Cryptocurrency insight and intelligence firm glassnodestates that a particular ‘niche’ sector within the decentralized finance (DeFi) sector is quite strong despite the problems in the crypto markets.

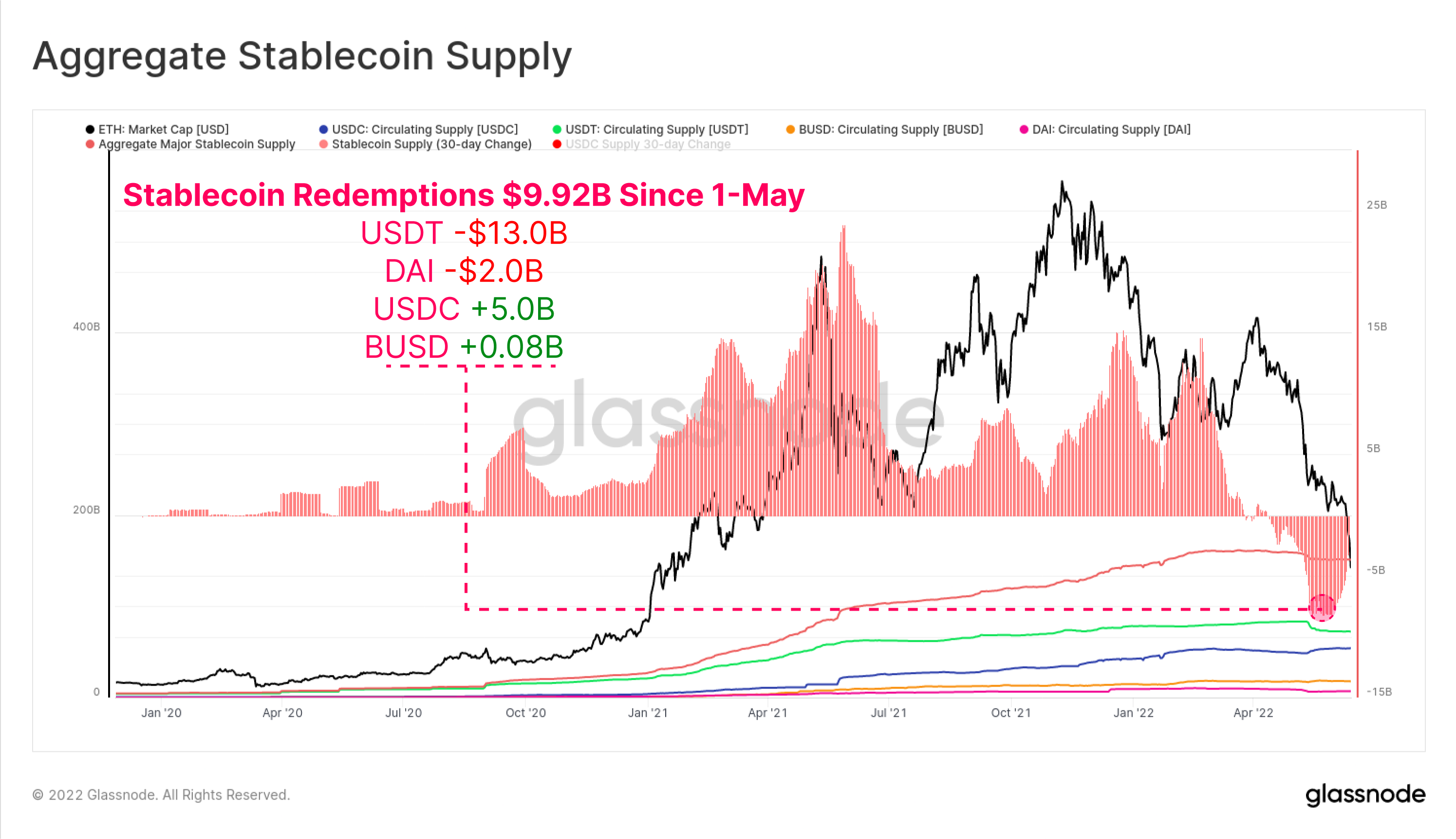

In a new analysis published by Glassnode, he stated that although many Ethereum (ETH) holders are currently making losses, capital is flowing into stablecoins.

