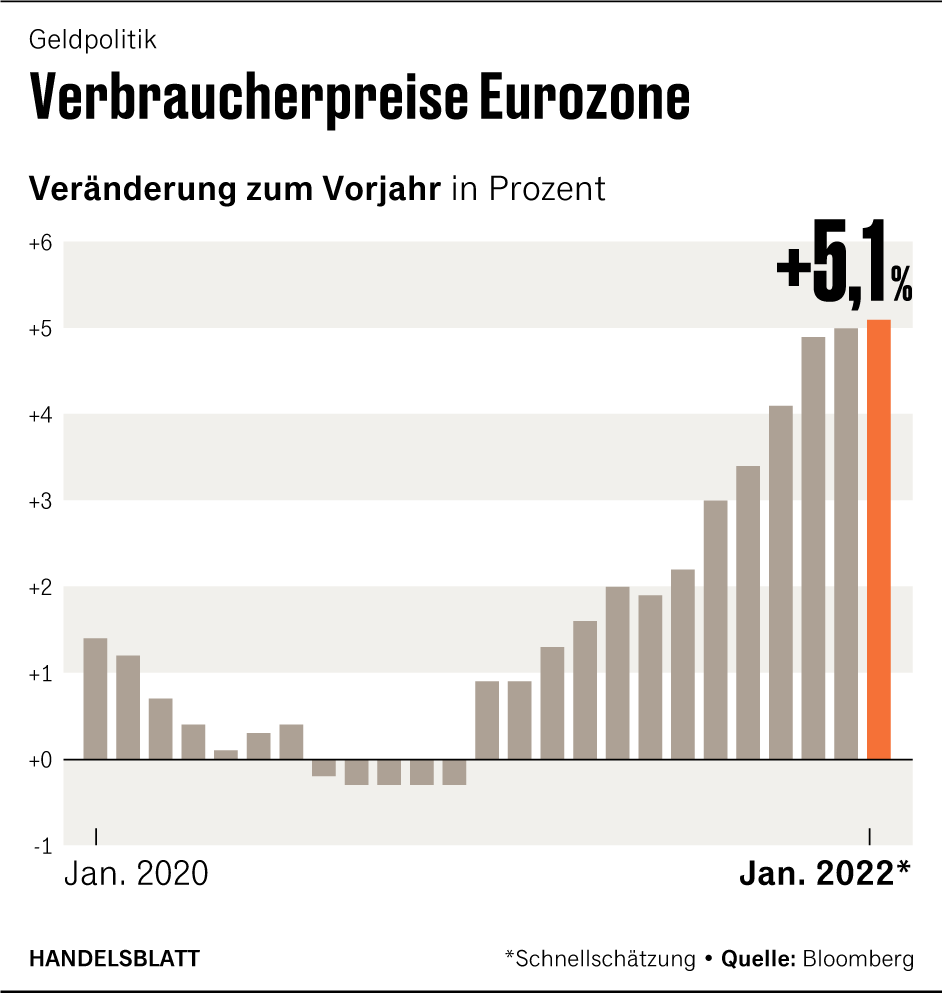

The background to the monetary policy debate is the very high inflation in the euro area, which rose to a record 5.1 percent in January. The ECB is aiming for an inflation rate of 2.0 percent in the medium term. In view of the high price pressure, it could decide to tighten monetary policy more quickly at its March meeting.

Whether the central bank will act depends to a large extent on the new inflation forecasts. In December, they had predicted a significant drop in inflation to 1.8 percent in 2023 and 2024. However, they will probably be higher in March.

Many experts therefore expect that the ECB will decide to end its bond purchases more quickly. This is considered a prerequisite for a possible rate hike this year.

Real estate prices must be included

Furthermore, according to Schnabel, the ECB must also take into account the rise in real estate prices when assessing inflation. The housing boom increases the risk that monetary authorities will act too late in changing monetary policy, she said.

As part of its strategy review, the ECB decided that in future it would like to take the costs of owner-occupied housing into account when determining price developments. So far, only the rental costs have been included in the calculation at European level. Since the inclusion is technically very complicated, it will take years before this is implemented.

According to calculations by the ECB, inflation (HICP) has been a maximum of 0.3 percentage points higher since 2011 if owner-occupied housing is taken into account. The difference would have been even greater in what is known as core inflation, which excludes food and energy prices that are particularly susceptible to fluctuations. In the third quarter of 2021, it would have been 0.6 percentage points higher. “We can’t ignore this,” Schnabel said.

In practice, however, some hurdles remain. For one thing, houses and apartments are also assets. People buy houses not only to live in them, but also to increase their value. However, only consumer prices and no asset prices are to be included in the consumer price index – it is difficult to distinguish between the two.

In addition, up-to-date values are needed to estimate the costs of owner-occupied housing. So far, the data in the euro area has only been collected on a quarterly basis.

More: Why housing costs should soon be included more in inflation.