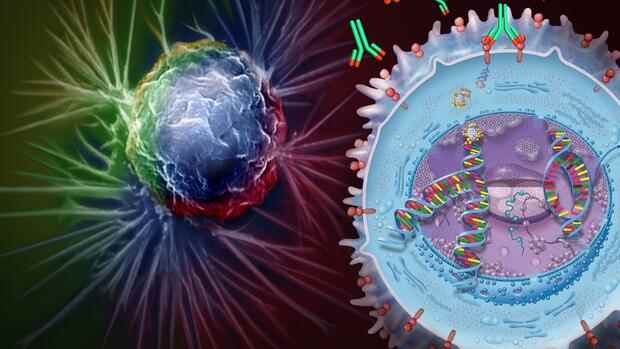

Illustration of breast cancer treatment with an antibody drug.

(Photo: picture-alliance / medicalpictur)

Frankfurt The Duisburg-based biotech company Emergence Therapeutics has raised a total of 87 million euros this year from the largest German biotech first-round financing to date. The Series A money comes from international and existing investors and is led by Israel-based Pontifax Venture Capital.

Emergence Therapeutics plans to use the money to start clinical trials for its lead product called ETx-22. This is an antibody-drug conjugate that is used to target tumors. Antibody-drug conjugates (ADC) are among the most promising fields of research in the fight against cancer.

The antibodies ensure that the cytotoxin is brought directly to the tumor. This should enable targeted destruction of the cancer cells, which ideally also has fewer side effects than chemotherapy that works throughout the body.

Many pharmaceutical and biotech companies around the world conduct research in this area. One of the pioneers is the US biotech company Seagen, which has already developed several ADCs. But large pharmaceutical companies such as Roche and Daiichi Sankyo are also active here. Roche has had the ADC Kadzyla for advanced or metastatic breast cancer on the market since 2014, and Daichi Sankyo has had the drug Enhertu, also for inoperable and metastatic breast cancer, since this year.

Top jobs of the day

Find the best jobs now and

be notified by email.

Emergence Therapeutics draws on the research of immuno-oncologist Daniel Olive, head of the Cancer Research Center in Marseille. Among other things, it was discovered there that the protein nectin-4 is expressed on the surface of the tumor in many cancers. It can therefore be a target for a specially designed antibody that was developed at the institute.

The French venture capital company Kurma Partners saw this approach as so promising that, in collaboration with Olive, at the end of 2019 it launched the biotech company Emergence Therapeutics in Duisburg, which developed the nectin-4 ADC.

Kurma Partners also won the Hightech-Gründerfonds, the NRW Bank, the Gründerfonds Ruhr and the French investment bank Bpifrance as founding investors. The Dutchman Jack Elands, an experienced biotech manager, was brought on board as CEO.

Worldwide competition

Peter Neubeck from Kurma Partners, who played a key role in setting up Emergence Therapeutics, sees good opportunities for Emergence’s main candidate, despite great competition in research into cancer drugs: “Nectin-4 is expressed in many types of tumors that are difficult to treat, for example metastatic breast cancer, pancreatic cancer, and ovarian cancer. There is still a high demand for therapeutics here, ”says Neubeck.

In any case, the data from the animal experiments on the Nectin-4-ADC were so promising from the perspective of various international investors that they joined Emergence: In addition to lead investor Pontifax, the US investors RA Capital Management, Orbimed Advisors, Surveyor Capital and Hadean Ventures were also able to do so as new investors are won, the existing investors also participated again. According to CEO Elands, the “significantly oversubscribed financing round” now gives the biotech company the opportunity to research the leading project up to the proof of concept in clinical studies on humans.

In the biotech industry, the trend towards ever larger rounds continues with emergence financing. According to statistics from the industry association Bio Deutschland, this round is by far the largest Series A round in the biotech industry.

The highest initial funding to date was collected by the laboratory cheese start-up Formo (the equivalent of around 42 million euros) and the Essen-based biotech company Abalos Therapeutics (a total of 43 million euros), which is developing a new immunotherapy against cancer.

More: Venture capital – that could be the biontechs of tomorrow.