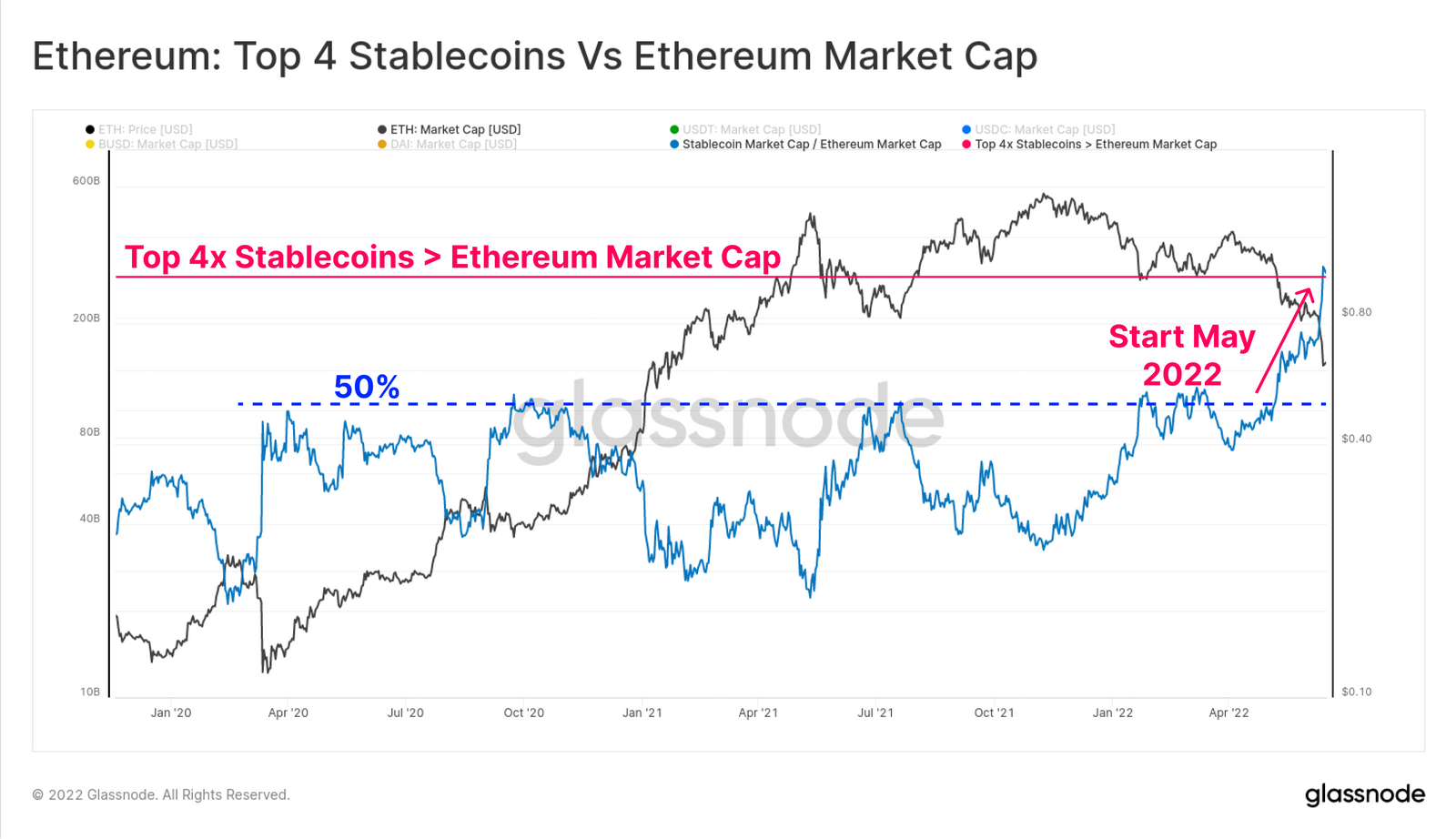

“The total capitalization of the four largest stablecoins (USDT, USDC, BUSD and DAI) has now exceeded $3.0 billion, surpassing the market cap of Ethereum. The combined value of these four altcoins had previously exceeded 50% of Ethereum’s market cap multiple times during 2020-22, but saw a dramatic increase in May and June this year. This is the first time this has happened.”

- Notable rise of stablecoins of USD as unit of account and quote asset.

- Seeing how strong the dollar-denominated liquidity demand has been in recent years. It’s also worth noting that stablecoins now make up three of the top six digital assets by market cap.

- The Ethereum ecosystem valuation during 2022 receives a massive valuation.

Glassnode also mentions that while not every stablecoin works on Ethereum, the data shows that market participants are taking a risk-averse approach.

“This incident highlights why the current leverage reduction is occurring as the disparity between the value of crypto collateral and the unit of account of margin debt (USD stablecoins) widens.”

