Great Britain is thus following the trend in the USA and Europe, where price pressure is also easing. The trend suggests that “inflation has peaked,” said David Bharier, economist at the British Chamber of Commerce, “but that just means prices will stabilize at much higher levels than a year ago.” .

It is still too early to give the all-clear, especially given that the inflation rate is still five times the Bank of England’s (BoE) target. In addition, according to government statistics, wages and salaries (excluding bonuses) in the UK rose by an average of 6.4 per cent in the three months to November, the fastest since the pandemic. Fearing a wage-price spiral, central bankers recently raised key interest rates to 3.5 percent. Economists expect another rate hike of 50 basis points in early February.

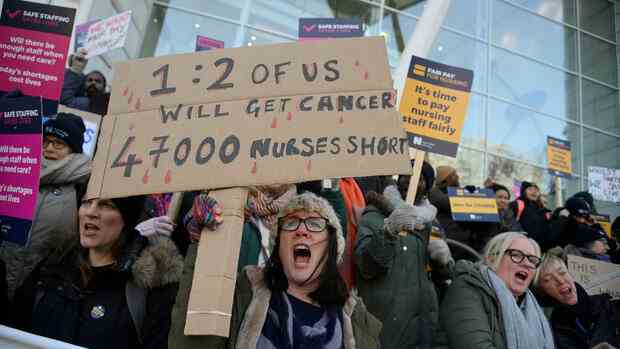

Fighting inflation is made more difficult by the strikes in the public sector, which have been going on for months. On Wednesday, nurses in England continued their industrial action for higher wages with a two-day walkout. The railway workers have again announced massive strikes for the beginning of February. In February and March, teachers in England and Wales also want to lay down their work.

Top jobs of the day

Find the best jobs now and

be notified by email.

“The best way to help people earn more is to stick with our plan to halve inflation this year. We must not do anything that risks perpetuating high prices in our economy,” said UK Treasury Secretary Jeremy Hunt. However, the Conservative Chancellor of the Exchequer describes only one side of the inflation dilemma.

Employees actually have less in their wallets

From the point of view of employees in the public sector, the situation is different: Their wages have recently increased by only 3.3 percent, compared with an average of more than seven percent in the private sector. The increase in wages is also well below the rate of inflation, which means that workers have less in their wallets in real terms.

In response to wage strikes, Britain’s Prime Minister wants to tighten strike laws.

(Photo: dpa)

The trade unions are therefore demanding inflation compensation. The government rejects this, citing the significantly lower recommendations of the independent wage-setting commissions in the public sector.

However, the workers’ organizations doubt the independence of the bodies, which are often staffed by former business managers. “The government is hiding behind the boards and refusing to reach a reasonable agreement with our public sector unions,” complains Paul Nowak of the TUC.

The conservative government now wants to tighten the rules for labor disputes in order to ensure basic provision of important public services such as health, transport and education.

Economists doubt the wage-price spiral in the public sector

Should strikes threaten this minimum, the government could sue unions or sack striking workers. “No one disputes the right to strike, but it is also important to reconcile this with people’s right to access life-saving healthcare,” Prime Minister Rishi Sunak said in justification of his move.

>> Also read here: Economist Kenneth Rogoff: “We are at the turning point of the world economy”

For the unions, this is another challenge from the government. The workers’ organizations also have a hard time talking to the head of the central bank, Andrew Bailey, who last year called on workers to hold back wages. The BoE expects the inflation rate in Great Britain to halve over the course of the year and warns of a new price surge due to high wage increases.

However, Ben Zaranko of the Institute for Fiscal Studies (IFS) in London thinks it is absurd that higher wages in the public sector are reflected in higher inflation rates. “It’s hard to see how an increase in public sector wages could directly contribute to a wage-price spiral, since there are no prices in the public sector,” explains the economist.

More: British economy grows slightly in November