The research arm of JPMorgan, the world’s fifth largest bank JPMorgan Chaseconducted a research on the latest situation in crypto exchanges after the bankruptcy of FTX.

In the report they prepared, JPMorgan Chase analysts determined that a large amount of money has been withdrawn especially from Gemini and Crypto.com exchanges in the past week. Experts say this FTX He associated it with the shattered confidence of investors as a result of the bankruptcy of the stock market.

According to Block’s data, stock market volumes were at $841 billion in January, while this figure has dropped to $544 billion as of today.

JPMorgan Chase experts concluded that the exchanges least affected by asset outflows are Bitfinex and Binance.

Stablecoin Sector Contracting

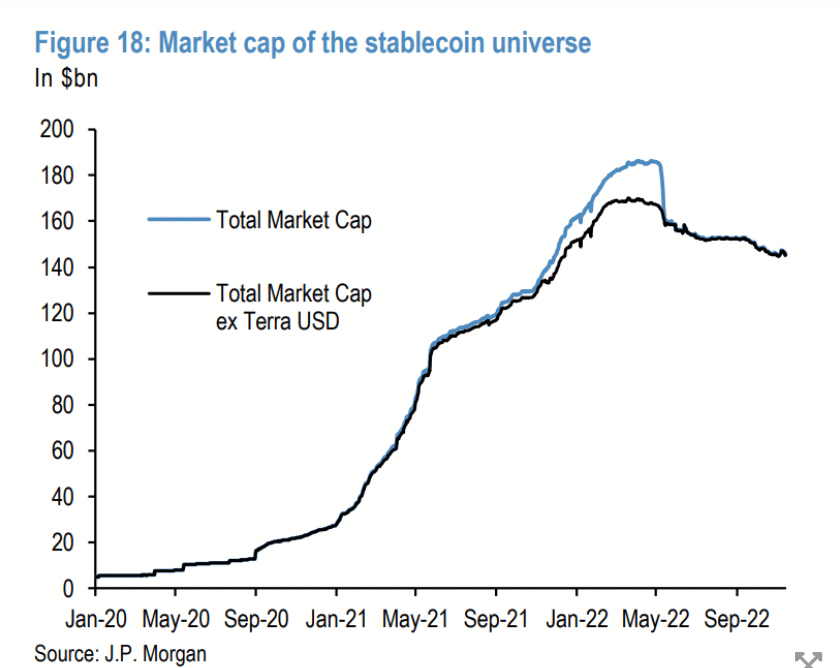

The research team of the giant bank, after the current situation of the stock markets, stablecoin focused on the market. Experts point out that stablecoins act as a bridge between traditional finance and cryptocurrencies. However, the stablecoin industry has been experiencing a contraction since May 2022.

While the total market cap of stablecoins hovered around $160 billion last May (excluding Terra), that figure has slumped to $140 billion today.

Experts explained that it is pointless to expect an overall rise in cryptocurrencies if the stablecoin market size continues to decline.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!