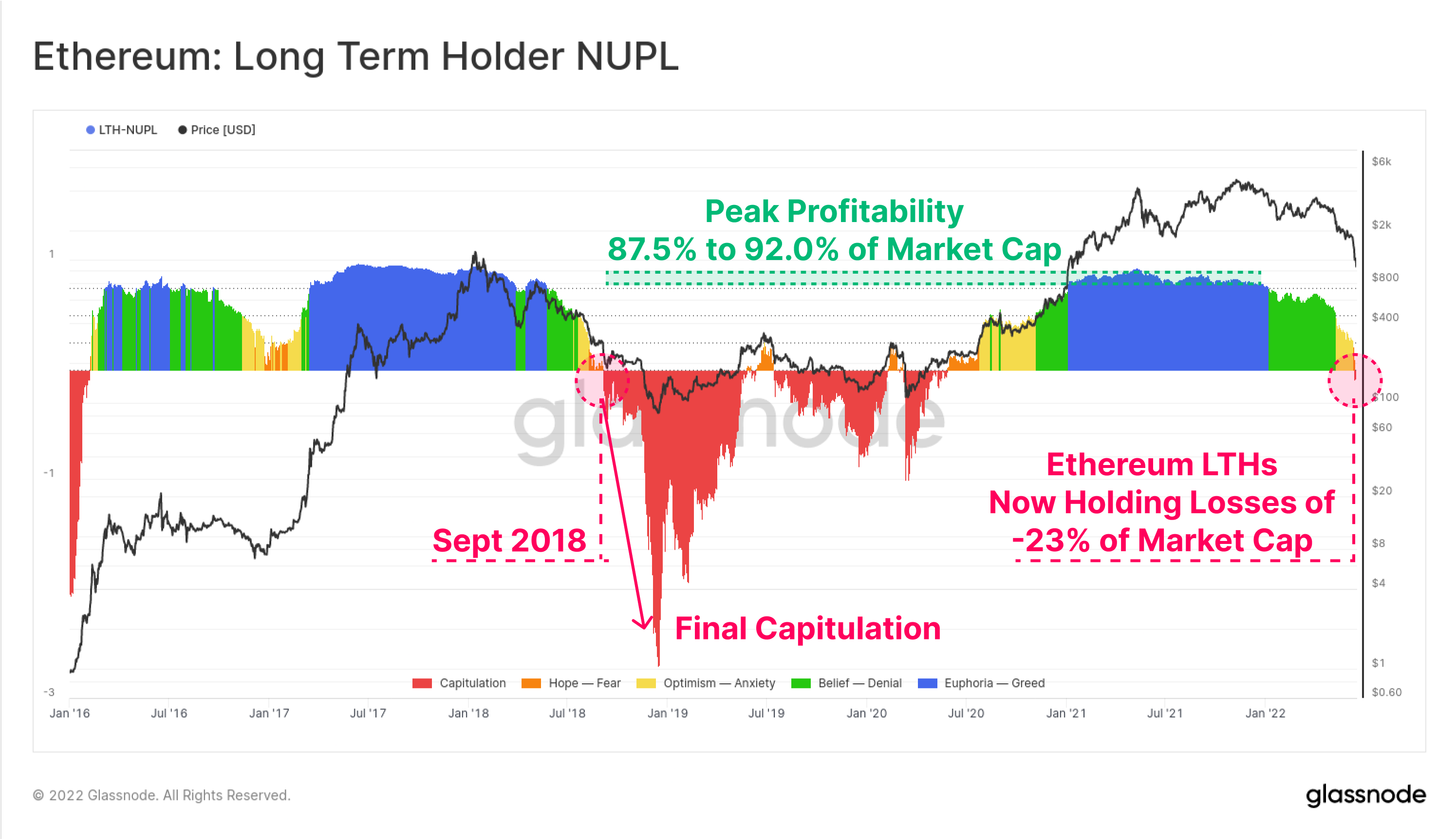

Glassnode considers how Ethereum’s recent drop in price shows that a significant percentage of token holders are sitting on significant unrealized losses not seen in nearly four years.

The ETH spot price is currently trading at $1,212, with the overall market well below the current $1,730 price. This means that the market is holding an average unrealized loss of -30.0%.

The Long-Term Owner Net Unrealized Profit/Loss (LTH-NUPL) metric shows that the current profitability of this cohort has fallen in the past at par and currently retains unrealized losses equal to 23% of market value.

These data reveal that even long-term investors make losses on average. The last example of this was seen in September 2018, which preceded an even deeper dip as prices fell 64% from $230 to $84.

Glassnode concludes its analysis by referring to historical cryptocurrency cycles where early innovation brought with it both price increases and leverage.

At the time of writing, Ethereum was trading at $1,086. ETH is down over 70% from its opening price of $3,730 in 2022.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.